Sticky UK services inflation shows signs of tax hike impact

There are tentative signs that the forthcoming rise in employer National Insurance is having an impact on service sector inflation, which came in a tad higher than expected in February. It should still fall back in the second quarter, though, keeping the Bank of England on track for three further rate cuts this year.

Are we starting to see prices rise in response to the forthcoming rise in employer taxes? UK services inflation stayed at 5% in February, a tad above consensus, in no small part because of a much larger month-on-month rise in catering services prices than we’ve been accustomed to for some time. This had been one of the most tangible sources of disinflation within the overall services basket in recent months. Hospitality is particularly exposed to the forthcoming tax hike, as well as the near-7% rise in the National Living Wage, given its labour-intensive nature.

This matters because services are the part of the inflation story that the Bank of England cares about most. And with no discernible rise in redundancies nor fall in employment, the hawks on Threadneedle Street might be tempted to conclude that the net impact of April’s tax hike is to push up prices rather than reduce jobs, despite survey after survey pointing to weaker hiring intentions.

It's still very early days, of course, and actually, there’s a much bigger story coming in the second quarter. April is when we get a whole host of annual price hikes within services – think phone and internet bills, for example. These are often explicitly tied to past rates of headline inflation. And, put simply, these have been a lot lower over the past few months than they were the winter before. If those contractual price hikes are more muted, then logic suggests that services inflation should come lower. We expect it to be much closer to 4% by the summer, contrary to the BoE’s forecasts, which show it staying around 5% over the same period.

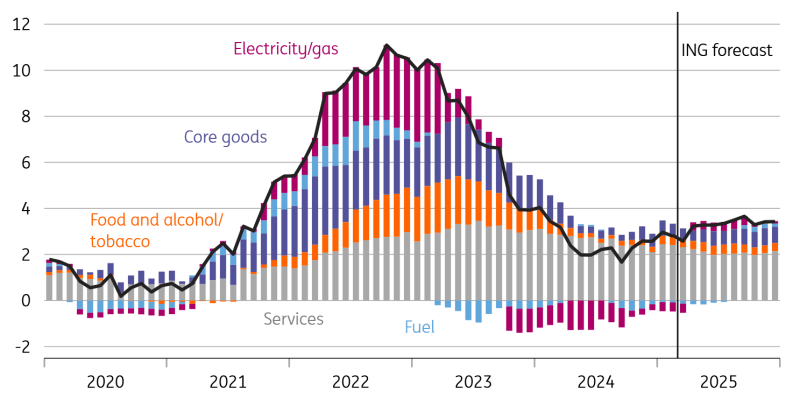

It's the opposite story for headline inflation, which, having slipped back from 3.0% to 2.8% in February, is set to rise back up towards 4% later this year. We have it touching 3.7% in September. That’s largely an energy story, in part because past falls in natural gas prices are no longer a drag on headline CPI. Water bills are also set to rise significantly next month. Core goods prices – that’s excluding food and energy – contribute a little more through this year too, particularly if the UK ends up raising tariffs in retaliation to any US decisions.

Headline inflation to drift towards 4% in the autumn

Source: Macrobond, ING calculations/forecasts

None of this should faze the Bank of England, though it seems officials are still a bit wary after a rise in energy and food prices eventually resulted in higher services inflation in the aftermath of the 2022 Ukraine invasion. The circumstances today look very different of course, and the rise in headline inflation is much more muted. But in the absence of a more material downturn in the jobs market, we suspect officials will stay cautious. We expect the current quarterly pace of rate cuts to continue through 2025 and into 2026, with a terminal rate of 3.25%.

As for the Spring Statement later today, the Office for Budget Responsibility is poised to lift its inflation forecasts for the next couple of years for all the reasons mentioned above. That’s usually good news for a chancellor, given that it automatically lifts tax revenue projections but doesn’t immediately lift spending, which is set in cash terms.

This time, however, it’s likely to be counterbalanced by a cut to the 2025 real growth forecast, from 2% to probably around 1%. Netted out, the impact of those two forecast changes on the ‘headroom’ – the amount of money left over once the fiscal rules have been met – is likely to be fairly minimal. The main change since October’s budget is that bond yields have risen and BoE rate cut expectations curtailed, pushing up forecasts of debt interest.

Read the original analysis: Sticky UK services inflation shows signs of tax hike impact

Author

James Smith

ING Economic and Financial Analysis

James is a Developed Market economist, with primary responsibility for coverage of the UK economy and the Bank of England. As part of the wider team in London, he also spends time looking at the US economy, the Fed, Brexit and Trump's policies.