Gold Price Weekly Forecast: US inflation numbers have the key to $1,900

- Gold price surged on Friday, turning positive for the week.

- XAU/USD surveyed above the key $1,800 mark, could target $1,890 if data allows it.

- US CPI will be watched closely next week ahead of the FOMC March meeting.

Gold price rose sharply on Friday, recovering key levels and reaffirming above $1,800/10. The outlook looks brighter for the yellow metal after Friday’s rally but, like the Federal Reserve (Fed), is ‘data-dependent’.

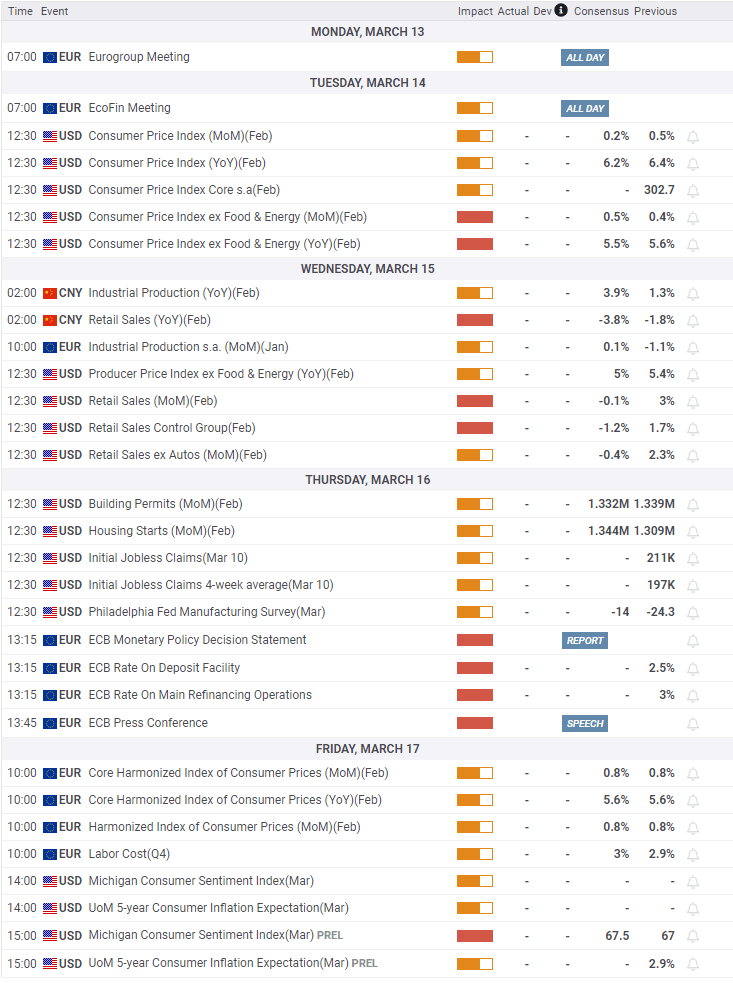

After FOMC Chairman Powell’s testimonies and the Nonfarm Payrolls, attention turns to next week’s US Consumer Price Index on Tuesday, the last crucial figures for Fed’s officials ahead of the March 21-22 meeting.

What happened last week?

It was a volatile week for Gold price; however price action remained mainly within the price range of the previous two weeks. On Monday, XAU/USD opened with some impulse after surging above $1,850 by the end of the last week. It peaked at $1,858, the highest level in almost three weeks, but retreated, ending the day below $1,850.

When Gold started to get comfortable above the 20-day Simple Moving Average, XAU/USD suffered the worst day in a month, falling more than $30, thanks to Jerome Powell. In a hearing before the US Senate (Semiannual monetary policy report to Congress), the Fed Chairman opened the door to a 50 basis points rate hike, triggering a rally in the US Dollar. As a result, US yields soared and Gold tumbled to weekly lows near $1,812.

During the Asian session on Wednesday, Gold price continued to push lower and tested levels under $1,810 as market participants increased the odds of a larger hike from the Fed. Despite positive employment numbers from ADP and JOLTS, XAU/USD spiked to $1,825, but the rally did not last, showing bearish pressure still in place. Powell testified on Wednesday again, staying hawkish. Fed’s Beige Book presented a mixed picture about current economic conditions.

On Thursday, the US Labor Department revealed a 21,000 increase in Initial Jobless Claims to 211,000 for the week ended March 4, the highest level since January and the largest surge since October, easing expectations of a more hawkish FOMC. A sell-off in Wall Street pushed Treasury bond yields to the downside, boosting XAU/USD.

The upward momentum continued on Friday, even after the US Bureau of Labor Statistics (BLS) revealed that Nonfarm Payrolls rose by 311,000 in February, surpassing expectations of 205,000 and confirming January’s shocking numbers. The Unemployment rate rose from 3.4% to 3.6%, together with an increase in the Labor Force Participation from 62.4% to 62.5%. Wages, measured by Average Hourly Earnings, rose by 4.6% YoY, below the 4.7% of market consensus. Despite the stronger-than-expected NFP, the US Dollar and yields fell sharply. Gold rose above $1,850, erasing weekly losses.

Next week

After hearing Fed Chair Powell speak largely during the week, Fed officials will enter a blackout period on Saturday, ahead of March’s FOMC meeting. Expectations about what the Fed will do at that meeting, and also regarding the terminal rate, will be a key driver in price action next week.

With Powell in the rearview and no more Fed talk ahead, the focus will be on US inflation data, which could determine the fate of the Fed’s next move. Also of importance will be retail sales numbers. At the weekly opening, markets will likely continue to analyse NFP and the reaction to the report.

The US Consumer Price Index (CPI) will be released on Tuesday. The annual CPI is expected to slow down from 6.4% to 6.2% and the core from 5.6% to 5.5%. High volatility should be expected around the report.

More inflation data is due on Wednesday with the US Producer Price Index (PPI). It is estimated to drop from 6% to 5.1% and the core from 5.4% to 5%.

If inflation numbers align with expectations or show a more significant slowdown, it would cement expectations for a 25 basis point rate hike from the Fed, favoring Gold bulls. On the contrary, a big surprise on the upside could trigger sharp moves, leaving Gold vulnerable to heavy losses. Also, on Wednesday, US February Retail Sales are on the docket.

The European Central Bank (ECB) will have its monetary policy meeting on Thursday. A 50 basis point rate hike is priced in. The debate is about how far and how fast the ECB will go thereafter. The meeting could have significant implications for the global bond market; if that is the case, Gold prices could swing.

Gold price technical outlook

Gold price defended the critical area above $1,800 that contains the 20 and 100-week Simple Moving Averages. A weekly close below would weaken the medium-term outlook for XAU/USD. As long as it remains above, a run toward $1,900 is on the table. Technical indicators in the weekly chart are mixed with RSI flat around midlines and MACD and Momentum giving soft bearish signs.

The short-term outlook for Gold improved considerably after Friday’s NFP. XAU/USD rose above the 20-day SMA and also retook $1,850. The next strong barrier is seen around $1,860. A close above would expose the next resistance area at $1,890 (Feb 9 high). Technical indicators are bullish but a consolidation above $1,860 is needed for confirmation.

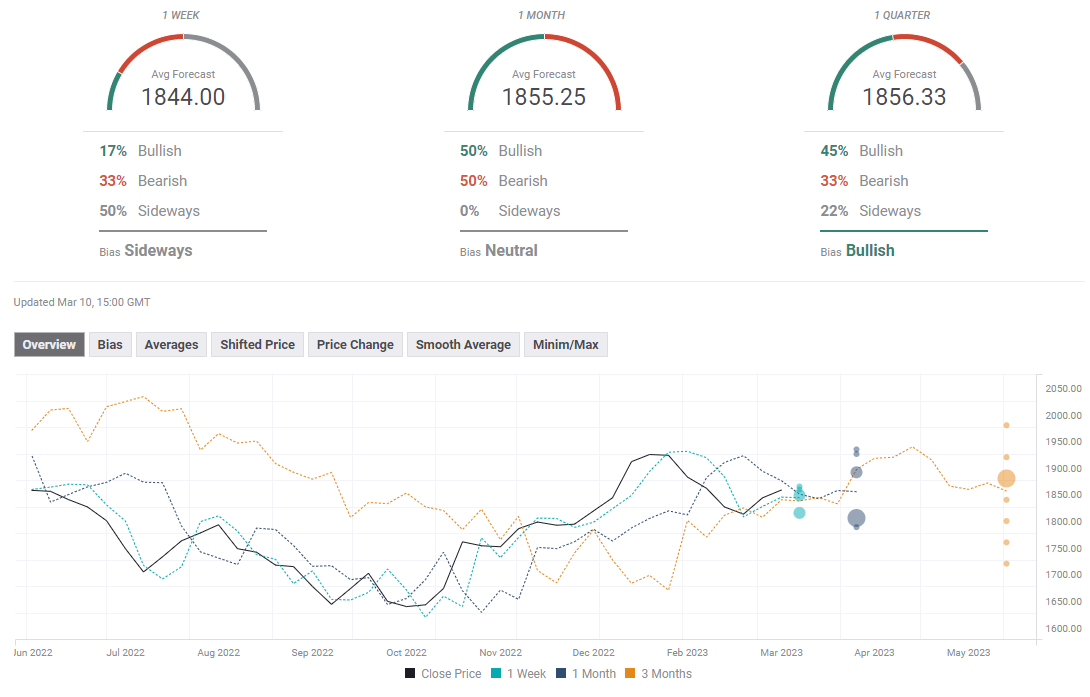

Gold price forecast poll

The FXStreet Forecast Poll paints a mixed picture for XAU/USD in the near term, with the one-week average target sitting at $1,845. The bullish bias stays intact in the one-month view.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.

-638140602410671093.png&w=1536&q=95)