Silver rockets to $30 as social media – fueled demand rises

Silver price rocketed by more than 10% today as social media users reported their huge purchases. Many silver bar sellers reported rising demand, with others running out of stock. In the past week, Reddit users in channels like Wall Street Bets have helped drive the price of stocks like GameStop, AMC, Nokia, and Blackberry. In addition to silver, they helped create hype on XRP, whose price rose by more than 40% today. As a result, silver miners like Polymetal and Fresnillo were the best-performing stocks in London today. Still, some analysts caution that this could be a pump and dump scheme that will leave many retail traders at a loss.

The British pound pulled-back today after mixed economic data from the United Kingdom. According to Markit, the country’s manufacturing sector held steady in January even as the government imposed a major lockdown in England. The manufacturing PMI increased from 52.9 in December to 54.1 in January. This was better than the expected increase to 52.9. Further data showed that mortgage lending dropped from 5.73 billion pounds to 5.59 billion pounds in December. This happened as the number of mortgage approvals fell from 105.32k in November to 103.38k in December.

The euro declined today after mixed data from the European Union. According to Markit, the German manufacturing PMI dropped from 58.3 in November to 57.1 in December. This was better than the estimated 57.0. In the European Union, the PMI rose from 54.7 to 54.8, which is a sign of resilience since the bloc was mostly in lockdown. Meanwhile, in Germany, retail sales dropped by 9.6% in December leading to an annual decline. The sales had jumped by 1.1% in November. In Sweden, the economy contracted by 2.6% in the fourth quarter.

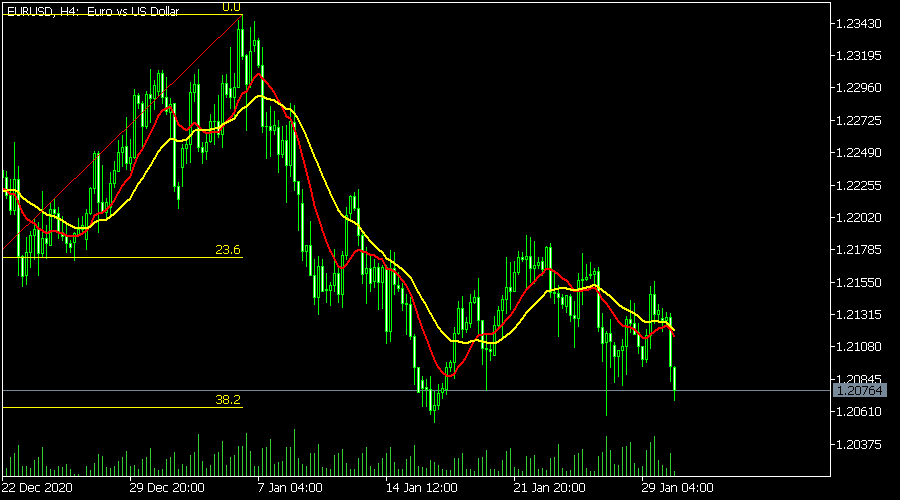

EUR/USD

The EUR/USD price dropped from the intraday high of 1.2155 to the current 1.2073, which is the lowest it has been since Thursday last week. On the four-hour chart, the price has moved below the 15-day and 25-day weighted moving average. Also, it is slightly above the 38.2% Fibonacci retracement level. Most importantly, it is a few pips above the year-to-date low of 1.2053. Therefore, the pair will likely continue falling as bears target the psychological level of 1.2000.

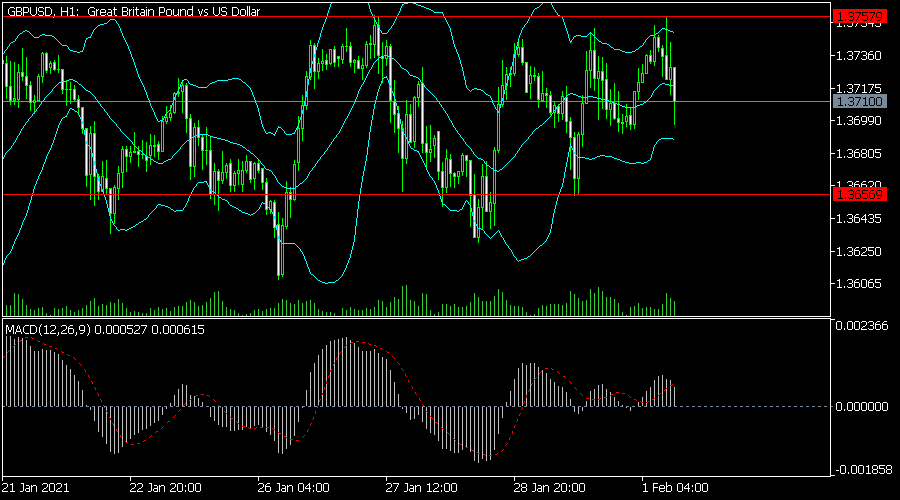

GBP/USD

The GBP/USD pair dropped to a low of 1.3696 after weak mortgage data. On the hourly chart, this price is between the middle and the lower line of the Bollinger Bands. It is also below the 25-day exponential moving average while the signal and histogram of the MACD are above the neutral level. Therefore, the key points of interest in the near term are the support at 1.3656 and the resistance at 1.3757.

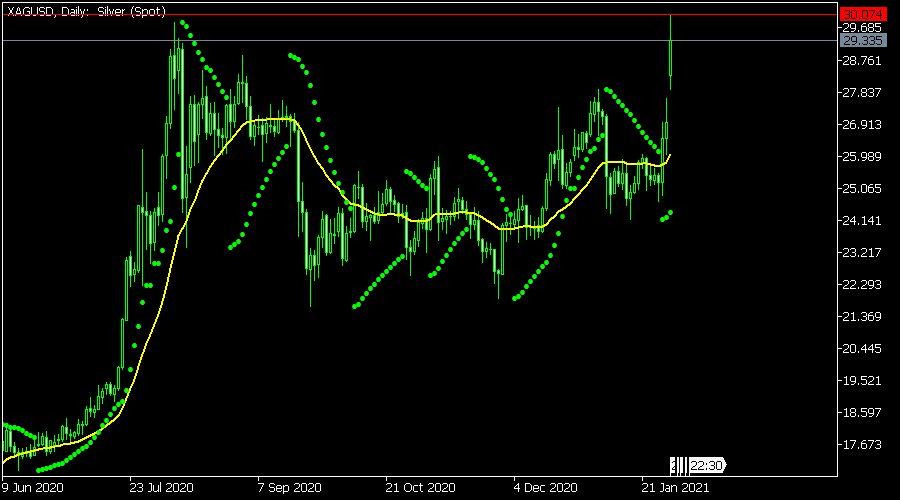

XAG/USD

The XAG/USD price soared to an intraday high of 30 as demand for physical silver continued to rise. On the daily chart, the price completed the formation of a cup pattern and is still above the 25-day moving average. It is also above the dots of the Parabolic SAR. Therefore, while the uptrend will likely continue, there is a likelihood of a pullback or consolidation happening.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.