Gold Weekly Forecast: Volatility set to remain high with tariff headlines dominating markets

- Gold surged to a new record high above $3,200 despite a bearish opening to the week.

- Safe-haven flows dominated the markets as the US-China trade conflict intensified.

- The technical outlook points to overbought conditions in the near term.

Gold (XAU/USD) started the week on the back foot and dropped below $3,000 before staging an impressive rally that lifted the price to a new all-time peak above $3,200 on Friday. Key macroeconomic data releases from China and new headlines surrounding the US-China trade conflict could continue to impact the precious metal’s valuation in the near term.

Gold registers impressive weekly gains

Gold ended the first week of April on a bearish note and continued to push lower on Monday. In the early trading hours of the American session, CNBC reported that Kevin Hassett, Director of the National Economic Council (NEC), said that United States (US) President Donald Trump was considering a 90-day pause in tariffs for all countries except China. Although this headline helped the market mood improve, the risk rally lost its stream as the White House came out with a statement, calling the CNBC reporting "fake news." Meanwhile, Trump took to social media to threaten an additional 50% tariffs on China, after Beijing issued retaliatory tariffs of 34% on US goods the previous Friday.

Markets turned relatively quiet on Tuesday, which made it difficult for XAU/USD to make a decisive move in either direction. On Wednesday, China's Finance Ministry said they will impose additional 84% tariffs on US imports from April 10, up from the 34% previously announced. Safe-haven flows started to dominate the action in financial markets after this development, opening the door for a rally in Gold. Later in the day, Trump stated that he had authorized a 90-day pause on reciprocal and 10% tariffs but noted they lifted additional tariffs on Chinese goods to 125%.

As the deepening trade conflict between the US-China fed into fears over a recession in the US, the US Dollar (USD) came under intense selling pressure on Thursday. Moreover, softer-than-expected inflation data from the US further weighed on the currency, allowing XAU/USD to continue to push higher. The US Bureau of Labor Statistics reported that the Consumer Price Index (CPI) declined by 0.1% on a monthly basis in March, while the core CPI rose by 0.1%. Both of these readings came in below analysts’ estimates.

During the European trading hours on Friday, China's Finance Ministry announced they would raise additional tariffs on US imports from 84% to 125% in retaliation. After rising more than 3% for two consecutive days, Gold extended its rally to a new record peak above $3,200.

Assessing Gold’s recent performance, the World Gold Council said in its latest Gold Market Commentary: “According to our Gold Return Attribution Model (GRAM), Euro strength and thus US dollar weakness was once again a key driver of Gold’s performance, alongside an increase in geopolitical risk capturing tariff fears.”

Gold investors await fresh tariff headlines, US inflation data

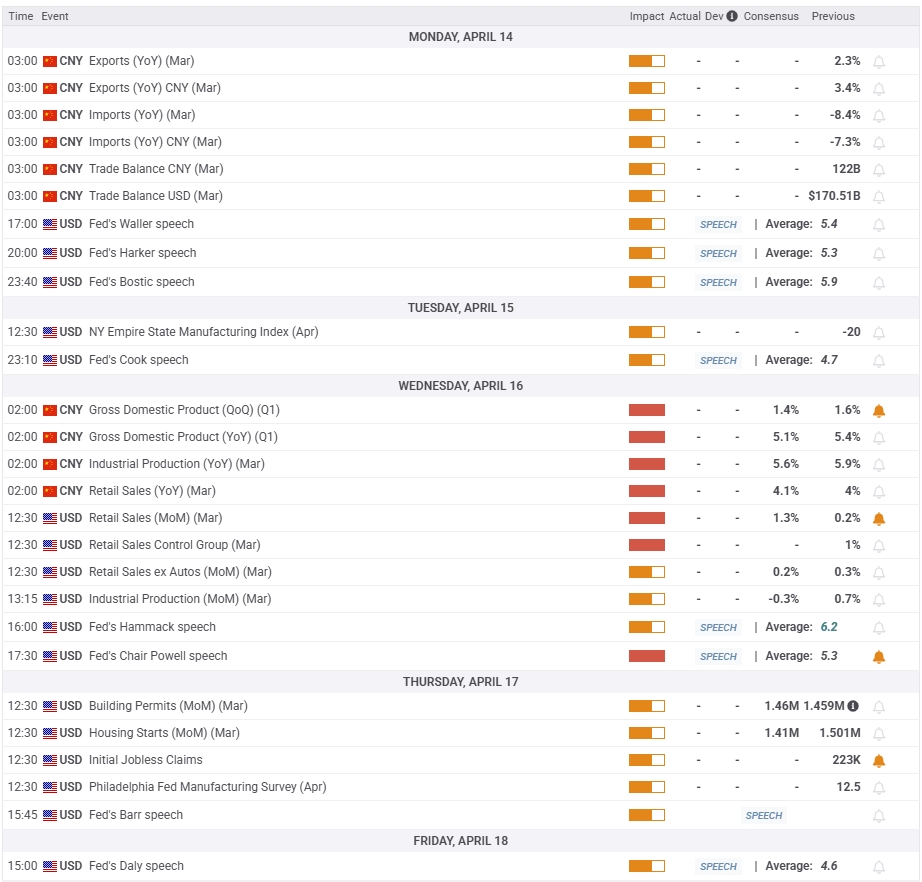

March Trade Balance data from China will be watched closely by market participants at the beginning of the week. Although this data might not reflect the impact of tariffs on China’s trade, a significant decline in exports could force investors to adopt a cautious stance. In this scenario, Gold could benefit from risk aversion. However, investors could also see this as a sign of a potentially worsening demand outlook for Gold and refrain from betting on an extended rally.

On Wednesday, the economic calendar will feature March Retail Sales, Industrial Production and first-quarter Gross Domestic Product (GDP) data from China. Markets expect the Chinese economy to grow at an annual rate of 5.1% in Q1. A positive print could help the risk mood improve and limit Gold’s upside with the immediate reaction. Later in the day, March Retail Sales data will be published from the US, which investors will likely ignore.

Investors will also continue to scrutinize headlines surrounding the US-China trade conflict and assess comments from Federal Reserve (Fed) officials.

When announcing the retaliatory tariffs against the US on Friday, China’s Finance Ministry noted that if the US continues to impose additional tariffs on Chinese goods exported to the US, they will ignore them. This statement suggests China’s tariffs on US goods have reached the upper limit. Hence, markets could breathe a sigh of relief if they remain confident that the trade conflict won’t escalate further. In this scenario, a recovery in risk sentiment could cause Gold to stage a correction.

According to the CME FedWatch Tool, markets are currently pricing about a 30% probability of a 25 basis point Fed rate cut in May. If Fed policymakers push back against this market expectation and put more emphasis on inflation risks rather than growth concerns, the USD could find a foothold and limit XAU/USD’s upside.

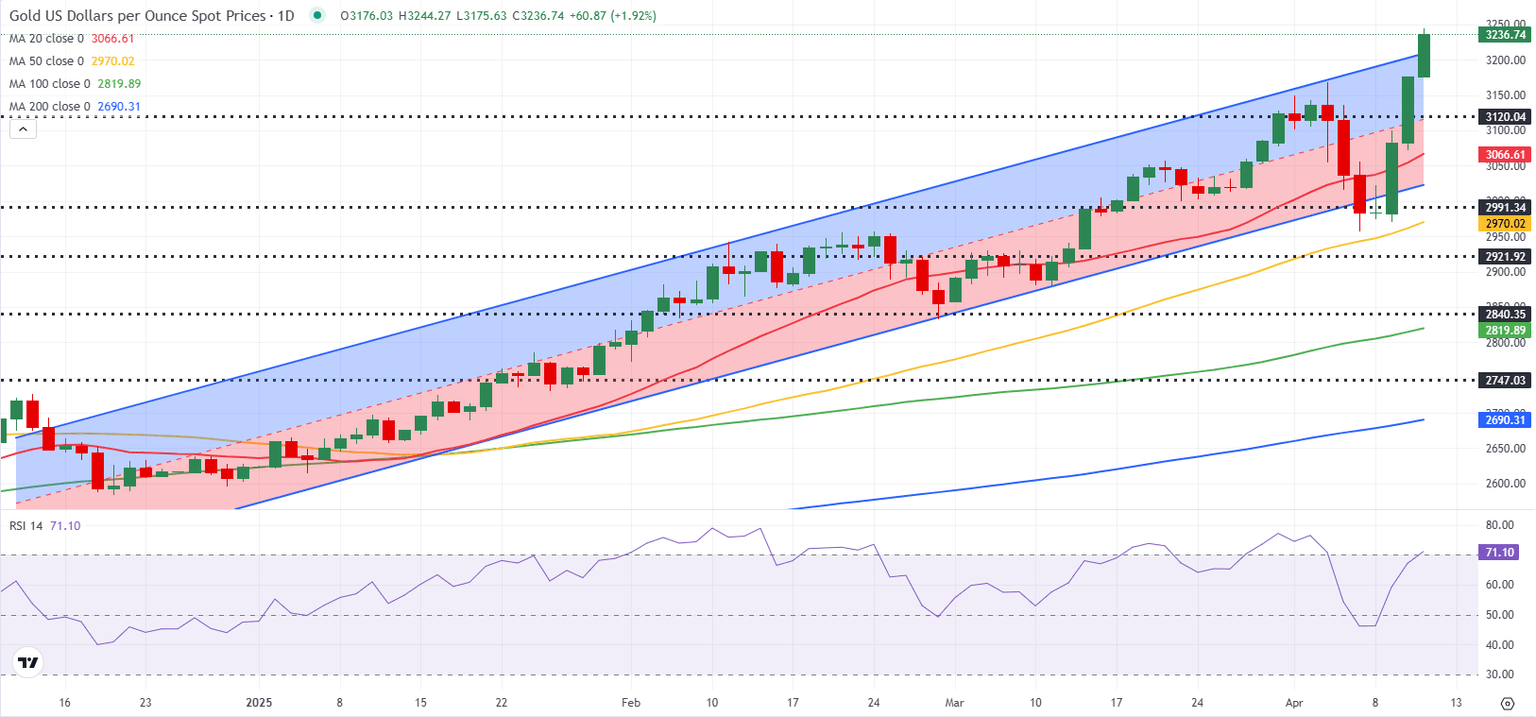

Gold technical analysis

Gold climbed above the upper limit of the four-month-old ascending regression channel and the Relative Strength Index (RSI) indicator on the daily chart rose above 70, reflecting overbought conditions.

In case XAU/USD starts correcting lower on improving market mood, first support level could be spotted at $3,120 before $3,100 (static level, round level) and $3,065, where the 20-day Simple Moving Average (SMA) is located.

On the upside, immediate resistance is located at $3,237 (all-time high) before $3,300 (round level) and $3,400 (round level).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.