Hurry up and wait, the Fed stands pat at July meeting

As widely expected, the Federal Reserve maintained its wait-and-see position, taking no interest rate action during the July FOMC meeting.

However, there were some evident cracks in the committee as two members dissented from the majority decision. It was the first time multiple committee members opposed the majority since late 1993.

Until at least September, the federal funds rate will remain set between 4.25% and 4.5%.

The messaging coming out of the meeting was similar to the mantra last month. Inflation remains somewhat elevated. The economy is still strong. We don’t know the impact of tariffs. It’s a time to wait and see.

However, there was a subtle shift in the official FOMC statement that could be taken as more dovish. Instead of claiming economic activity “has continued to expand at a solid pace,” the committee said the “growth of economic activity moderated in the first half of the year.” The FOMC statement also said, “Uncertainty about the economic outlook remains elevated.”

During his post-meeting press conference, Powell said the committee decided to hold its policy rate “where it’s been, which I would characterize as modestly restrictive.”

“It seems to me, and to almost the whole committee, that the economy is not performing as though restrictive policy is holding it back inappropriately and modestly restrictive policy seems appropriate.”

Powell hinted that the majority of the FOMC isn’t in any hurry to make any policy shifts, saying, “We’ve learned that the process will probably be slower than expected.”

Many market observers read this as a hawkish signal that the central bank may not cut in September either. After stocks took a dip in the wake of Powell’s comment, New York Life Investments chief market strategist Lauren Goodwin told NBC News, “The markets seem to think that Powell pushed back on a September rate cut.”

However, Powell insisted, “We have made no decisions about September.”

“We don’t do that in advance. We’ll be taking that information into consideration and all the other information we get as we make our decision.”

It’s clear that the majority of the FOMC remains worried about price inflation. Based on the CPI, price inflation heated up in June. Powell said that tariffs have “begun to show through more clearly to prices of some goods,” but it is too early to determine their overall effect.

“Our obligation is to keep longer term … inflation expectations well anchored and to prevent a one-time increase in the price level from becoming an ongoing inflation problem.”

Equally concerned about higher inflation and a weakening economy, Powell and Company have adopted a “hurry up and wait” position.

President Trump has been pushing hard for rate cuts, and he took to social media to make his displeasure known.

"Jerome ‘Too Late’ Powell has done it again!!! He is TOO LATE. Put another way, ‘Too Late’ is a TOTAL LOSER, and our Country is paying the price!"

The dissenters

The FOMC voted 9-2 to hold rates steady, with Michelle Bowman and Christopher Waller pushing instead for a quarter-point rate cut.

Bowman and Waller were both Trump appointees (as was Powell), and they are both considered to be on the short-list to replace Powell when his term ends next May.

Powell seemed to welcome the pushback.

“This was quite a good meeting all around the table, where people thought carefully about this and put their positions out there. You want that clear thinking and expression of your thinking, and we certainly had that today, I think, all around the table.”

The split in the committee will provide a little additional fuel for those pushing for looser monetary policy.

Is monetary policy really restrictive?

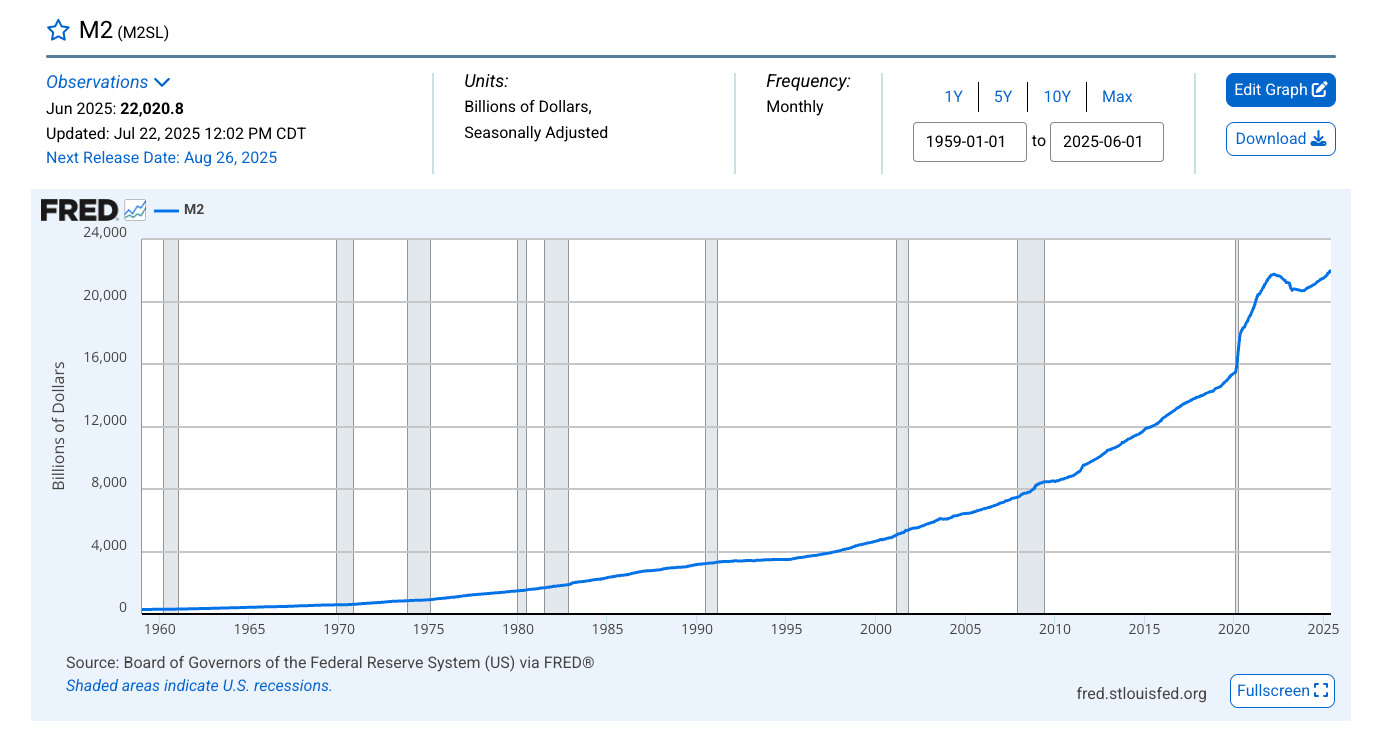

Powell called the current policy “modestly restrictive.” This characterization is debatable. As of the end of June, the money supply had expanded by more than $600 billion since its low point in mid-2023.

As of June, the M2 money supply stood at $22 trillion and is above the peak reached during the pandemic.

This is, by definition, inflation. And it certainly isn’t indicative of even modestly tight monetary policy.

The Chicago Fed’s own metric indicates that monetary policy remains historically loose. As of the week ending July 25, the National Financial Conditions Index (NFCI) stood at -0.57. A negative number reflects historically loose financial conditions. The NFCI remained negative even as the Fed was raising rates in 2023.

Looking at the historical data also reveals that the current interest rate level isn’t high at all.

So, why are so many people clamoring for rate cuts?

Because decades of artificially low rates and multiple rounds of quantitative easing since the 2008 financial crisis have addicted the economy to easy money. Fed policy incentivized a borrowing spree, and the economy is loaded up with debt. A debt-riddled economy can’t operate in an even modestly higher rate environment.

On the other side of the coin, you have inflation.

While the Federal Reserve tightened monetary policy enough to rein in rising prices, it never did enough to slay the inflation dragon.

When you break down the Fed’s messaging, it’s clear they’re torn between two worries. They know the economy is getting shaky, but they are also aware that inflation isn’t dead.

And what do we call high inflation coupled with low growth?

Stagflation.

It appears the plan is to stand pat and then address whichever side of the coin gets ugly first. If the CPI surges, rates will remain elevated, but if the economy begins to wobble, you can expect fast and aggressive cuts.

The Fed’s current inaction is exactly what you would expect given the Catch-22 it finds itself in. It simultaneously needs to cut rates to prop up the easy money-addicted economy and hold rates steady (or even raise them) to keep inflation at bay.

What is a central banker to do?

Wait and see.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.