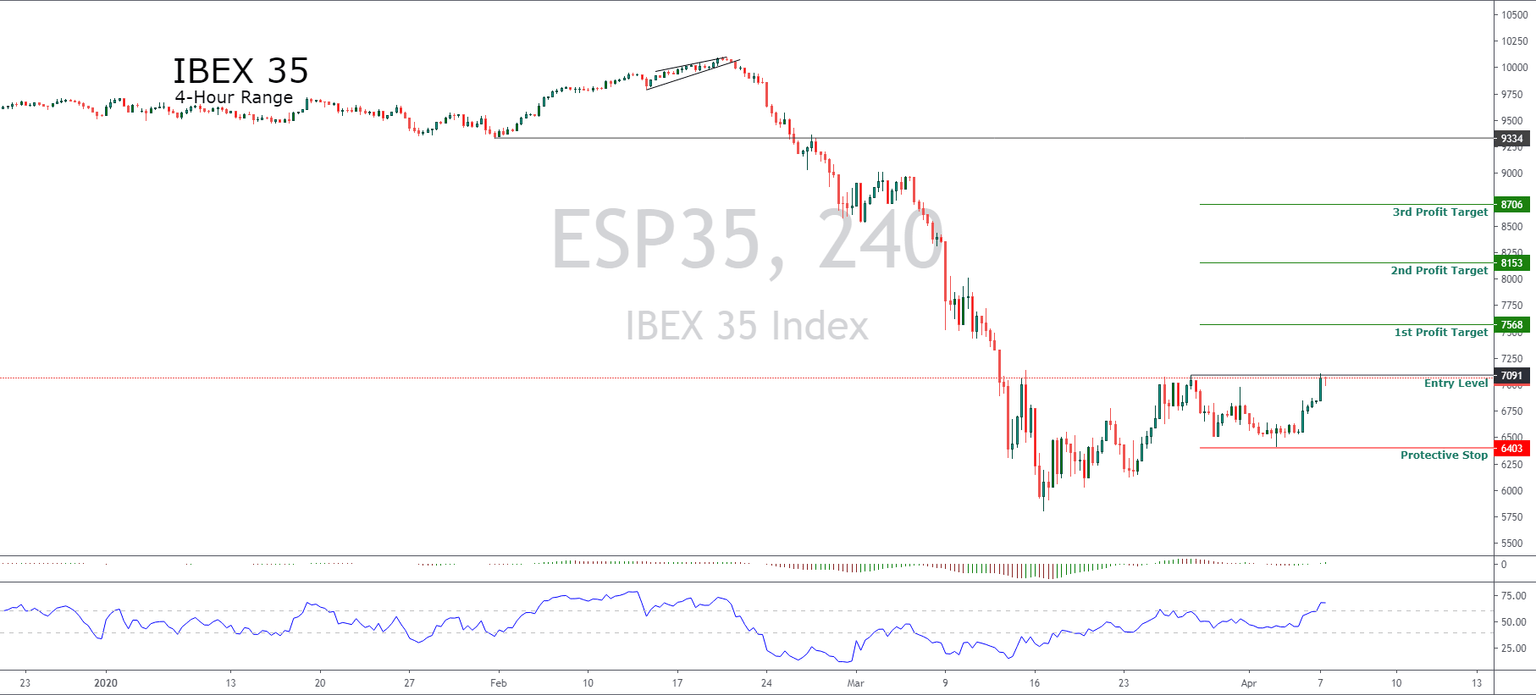

IBEX 35 exhibiting bullish signals

The Spanish benchmark IBEX 35 in its 4-hour chart represents a sequence of increasingly higher lows and the recent re-test of the 7,090 pts, a short-term resistance, which suggests the possibility of new upsides. Likewise, the RSI oscillator moves above level 60, which gives us another argument to value the probability of an upward move.

On the other hand, the bullish sentiment observed in the last two trading sessions in the global stock market leads us to expect a new bounce up in IBEX 35.

A bullish position will activate if the price breaks and closes above 7,091 pts. In our conservative scenario, we foresee an upside to 7,568 pts. If IBEX 35 extends its bullish momentum, the Spanish index could advance to 8,153 pts, and even soars until 8,706 pts.

The level that invalidates our bullish scenario locates at 6,403 pts.

Trading Plan Summary

-

Entry Level: 7,091 pts.

-

Protective Stop: 6,403 pts.

-

1st Profit Target: 7,568 pts.

-

2nd Profit Target: 8,153 pts.

-

3rd Profit Target: 8,706 pts.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and