Gold: time for a near term pullback rally? [Video]

![Gold: time for a near term pullback rally? [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-nuggets-7636265_XtraLarge.jpg)

Gold

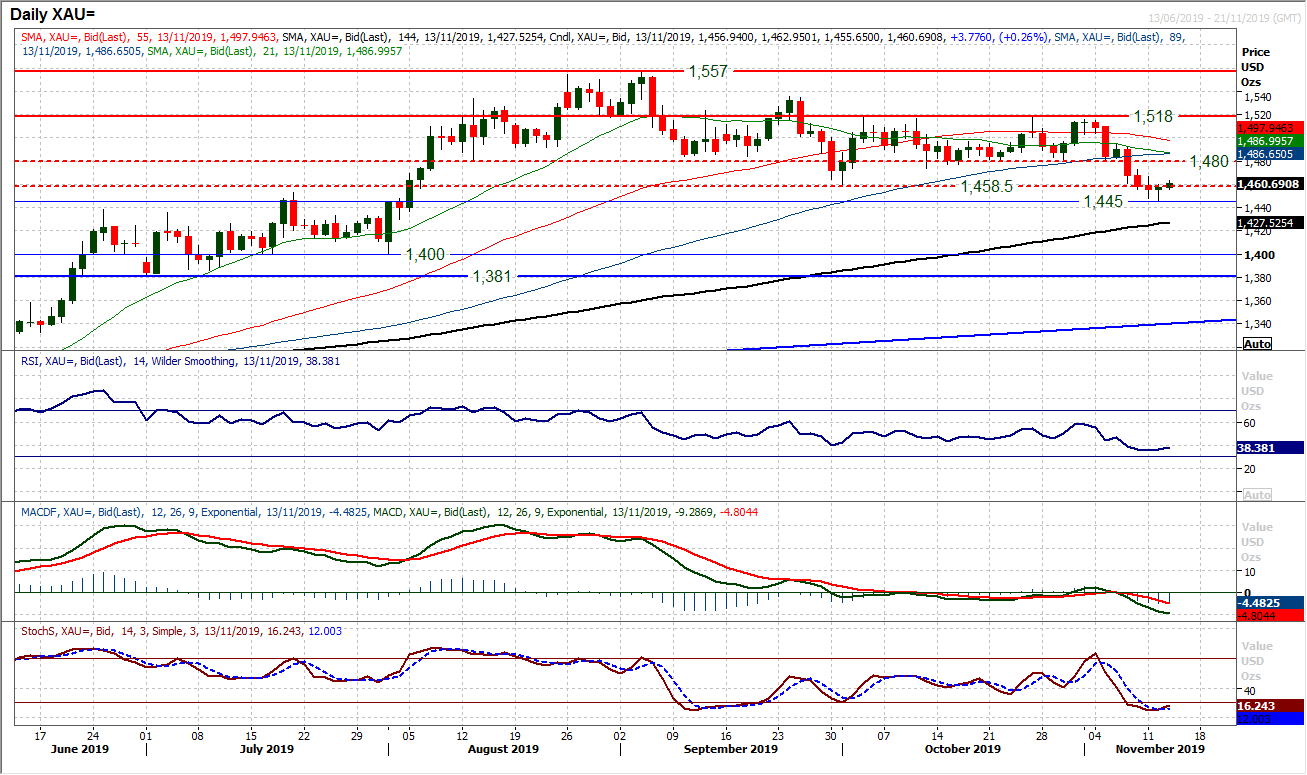

Time for a near term pullback rally? A small bull hammer one day candlestick pattern has swung the market higher. A close back above $1458 today would add to this recovery potential, however, we would view this as just a near term move. This is likely to simply be a rally that helps to renew downside potential. With the market breaking support at $1474/$1480 and subsequently $1458 this week this has been a key trend changing move. We now see rallies into resistance as a chance to sell. The hourly chart shows improved near term momentum and above $1458 implies a rebound into the low $1470s. However, the move to such a more negative momentum configuration really suggests that sentiment has shifted on gold for now. A deeper correction is developing and we would view $1474/$1480 as an area where the sellers will look for opportunities again.

Author

Richard Perry

Independent Analyst