Markit Eurozone January PMI Preview: Manufacturing looks ahead

- Declines further into contraction expected in January services and composite indexes.

- Manufacturing PMI to decrease but remain above 50.

- Service PMI to reflect the pandemic stranglehold on EZ economy.

- Euro will be unmoved by changes in business confidence.

The lengthening wait for the vaccine to end the pandemic has drained the optimism from the European service sector while manufacturing seems keyed for its strongest performance in four years.

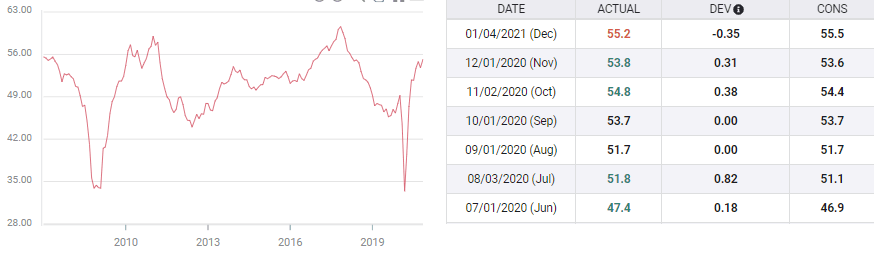

Purchasing Managers' Indexes from IHS Markit of London for January are expected to fall to 45 from 46.4 in services, and to 54.6 in manufacturing from 55.2. The composite Index is projected to slip to 47.9 from 49.1.

Manufacturing vs Services

Over the past six months the manufacturing index has averaged 53.5 its best performance since the second half of 2017. The July jump to 51.8 after the pandemic low of 33.4 three months earlier was the first reading above the 50 demarcation between expansion and contraction since January 2019.

Attitudes in the service sector however, have lost all of their their summer gains from 12 in April to 54.7 in July. If the 45 forecast for January is accurate the index will have spent six consecutive months in negative territory. The 48 average from July to November is the lowest for the much larger sector since 2012.

The Composite Index, as might be expected mediates between the two, averaging 50.3 from July

Revived lockdowns in many European countries, as in most places, have had their largest impact on the already devastated restaurant, travel and hospitality industries and the overall service sector.

Consumer Confidence and Retail Sales

European Consumer Confidence has stalled for the past four months averaging -15.6 from October after reaching a recovery high of -13.9 in September.

Retail Sales in November reflected the increasing consumer discomfort. Sales dropped 2.9%, far worse than the 0.8% forecast and October's 4.2% gain.

Retail Sales

Conclusion and the euro

The pandemic split between lockdown conscious consumers and the closely tied service sector and the forward looking manufacturing establishment will continue until the pandemic is visibly in retreat.

Risk for both sectors is on the downside but it is more acute for services. Whether better or worse, the PMI's will have little impact on the euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.