Yesterday’s outcome was not at all as markets expected

Outlook

Yesterday’s outcome was not at all as expected in FX. The Fed was okay and so was the Powell press conference, but the FX gang was not impressed by good growth forecasts and the suggestion the next cut will be postponed to later in the spring. There may be two cuts instead of three. And the Fed is resuming QE in the form of buying short-dated paper, starting tomorrow.

The postponement is a hawk and the QE is a dove. Well, not really. The cut will benefit smaller companies with debt and the buying of short-term paper helps the banks keep (or restart) lending without anxiety about liquidity.

We find it interesting that so many reports say dissents numbered two when it was three—two against any cut and one for 50 bp, as though the only dissents that matter are the ones for no cut. The vote for the cut was 9 of 12.

The growth forecast is 2.3% for 2026, a jump from 1.8% predicted at the Sept meeting. The board also cut the inflation forecast from 2.6% in Sept to 2.4%. Powell said if there are no new tariff announcements, goods inflation should peak in the first quarter. The implication is that pre-tariff inventory builds will be running out by then and we will get a one-time price hike. Another implication, although it’s unfair to attribute it to Powell, is that if Trump would just stop fiddling with tariffs, he can get the rate cuts he prefers. Trump, of course, is immune to economic logic.

Powell said the 150 bp of cuts thus far leaves the rate roughly neutral and “We’re well positioned to wait and see how the economy evolves from here.” He also mentioned that the consumer is still in fairly fine fettle.

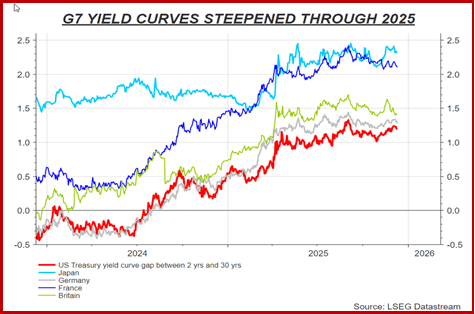

All these should have pointed to a stronger dollar. Note that the 10-year yield fell half as much as the 2-year, indicating the inflation premium is still alive, if not exactly kicking. The bond market is still a sleeping giant. We continue to expect it to wake up and take the 10-year yield higher. See the 2/10 spread chart above over the past 5 days.

At any moment we can expect the White House to complain about Powell and the Fed, starting up that uncertainty again about what the next guy will say and do. As noted before, the Board has 12 members, so the chairman can influence but not control. All the same, we expect hang-wringing and breast-beating when Trump names the guy, presumably his lackey Hassett.

Data today includes PPI, the usual Thursday jobless claims, and trade. PPI is a bit of a wild card. Markets do not usually respond to it, in part because it tends not to feed CPI in the US as elsewhere, but we were starved of data for so long, it could have consequences this time, especially if services are hot.

Last time initial claims were 214,750, forecast up to 219,000 this time. The 4-week moving average is 214,750. As for trade, it may be at the center of the tariff war but in practice, the dollar tends not to respond to increases or decreases in the deficit.

Forecast

The big theme today is that the easing cycle is over and even if central banks are not saying so out loud (except for the ECB), the future holds rate increases. Bond markets are telling us so. Reuters notes “Just this week, European Central Bank hawks suggested that higher rates are the next likely move. The Reserve Bank of Australia made it crystal clear it's now done with rate cuts. And, only slightly less emphatically, the Bank of Canada and Reserve Bank of New Zealand have sent similar messages. The Bank of Japan, meantime, is now odds-on to lift its main rate again next week.

“Even if central banks give next year a skip, bond markets with maturities of two years or more need to start repricing for what comes after.

“Just looking at 10-year benchmark government yields, the wheels are already in motion. Japan's is at 18-year highs, Australia's hit a two-year high this week, Canada's has climbed 30 basis points this month and even U.S. Treasuries are at their highest in three months, despite ongoing Fed easing.”

There’s more, including the effect on vast fiscal deficits, including the US. The “bear steepening” (short rates up more than longer ones) is “a tougher environment for bonds.

It may take another shock or something akin to an AI bubble burst to alter the picture decisively in favor of bonds again.”

The Dollar is long accustomed to tracking yields, but more the 10-year than the shorter end, even if the 2-year is considered more sensitive. Given the huge US deficit and dreadfully incompetent White House, we should probably expect the US yields to top the list, with maybe the UK a notch above (as usual). Again the long term outlook is for the dollar to retain some muscle. In other words, we don’t much trust the current move will be long-lasting.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat