Swiss franc weakness continues as unemployment rate rises

European stocks and American futures bounced back today as traders remained optimistic that the recent sell-off will abate. In Europe, the DAX index rose by 0.86% while the FTSE 100 rose by 0.80%. In the United States, futures tied to the S&P 500 and Dow Jones rose by 0.80% and 0.53%. The current relief rally comes after a few days of significant declines in global stocks. Some analysts believe that the plunge was because of fears of overvaluations in the stock market. Others believe that the correction was long overdue, considering that the fear and greed index has recently moved to its highest level in months.

The Swiss franc was little changed against the US dollar as traders reacted mildly to the Swiss unemployment rate data. According to the State Secretariat for Economic Affairs (SECO), the number of unemployed people in Switzerland increased slightly in August. This led to the country’s unemployment rate jumping to 3.3% from the previous 3.2%. This increase was in line with what analysts were expecting. While an increase in the unemployment rate is bad for an economy, Switzerland has fared somewhat better than the US and EU which have an unemployment rate of 8.4% and 7.6%, respectively.

The New Zealand dollar rose slightly even as traders digested weak economic data from the country. According to the country’s statistics office, the manufacturing sales volume fell by more than 12.2% in the second quarter. That was a significant weakness from the first quarter’s decrease of 1.7%. Other data by ANZ Bank showed that businesses are still worried about the future. Confidence among executives declined to -26.0 in August, possibly as most of them remained concerned about the new coronavirus wave in the country. Elsewhere, the Canadian dollar was little changed against key peers as traders waited for the BOC interest rate decision that will come out at 14:00 GMT.

NZD/USD

The NZD/USD pair rose to an intraday high of 0.6635, which is slightly above yesterday’s low of 0.6600. On the daily chart, the day’s low was along the ascending white trendline. The price is also above the 78.6% Fibonacci retracement level and the 50-day and 100-day exponential moving averages. Also, the signal and main line of the MACD have fallen below the neutral line. The upward trend is likely to remain so long as the price is above the ascending trendline.

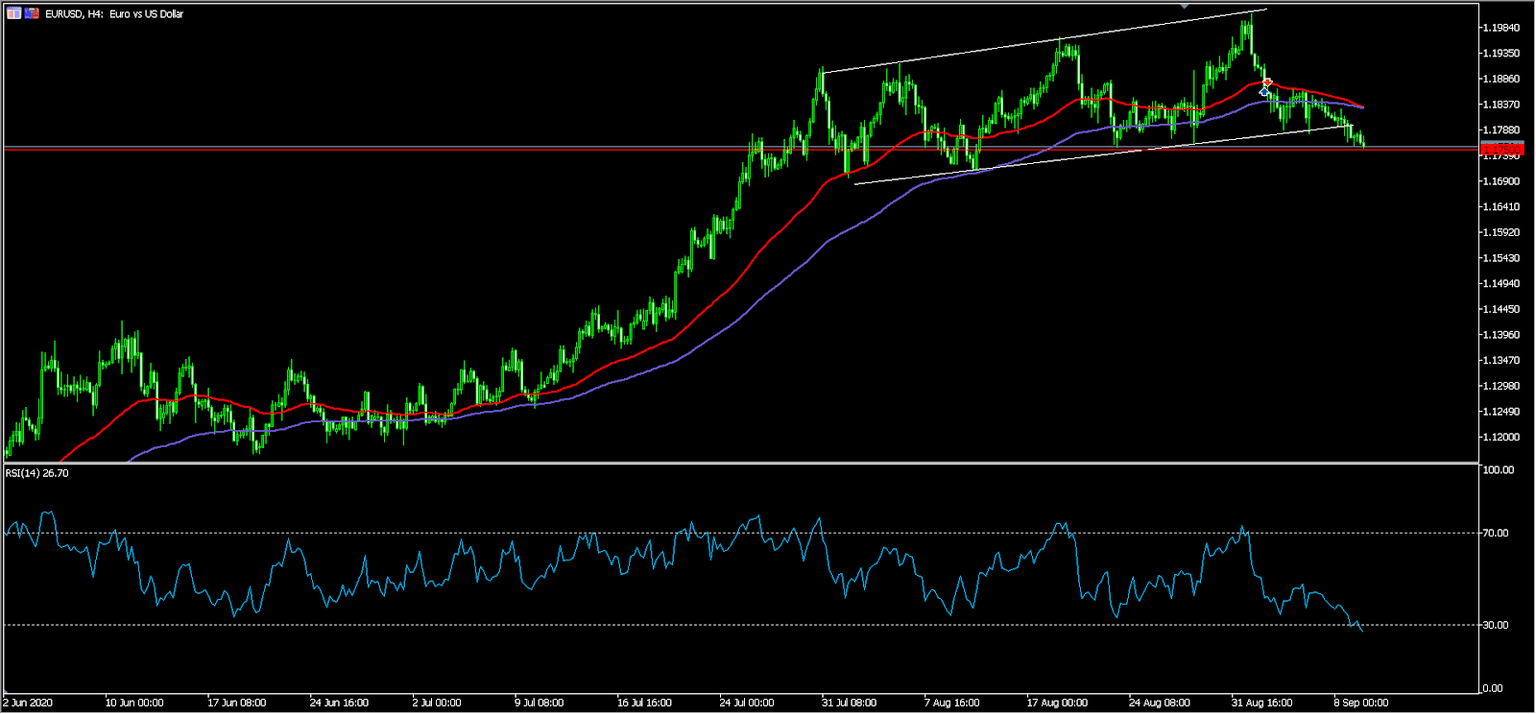

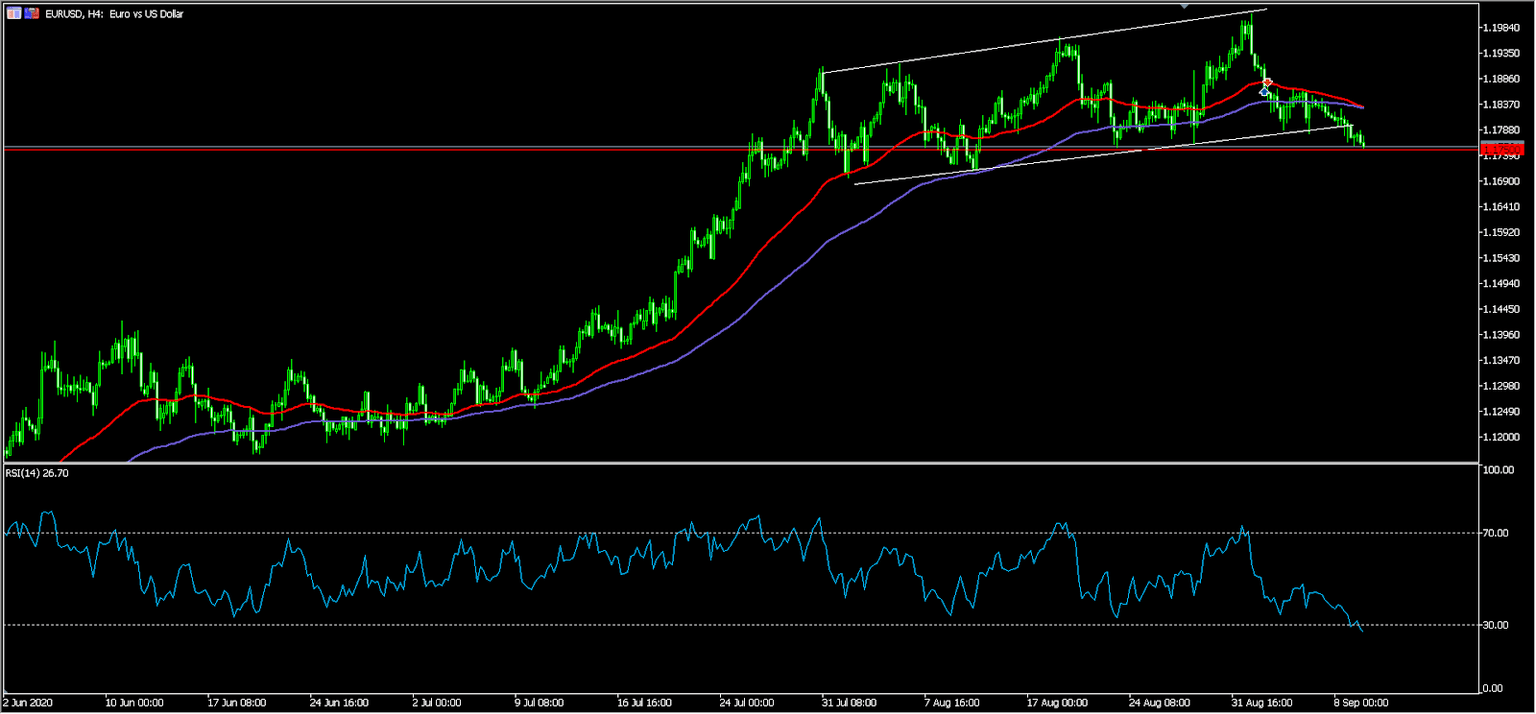

EUR/USD

The EUR/USD pair dropped to an intraday low of 1.1750, which is the lowest it has been since August 12. As the price dropped, it moved below the lower line of the previous ascending channel. It has also moved below the 50-day and 100-day exponential moving averages. Also, the Relative Strength Index (RSI) has dropped to the overbought level of 30. Therefore, it seems like the pair has reversed, which means that the price is likely to continue falling. However, this could change tomorrow when the ECB releases its rates decision.

USD/CHF

The USD/CHF pair rose to an intraday high of 0.9186, which is the highest it has been since August 12. The pair has risen from a low of 0.9000 this month. It is also slightly above the 50-day and 100-day exponential moving averages while the RSI has risen close to the overbought level of 70. It has also moved above the descending trendline that is shown in yellow. Therefore, there is a likelihood that the pair will continue rising.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.