Gold: solid bull candle re-asserting the positive outlook [Video]

![Gold: solid bull candle re-asserting the positive outlook [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-nuggets-7636265_XtraLarge.jpg)

Gold

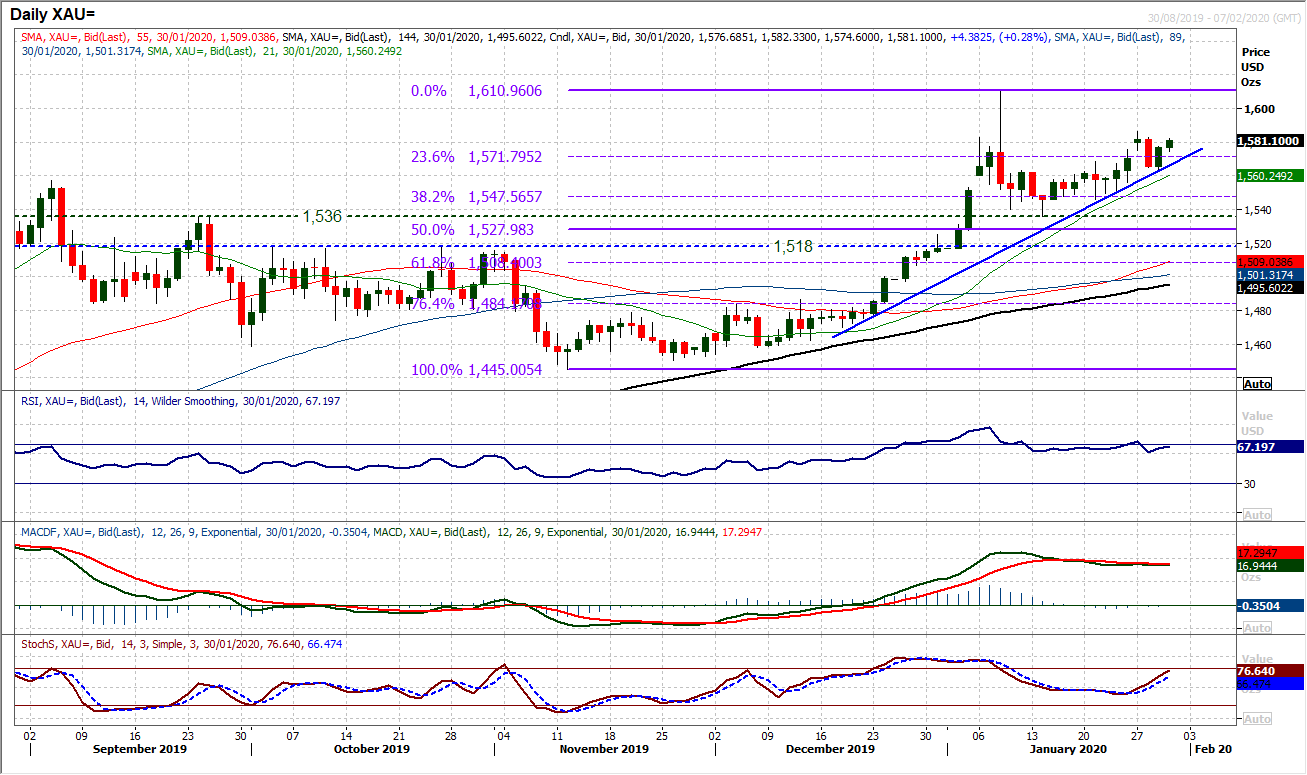

Tuesday’s sharp corrective candle looks to have been that buying opportunity. The outlook for gold has been positive since mid-December and we continue to look towards weakness to be bought into. A six week uptrend is again the basis of support with yesterday’s solid bull candle re-asserting the outlook. The importance of a confluence of support with the $1562/$1568 breakouts along with the six week uptrend at $1566 today is adding to this. A move back above the 23.6% Fibonacci retracement (of $1445/$1611) at $1572 is also a positive sign. As long as there is support of $1548 from the 38.2% Fibonacci retracement (of $1445/$1611) intact then the bulls will remain confident. Momentum indicators remain positively configured to buy into weakness still. A close above $1586 re-opens the high of $1611.

Author

Richard Perry

Independent Analyst