Gold rally strengthens on global conflict and safe-haven demand

Gold (XAUUSD) continues to push higher, breaking records as geopolitical tensions and policy uncertainty fuel safe-haven demand. The US–Venezuela conflict, mixed economic data, and rising expectations for Fed rate cuts have created a supportive environment. At the same time, a strong technical breakout confirms bullish momentum. These factors point to continued upside for gold in the near term.

Gold extends rally amid geopolitical risk and dovish Fed outlook

Gold remains on an upward path, driven by geopolitical tensions and safe-haven demand. The ongoing conflict between the US and Venezuela has intensified. The Venezuelan parliament passed a law criminalizing interference with commercial activity, including the seizure of oil tankers. This move comes in direct response to recent US actions targeting Venezuelan oil exports. The escalation has rattled markets and boosted safe-haven flows into gold.

At the same time, U.S. economic indicators offer a mixed picture. GDP data for Q3 came in hotter than expected at 4.3% annualized growth, beating the 3.3% consensus. However, consumer sentiment remains weak. The Conference Board's Consumer Confidence Index dropped to 89.1 in December, down from 92.9 in November. This disconnect between headline growth and consumer outlook adds uncertainty to the macro picture, increasing the appeal of gold.

Expectations for policy easing have also strengthened. Market participants now anticipate multiple Fed rate cuts in 2026. Signs of slowing inflation and weak job growth are key drivers. On the political front, President Trump stated that his choice for the next Fed Chair would be someone who believes in much lower rates. These comments raise concerns about Fed independence but also highlight the outlook for looser monetary policy. Lower rates reduce the opportunity cost of holding gold, providing a bullish backdrop for the metal.

Gold confirms triple cup-and-handle breakout with strong technical setup

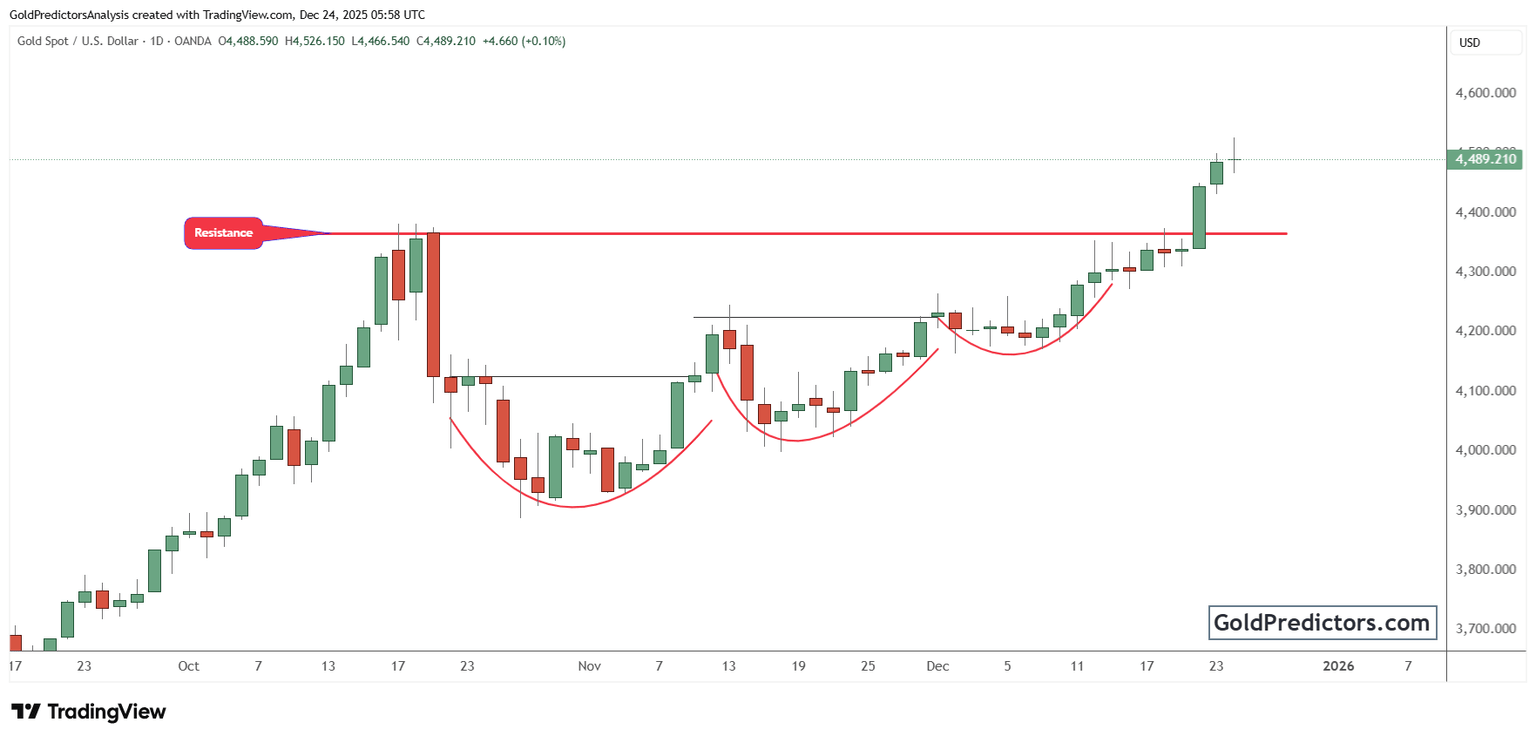

The gold chart below shows a clear bullish continuation pattern. After the sharp rally in September and October, price hit resistance near $4,400 and formed a broad consolidation range. Within this range, gold developed a series of three cup-shaped patterns. Each formed a rounded base, reflecting steady accumulation and higher lows.

Moreover, the structure forms a clear triple cup-and-handle pattern. Each cup marked a temporary pullback followed by a recovery to previous highs. These patterns show growing market confidence. Buyers consistently stepped in during each dip, driving price back to the neckline of the formation. The final breakout occurred once price surpassed the $4,400 resistance with strong momentum.

The breakout above resistance confirms the bullish formation and points to continued upside. The upward move affirms the trend and signals strong momentum. Volume and candle structure support the breakout, with consecutive bullish candles and minimal upper wicks. If the breakout holds, the next upside extension could reach significantly higher, possibly toward the $4,800–$5,000 zone in the coming weeks.

Gold outlook: Sustained rally driven by macro risks and technical breakout

Gold remains in a strong uptrend, supported by rising geopolitical tensions, policy uncertainty, and a confirmed technical breakout. Safe-haven demand continues to drive momentum as markets brace for Fed rate cuts in 2026. The triple cup-and-handle pattern adds confidence to the rally, while bullish candle structure suggests further upside. As long as macro risks persist and rate expectations stay dovish, gold is likely to push higher in the weeks ahead.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.