Gold Price Weekly Forecast: US jobs and inflation data could boost XAU/USD

- Gold is set to achieve weekly gains despite the strength of the Dollar.

- Fed Chair Powell reiterated the FOMC is ready to hike further if appropriate.

- XAU/USD faces a mixed outlook, with the rebound lacking conviction.

Gold prices were poised to achieve their first weekly gain in a month. However, following Federal Reserve (Fed) Chair Powell's speech, they started to decline, eroding significant gains and indicating a prevailing downside bias. The fundamental narrative currently favors the US Dollar, which could continue to limit any potential correction in XAU/USD.

Powell ends Gold’s bounce

Market participants eagerly waited for Federal Reserve Chair Jerome Powell's speech at the Jackson Hole Symposium throughout the week. However, his remarks offered little new information and reiterated the Fed's readiness to raise rates further if deemed appropriate. Powell also acknowledged the central bank's attentiveness to signs that the economy is not cooling as expected. He concluded by stating that the Fed will proceed cautiously in deciding whether to tighten policy further or maintain the current rate and await additional data.

The US dollar initially weakened but then reversed course as the swap market shifted from June to July 2024, the timing of the first rate cut by the Fed. The DXY climbed to fresh monthly highs above 104.00, and US Treasury yields resumed the upside.

Regarding economic data, the key reports during the week were the global Purchasing Managers' Index (PMI) figures. These numbers mostly came in below expectations, except for Japan. The weaker-than-expected PMI figures contributed to a deterioration in risk sentiment worldwide, limited the upside in government bond yields and aided in the correction of XAU/USD.

The US S&P Global PMI indicated that "business activity growth came close to stalling in August" and that "the service sector-led acceleration of growth in the second quarter has faded, accompanied by a further fall in factory output," as explained by Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

A firm Dollar and higher yields

Gold is facing challenges from two related fronts. One is the impact of higher Treasury yields. As US data shows a resilient economy, the possibility of further rate hikes remains open. Even if rate hikes are not imminent, the expectation of a prolonged period before rate cuts contributes to keeping US yields at multi-year highs, which weighs on Gold prices.

Another factor weighing on the yellow metal is the strength of the US Dollar, which is partly driven by the bond market, but also reflects the relatively better economic outlook of the US compared to the Eurozone and the UK. Even countries like New Zealand and Australia, which are showing worrisome signs, do not have expectations of near-term rate hikes from their respective central banks. This divergence reinforces the strength of the US Dollar, limiting the upside potential for XAU/USD.

Furthermore, risk aversion does not necessarily translate into a positive outlook for Gold. In recent days, a combination of declining equity prices and higher US yields has resulted in a sharp decline in XAU/USD. Typically, risk aversion leads to increased demand for safe-haven assets, including Treasury bonds. However, recent risk aversion events had not been accompanied by bond rallies. A decline in US yields and a correction in the US Dollar could boost the price of XAU/USD.

Next week: From central banks to inflation and employment data

After hearing from central banks, economic data will take center stage next week, particularly inflation figures and US labor market numbers. There will also be other relevant reports.

Germany will report preliminary Consumer Price Index (CPI) figures on Wednesday, followed by the Eurozone's inflation numbers on Thursday. These figures will be crucial before the September 14 European Central Bank (ECB) Governing Council meeting. If inflation shows further slowing, it could lower European yields and benefit Gold. Germany will also report employment and retail sales data on Thursday.

In the US, on Tuesday, the JOLTS Job Openings report could bring some surprises and kick off the series of labor market data that continues on Wednesday with the ADP private employment report. Additionally, on Wednesday, the US will release a new reading of Q2 GDP growth. Thursday will bring the weekly Jobless Claims data and the Core Personal Consumption Expenditures Price Index (Core PCE), the Fed's preferred inflation measure. Friday will be a critical day with the release of the official US employment report, including Nonfarm Payrolls. The ISM Manufacturing PMI is also due.

It will be a busy week with significant economic data, likely triggering sharp moves across financial markets, including metals. If the numbers point to the necessity of more tightening from the Federal Reserve, the US Dollar could rise sharply, weighing on the yellow metal. Conversely, if the numbers continue to show economic weakness and a slowdown in inflation, Gold could gain momentum.

Market participants will also closely monitor Chinese data and potential stimulus measures. The performance of the stock markets will also be crucial. Wall Street experienced its second consecutive decline.

Gold price technical outlook

Gold held above the $1,885 level and bounced to the upside. However, it encountered resistance near $1,925 and resumed its downward movement. The price action suggests that the bias remains tilted towards the downside. The weekly chart shows prices are well below a bearish 20-Simple Moving Average (SMA). A weekly close above $1,935 could alleviate the negative momentum, while surpassing $1,950 could change the short-term outlook.

Downside risks continue to dominate. If Gold breaks below the $1,885 level, it would likely pave the way for a test of the 50-week and 100-week SMAs, which are around $1,850.

The daily chart indicates that the bullish correction ran out of steam above $1,920 as the price faced rejection from the 20-day SMA. Should XAU/USD reclaim that level, it could potentially aim for testing a downtrend line around $1,945.

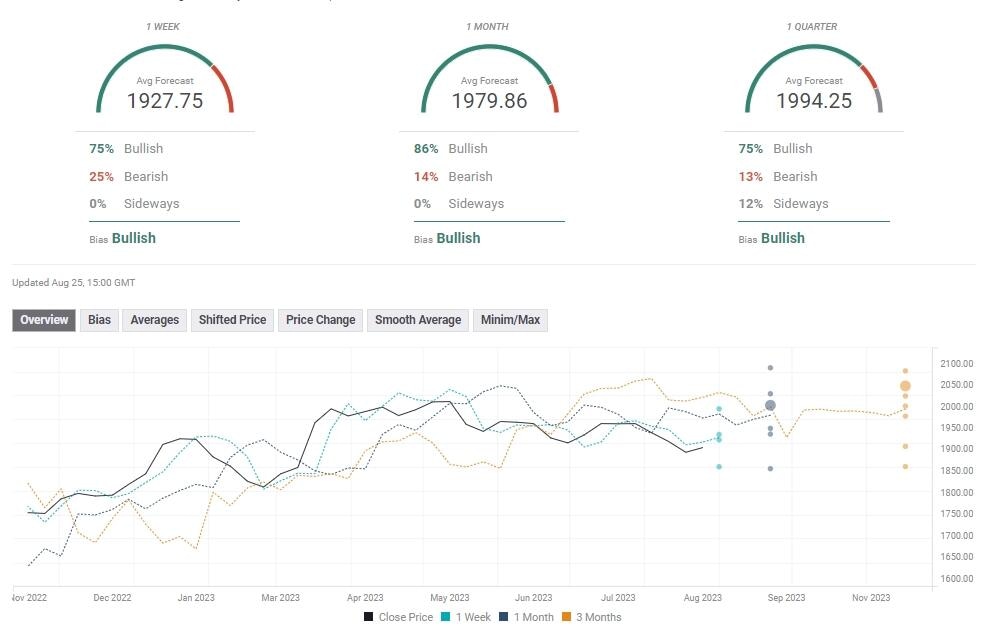

Gold price forecast poll

The FXStreet Forecast Poll indicates that most experts anticipate Gold prices to move higher, with many expecting prices to exceed $2,000 within a one-quarter perspective. Analysts foresee modest price increases for the upcoming weeks, with the average price estimate at $1,980 in a one-month view.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.

-638285748582990920.png&w=1536&q=95)