Gold Price Weekly Forecast: $2,100 on the radar but not risk-free

- Gold price rose toward the record high area but failed to stabilize above $2,050.

- After the Fed, ECB and NFP, attention turns to US inflation data.

- While the $2,100 area is still in sight, a deeper correction may be possible, amid high volatility.

Gold prices reached the record high area early last Thursday after the FOMC meeting, hitting $2,075 before correcting lower, with the decline accelerating after the release of the US Nonfarm Payroll (NFP) report. While XAU/USD initially broke out of a two-week range to the upside, it quickly pulled back, leaving a gloomy outlook and high volatility in its wake. With central bank meetings and jobs data in the rear-view mirror, eyes turn to US inflation.

Not so fast

The Federal Reserve (Fed) delivered as expected on Wednesday by raising interest rates by 25 basis points and signaling a pause. However, renewed banking developments stole the headlines from the Fed and triggered risk aversion, as well as bets of rate cuts during the second half of the year, resulting in a decline in US yields. This context, along with some technical factors, contributed to a spike in XAU/USD to $2,075; the area of record highs, but it quickly pulled back, unable to firmly consolidate above $2,050.

On Friday, market sentiment improved, banking concerns eased, and US yields rebounded sharply, also boosted after another upbeat jobs report from the US. Nonfarm payrolls rose by 253,000 in April, surpassing expectations of 179,000, and the Unemployment Rate dropped from 3.5% to 3.4%. The data suggests that the labor market remains tight, which partially explains why the Fed raised rates. The other reason is persistently high inflation.

Gold tumbled on Friday as the interest rate market eased bets of rate cuts for the second half of the year, which was a key risk for the yellow metal. If the change in expectations continues, Gold could suffer more, while at the same time, leaving space for a sharp rebound in line with the main trend.

During the week, the European Central Bank (ECB) also raised interest rates and signaled it will continue to do so. However, the impact on yields was limited as the outcome was priced in. Two or three more rate hikes from the ECB are expected. Central banks around the world are seen near their peak rates, with more expected to join the “pause group” soon. However, there is always room for surprise, like the one from the Reserve Bank of Australia (RBA) that hiked unexpectedly as inflation remains elevated.

Bank stocks and inflation

After a busy week with Gold breaking out of its range and increasing volatility, next week's price action should offer interesting swings despite the lighter economic calendar.

The key event will be the release of US inflation numbers for April. The Consumer Price Index (CPI) is expected to have risen 0.4% in April, and 4.4% from a year ago, down from 5% in March. However, the Core CPI is seen rising from an annual rate of 5.6% to 5.8%. A confirmation would point to a considerable slowing in headline inflation, but the Core would still be uncomfortably high.

On Thursday, the US Producer Price Index (PPI) is due and will be watched closely. Also, on that day, the Bank of England (BoE) will have its monetary policy meeting, with a 25 basis point rate hike expected. On Friday, the University of Michigan will release the preliminary data of the Consumer Sentiment report for May, including inflation expectations.

Developments around the banking crisis and its impact on sentiment will be critical for Gold. The metal so far has responded well to renewed concerns, supported by lower US yields. No news from the Federal Deposit Insurance Corporation (FDIC) could be bad news for Gold. But if economic data points to persistent inflation pressures, with numbers well above expectations, it could be devastating for Gold bulls in the very short term. Figures in line with expectations, on the contrary, will keep XAU/USD sensitive to Fed forecasts, exposing it to large swings.

Gold tested levels out of its recent range, rising to record highs, and then pulled back in, leading to rising odds of a deeper correction. The context warrants persistent volatility in both directions.

Gold price technical outlook

The weekly chart shows a spike and then a pullback into the prevailing range, which is a warning of a potential deeper bearish correction, following the false breakout. However, XAU/USD still has strong support above $1,970. While above, losses seem limited, a break lower, on the contrary, could trigger stops and open the door to more losses, targeting initially the $1,950 zone and then $1,910.

On the upside, for daily trading, if Gold recovers levels above $2,020, it would alleviate the current bearish pressure. If it manages to consolidate above $2,050, it would be back on the road to $2,100.

Although the trend is up, the sharp retreat from $2,075 – if confirmed by a move to sub-$2,000 levels – could suggest that the next leg may be to the downside.

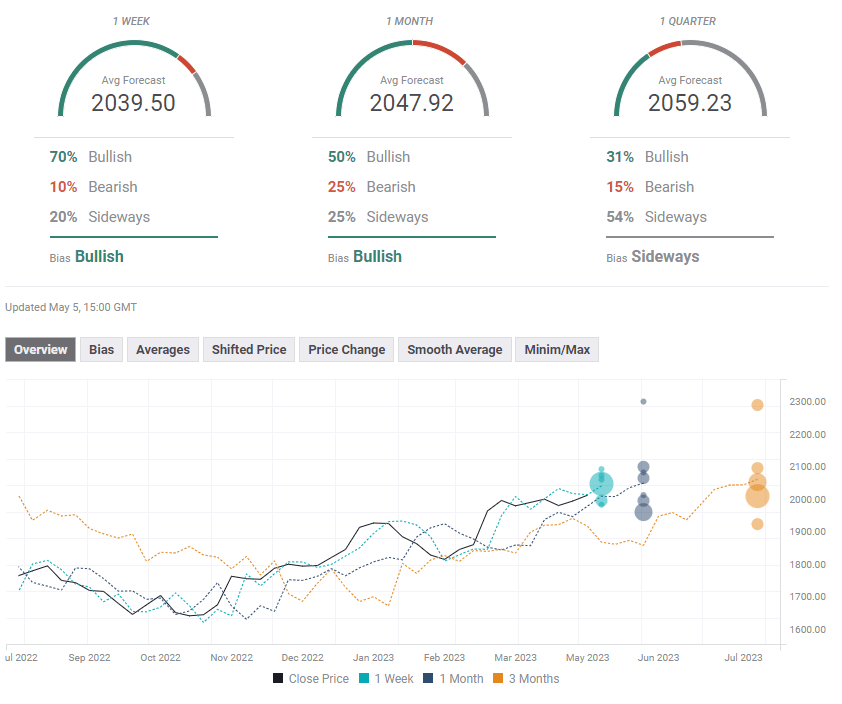

Gold sentiment poll

The FXStreet Forecast Poll points to a mixed short-term outlook, with 70% of the experts seeing the gold price above $2,000. The one-quarter outlook remains bullish, but at this moment, the majority of experts do not see a sustainable run above $2,100.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.