Gold price rockets ahead of Georgia senate election

Gold price soared to the highest level in two months as traders looked ahead to the upcoming run-off election in Georgia. This senatorial election will determine who will lead the senate in the first part of Joe Biden’s administration. If the Republicans win one of the two seats, it will mean that Senator Mitch McConnel will be the Senate majority leader. He will then be able to block most of Joe Biden’s agenda, including higher taxes, more regulations, and judicial appointments. On the other hand, if Democrats win, it will lead to the possibility of more stimulus, regulations, and higher taxes.

The British pound pulled-back as the rising number of coronavirus cases outweighed the recent Brexit deal. In a statement, Boris Johnson said that the government would be forced to implement more lockdowns to prevent the spread of the new virus. This is happening even as the government ramps up its vaccination measures. The pound weakened even after the relatively robust manufacturing PMI data. According to Markit, the manufacturing PMI increased from 55.6 in November to 57.5 in December. That was a better performance than the median estimate of 55.2.

The price of crude oil rose today as OPEC+ members started their virtual meeting to deliberate on the current situation. The two sides are expected to disagree about the need for more supply cuts in February. In their previous meeting, they agreed to gradually increase production starting from this month. In a statement yesterday, Mohammed Barkindo, OPEC Secretary General, warned that the outlook for the first half of the year was still mixed. He also said that there were many downside risks, including the rising production from the United States.

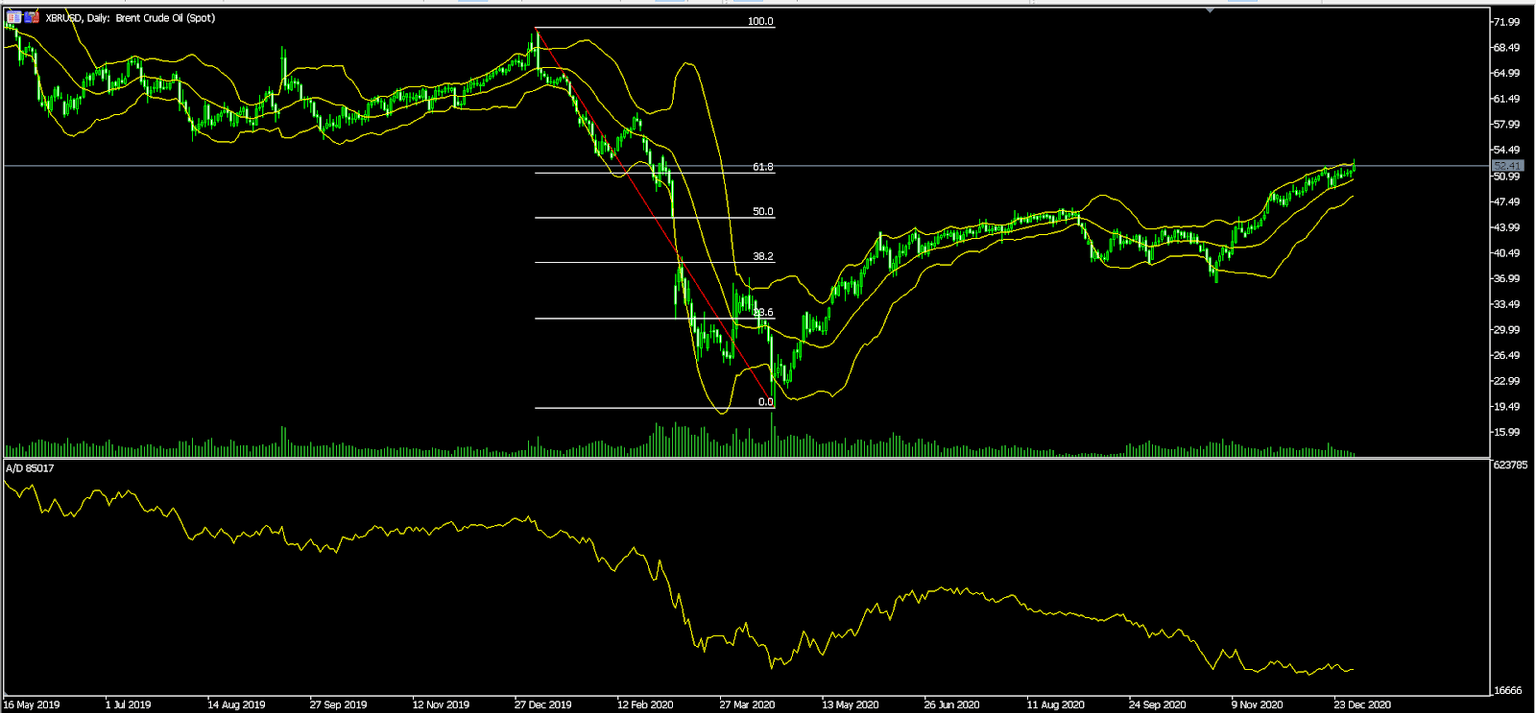

XBR/USD

The XBR/USD pair rose to an intraday high of 53.30, the highest level since March last year. On the daily chart, the price is along the upper side of the Bollinger Bands and slightly above the 61.8% Fibonacci retracement. The accumulation/distribution indicator has also continued to fall. Also, the price is slightly above the 25-day moving average. Therefore, in the near term, the pair is likely to continue rising as bulls aim for the next resistance level at 55.0.

EUR/USD

The EUR/USD pair rose to an intraday high of 1.2293, which is substantially higher than Friday’s low of 1.2200. On the four-hour chart, the pair is above the 25-day and 15-day moving averages while the Average Directional Index (ADX) has continued to fall. The two lines of the Stochastic oscillator have also continued to rise. Therefore, for today, the pair will likely continue rising as bulls target the next resistance at 1.2300.

XAU/USD

The XAU/USD spiked to an intraday high of 1,935, which was the highest level in two months. On the four-hour chart, the price is above the rising trendline. It is also along the upper line of the Bollinger Bands, signalling that bulls are still in control. The Relative Strength Index has moved to the overbought level of 70 while the signal and main line of the MACD have continued to rise. The pair will likely continue rising, with the next target being 1,950.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.