South Korea’s trade slowdown suggests US tariffs starting to hit global economy

South Korean exports fell significantly in April, based on an early look at activity in the first 20 days of the month. The data suggests US tariffs are beginning to hit global trade hard.

South Korea's April trade data is a vital early look at global trade trends

The sudden 5.2% drop in South Korean exports in the first 20 years of April suggests US tariffs are really hitting Asia’s fourth-biggest economy. Though figures for the full month will come later, this series is a key bellwether for where activity is heading. Shipments of cars and steel, subject to 25% US tariffs in recent months, were most impacted, falling 6.5% and 8.7% year on year, respectively. By contrast, semiconductors, which are exempt from the tariffs for now, rose a solid 10.7%.

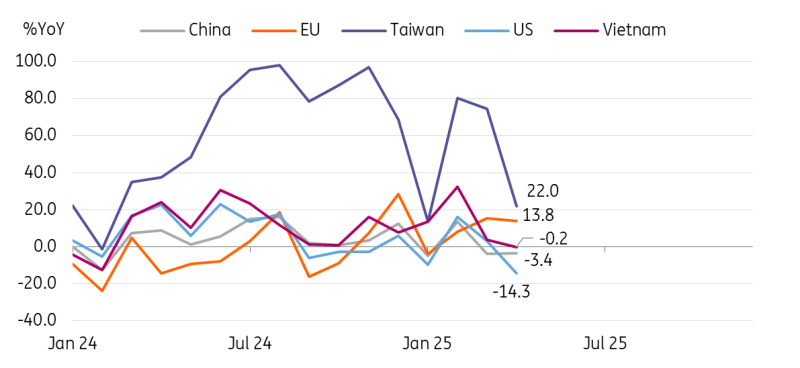

By destination, exports to the EU and Taiwan rose YoY 13.8% and 22.0%, respectively, probably due to strong vessel activity and semiconductors. We believe that vessels and semiconductors are likely the two main drivers of exports this year; other sectors are expected to decline quite sharply. Exports to China, the US, and Vietnam declined by 3.4%, 14.3% and 0.2%, respectively. We assess that the US-China tariff war is negatively affecting Asia's export trends in general.

Imports for the first 20 days in April dropped 11.8% YoY. Energy imports declined the most (-27.9%) and semiconductors fell 2.0%. Falling global commodity prices could be the main reason. We suspect Chinese semiconductor imports might have declined quite sharply, as they are largest Chinese imports item to Korea.

Semiconductor exports rose solidly

Source: CEIC

US-China trade war is already causing a downshift in Asian exports

Today’s data suggests that US tariffs are complicating global trade dynamics. Thanks to the exemption of chip tariffs so far, we think demand for high-end chips remains solid. But the legacy chip market is likely to weaken due to disruptions to supply chains and heightened trade tension between the US and China. We think this explains the drop in exports to Vietnam, Malaysia, and China.

Exports to China, the US, and Vietnam declined

Source: CEIC

Korean chipmakers are likely to increase its capex investment despite growing uncertinaty

For Korea specifically, we expect the trade surplus to continue as imports drop faster than exports. This is partly due to the nature of Korea's export mix, which is heavily focused on processed manufacturing. Also, weak global commodity prices are likely to lift some burdens for Korean exporters. As such, the contribution of net exports is likely to stay positive in the current quarter. Also, a solid rise in capital goods imports suggests that despite the uncertainty ahead, chipmakers are increasing capex investments. This could be positive for equipment investment in the current quarter.

Read the original analysis: South Korea’s trade slowdown suggests US tariffs starting to hit global economy

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.