Narrowing in trade deficit may not mean big boost for Q3 GDP

Summary

The trade deficit narrowed sharply to -$52.8B in September. Most of the increase in exports was driven by non-monetary gold, which is largely excluded from GDP calculations. The upshot: trade is apt to be far less consequential to top-line growth than it was in the first half.

All the glitters is Gold

The trade deficit narrowed sharply in September as a modest 0.6% gain in imports was more than offset by a 3.0% increase in exports. While it is tempting to see a rebound in exports as a positive development for manufacturing, a word of caution: Of the $8.8 billion monthly increase in goods exports, $6.1 billion of the increase came from exports of non-monetary gold. Non-monetary gold exports (gold for industry/jewelry, not central bank reserves) are largely excluded from GDP calculations by statistical agencies like the BEA. This actually makes a degree of intuitive sense because it is treated as financial asset transfers, not final goods production. Exports of American-made capital goods fell by $3.3 billion September.

When looking back on 2025, the economic theme remembered most will likely be the disruption from trade. The drag from net exports in the first quarter was the largest in more than 50 years of data and the boost in the second quarter was the largest. Today's report offers a fresh read on September, the final month of the third quarter. The upshot is that trade is apt to be far less consequential to top-line growth in Q3. We had penciled in a 0.4 percentage point boost from trade in Q3, that is more or less intact after today's data.

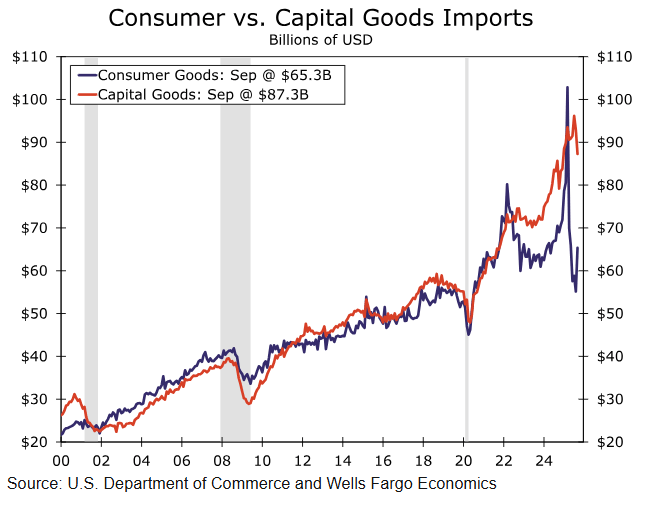

On the imports side, the theme in recent months has been that businesses are still investing even if consumers are pulling back. Long lead times for capital goods means orders placed 2022-2024 are just showing up now (think semiconductors, machine tools, chip-making equipment). But consumers had been pulling back and retailers do not want to get caught holding the unsold inventory. After being stuck with excess merchandise in prior years of this cycle, retailers had to mark down stock to move it. Since that is much more expensive when you are paying import duties, no one is trying harder to find out the underlying level of demand like retailers.

The nearby chart shows really well the pull-forward in consumer goods and subsequent payback. We had a bit of reversion here in September. Capital goods imports slowed a bit and consumer goods imports partially reversed a decline earlier this year.

Author

Wells Fargo Research Team

Wells Fargo