Markets sitting in consolidation ahead of the FOMC and tariffs decision [Video]

![Markets sitting in consolidation ahead of the FOMC and tariffs decision [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Candlesticks/drawing-candle-chart-56105994_XtraLarge.jpg)

Market Overview

In light of what is on the near term horizon, traders can be forgiven for taking a step back in the next day or so. With a decision on the potential next tranche of tariffs due by 15th December, there is also central bank meetings of the FOMC, ECB and Bank of England in the coming days. Furthermore, a UK election result which could define the direction of Brexit (another key risk factor) for well into 2020. It perhaps comes as little surprise that major markets have hit a period of consolidation. Yields are lacking direction, forex major pairs are holding support and resistance levels, and gold continues to range. Equities have been the most interesting mover of the key asset classes in recent days, but also show a lack of conviction early this week. It will be interesting if comments from the US Agricultural Secretary Sonny Perdue, that the tariffs will not be implemented, can cut through for traders today. The slightest degree of positive risk suggest only minimal reaction. The trouble is that the Fed and ECB are likely to sit very tight in their policy meetings, whilst the Bank of England will feel restrained from any action which could be deemed to influence the election. It may not be until the small hours of Friday morning and the UK election at which the first signs of volatility return again. That is unless there is an indication of the tariffs decision before then. Overnight, China inflation showed mixed signals in November. China CPI jumped to +4.5% (+4.2% exp, +3.8% in October) amid soaring prices of pork in the swine flu epidemic. However, on the flip-side, the China PPI remains in deflation at -1.4% (-1.5% exp, -1.6% in October) as the trade dispute and global economic slowdown bites.

Wall Street closed lower last night with the S&P 500 -0.3% at 3136. However, a degree of stability has taken overnight, with US futures +0.1% higher. This has generated a quiet session in Asia (Nikkei -0.1%, Shanghai Composite +0.1%). European markets are equally cautious early today with FTSE futures +0.1% and DAX futures 0.1%. In forex, a marginal slip back on USD is again taking off, with NZD rising to the top of the performance table, whilst JPY is underperforming. In commodities, there is almost no direction on gold or silver, whilst oil is also consolidating.

The economic calendar has a European focus today. The UK data comes with UK monthly GDP for October at 0930GMT which is expected to show +0.1% growth (-0.1% in September) with the rolling 3 month growth at 0.0% as stagnation continues. UK Industrial Production is at 0930GMT and is expected to show monthly growth of +0.2% in October (-0.3% in September) whilst this would marginally improve YoY growth back to -1.2% (-1.4% in September). German ZEW Economic Sentiment is at 1000GMT and is expected to show a small improvement to 0.0 in December (from -2.1 in November. The German ZEW Current Conditions are also expected to show improvement to -22.3 in December (from -24.7 in November).

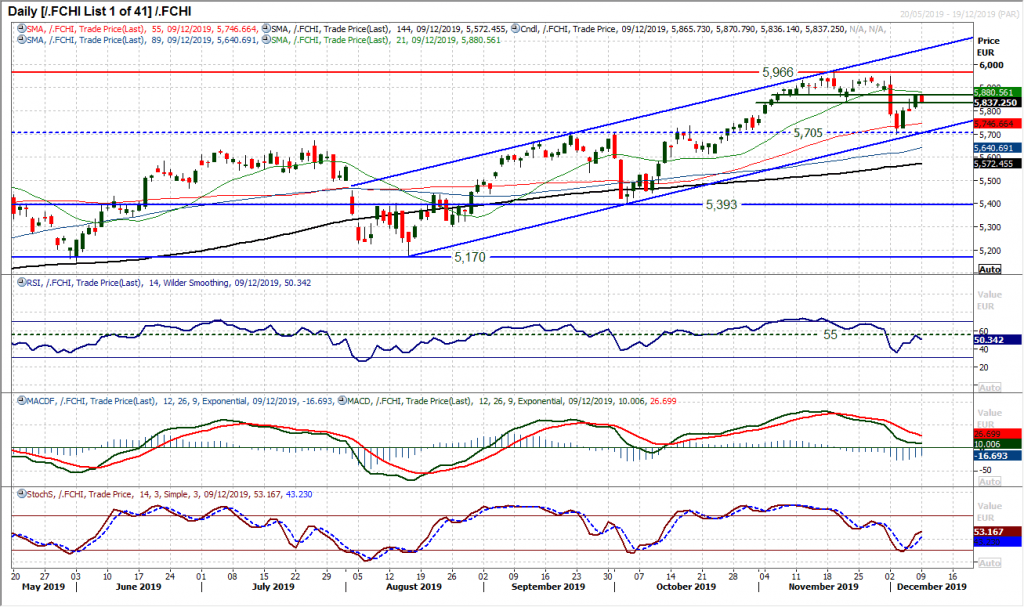

Chart of the Day – French CAC 40

The French CAC has been trending higher since August as corrections have been bought into. The reaction to the sharp decline of early December has many similar hallmarks to the recovery in the wake of the early October correction. The rebound is once more back at an interesting inflection point. The bulls are ready, but the rebound has hit the buffers around some overhead supply from mid-November. However, given the renewed upside potential on momentum indicators, such as MACD Lines bottoming above neutral, the market is primed for the next leg higher. Near term resistance is around 5870/5875, whilst it is interesting to see the RSI faltering around 55, often a turning point for the next leg higher for the channel. It now needs a push through 5875 to open the move towards a test of the key resistance 5948/5966. A close back under 5800 would suggest the bulls may not quite be ready yet for the move, but whilst the trend channel is intact we are happy to buy into weakness.

WTI Oil

The history of this recovery on WTI over the past nine weeks shows that breakouts struggle for sustained traction. Breakouts above resistance tend to be met with consolidation before another spike lower lends a buying opportunity. Friday’s latest breakout has since been followed by an inside day yesterday and another early consolidation today. It is interesting to see that momentum indicators are tailing off again (RSI at or around 60) and Stochastics lines a shade above 80. We remain buyers into weakness as too many times the breakouts have not been the conviction signal to buy. There is support again around $57.20/$58.00. We do see a positive recovery outlook continuing on oil, but breakouts should be viewed with caution. If the US avoids placing extra tariffs on China then this would be oil positive.

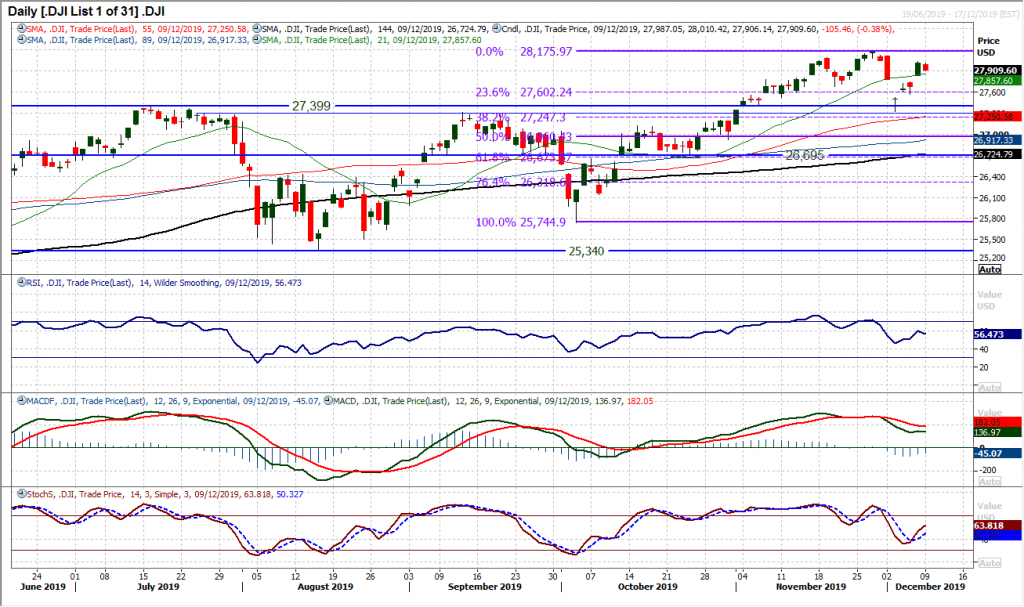

Dow Jones Industrial Average

A minor corrective slip on the Dow has just taken some of the steam out of the move higher. An “inside day” has just pulled the reins on a rising RSI and Stochastics. Essentially, yesterday’s session has taken the impetus out of the bull run, but is likely to be part of a consolidation in front of a raft of key announcements in the coming days. Wall Street focus will be on not only the Fed (Wednesday), but at some stage in the coming days on a decision over tariffs. Technically, the Dow has initial support at 27,840 with a gap still open at 27,745. Given the legacy of Friday’s sharp move higher still is a dominant factor in this chart which has opened the highs again at 28,175, the inside day for yesterday’s session changes very little. We see near term rallies as a chance to buy for a retest of the high. Support at 27,562 is a key near term higher low.

Author

Richard Perry

Independent Analyst