Palladium Rally Could be at Risk

Palladium prices continue its advance and look to strike over the $1,800 per ounce again. Although Gold is the risk-off asset for excellence, Palladium has become more valuable than Gold in the precious metals sector.

Currently, Palladium is trading at $1,780 per ounce, being almost 20% more valuable than Gold, which is traded at $ 1,488 per ounce.

Palladium demand remains strong, and supply shows signals of increasing scarcity. However, the Palladium bull market seems to be at risk, and it is induced by Platinum.

Both Palladium and Platinum are utilized in the automotive industry to reduce polluting emissions. The main reason that places Palladium's bull market at risk is that Platinum could act as a substitute for Palladium.

The second risk factor for the Palladium rally is that Platinum is traded at half the value of Palladium.

Technical Overview

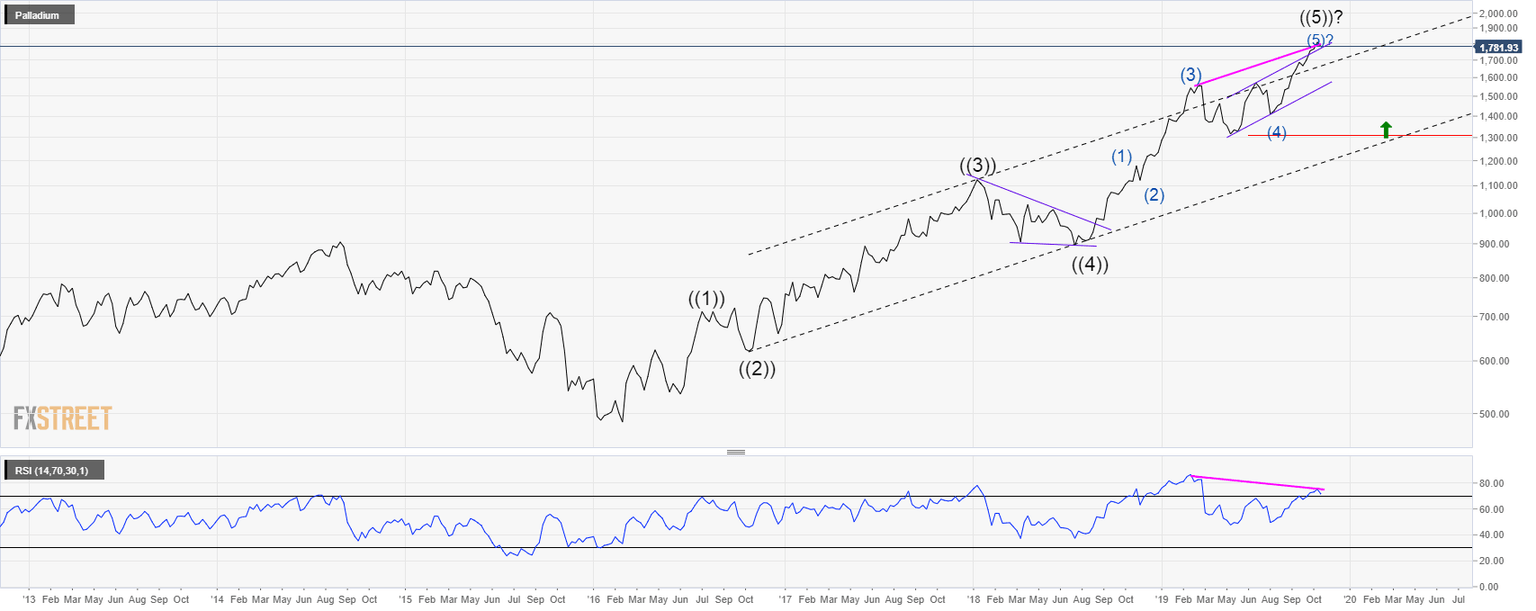

Palladium, in its weekly timeframe, shows signals of bullish exhaustion. The RSI indicator exposes a bearish divergence which reveals the end of wave (3) of intermediate degree labeled in blue, and the potential end of wave (5) of wave ((5)) of primary degree labeled in black.

Currently, the precious metal moves above the long-term ascending channel. In this context, we could expect more upsides for the precious metal.

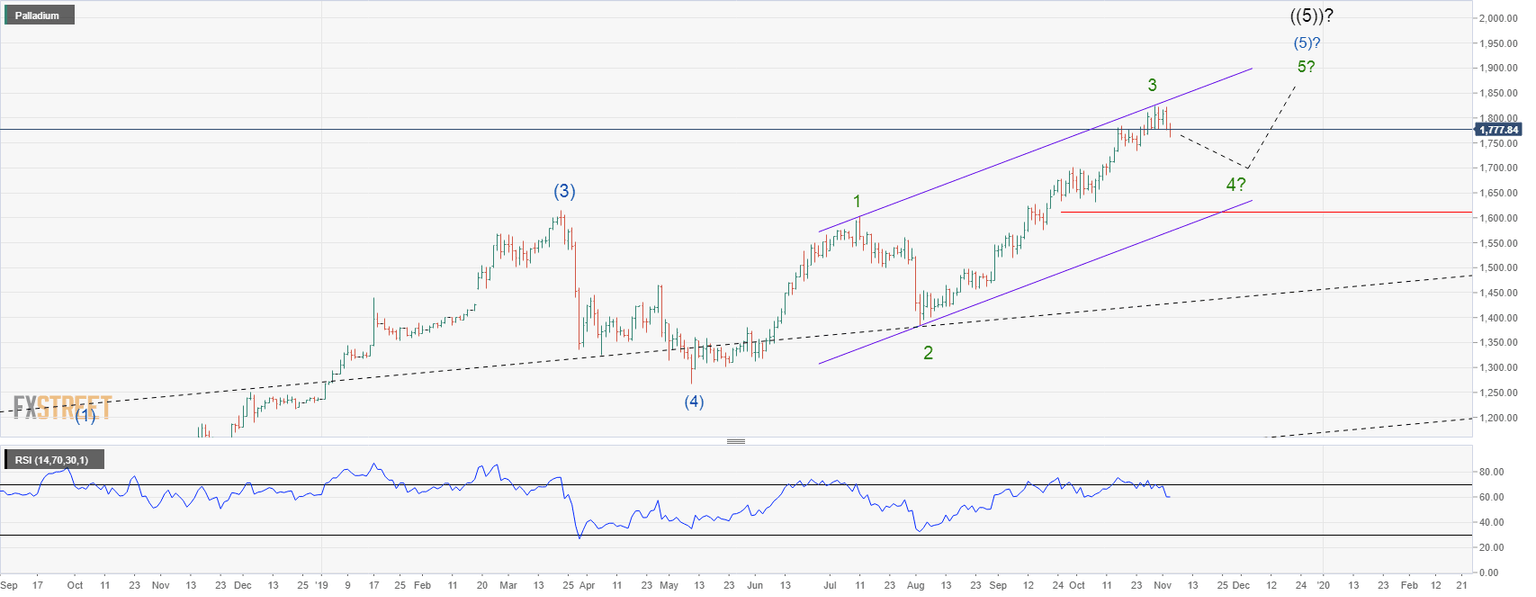

The daily chart illustrates an incomplete bullish sequence on the fifth wave of intermediate degree. So, Palladium could have completed the wave 3 of minor degree labeled in green.

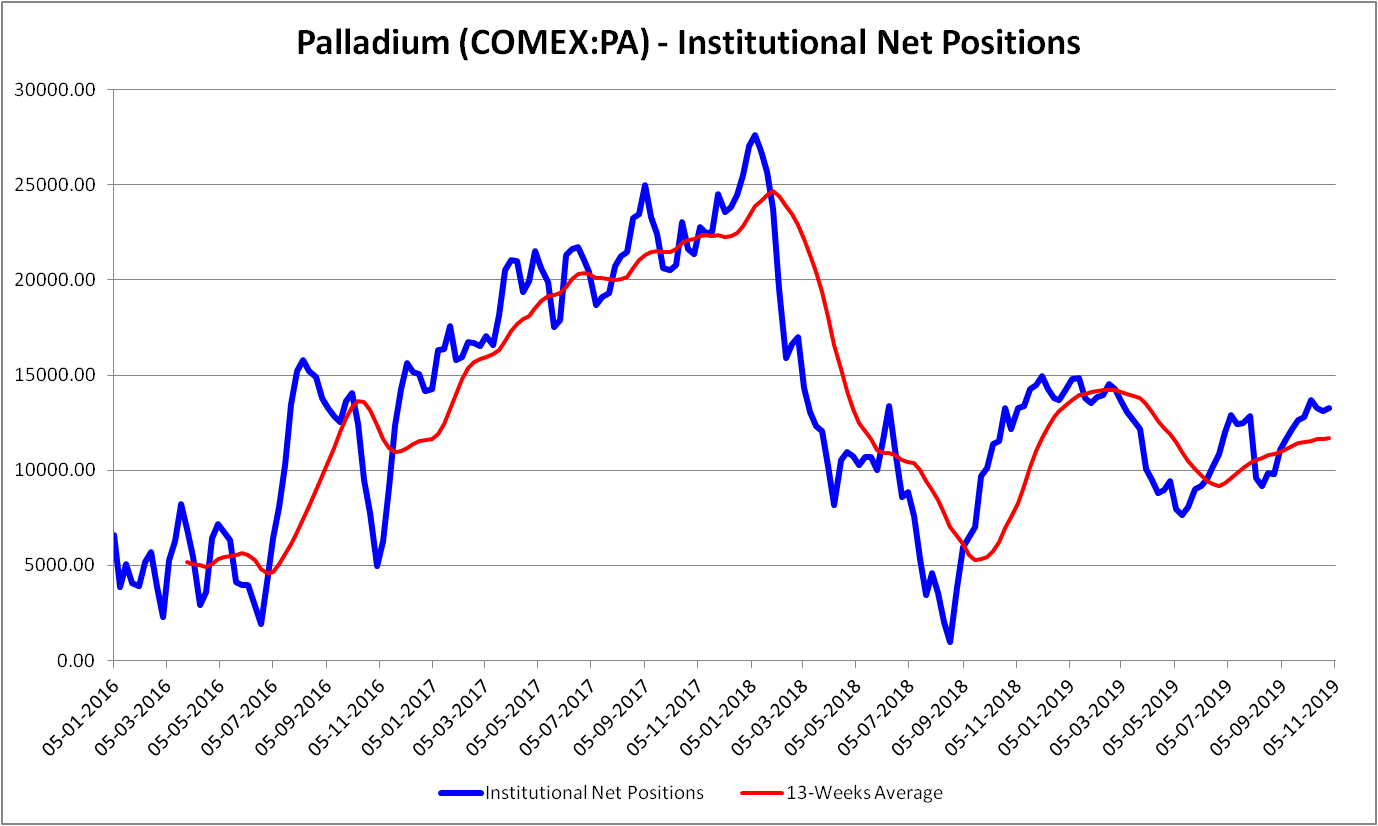

In the last CFTC report, institutional traders unveiled an increment in both trading sides. The long-side positioning boosted by 1.34% (WoW), this reading left to speculative traders with 77.57% positions. On the sell-side, institutional traders increased their positioning by 1.43% (WoW).

On the other hand, the institutional net positioning raised to 13,258 contracts from the 13,085 lecture reported on the previous CFTC report. This reading is over the 13-weeks average that reaches to 11,961 contracts.

In summary, the Palladium market bias continues driven by the bullish sentiment. Finally, the Elliott wave structure suggests the possibility of a consolidation structure as a wave four.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and