Gold Price Forecast: XAU/USD targets record highs amid cooling inflation, trade war

- Gold price eyes third straight daily gain and US PPI data on Thursday.

- US Dollar and US Treasury bond yields reverse post-CPI bump amid tit-for-tat tariff war.

- Gold price looks to retest all-time highs of $2,956 as daily RSI stays bullish.

Gold price is building on the recent upswing early Thursday, looking to retest lifetime highs of $2,956. Gold buyers cheer a bullish technical setup as markets assess the implications of US President Donald Trump-induced global trade war.

Gold price receives a double booster shot

Fears of tariff uncertainty have returned in Asian trades on Thursday, fading a temporary relief offered to investors by Wednesday’s US inflation cooldown. This nervousness allows the gold price to extend its upbeat momentum to a third consecutive day.

Markets remain wary that the tit-for-tat tariffs implemented by Canada, China, and the European Union (EU) on the United States (US) could escalate a global trade war, detrimental to the economic growth outlook.

In light of this, investors scurry into the traditional store of value, Gold price while the US Dollar (USD) and the US Treasury bond yields face renewed headwinds.

Greenback buyers found a brief respite on Wednesday after the US Consumer Price Index (CPI) rose less than expected across the time horizons, easing US economic slowdown concerns spurred by Trump’s tariffs. The US annual headline CPI rose 2.8% in February versus January’s 3% and the expected 2.9% figure. The monthly CPI and core CPI increased 0.2% in the same period.

Cooling inflation also doubled down on the bets that the US Federal Reserve (Fed) will keep up with its rate-cutting cycle, boosting the appeal of the non-interest-bearing Gold price.

However, markets quickly realized that the February inflation data failed to capture the impact of a host of tariff barriers launched by Trump, bringing recession fears back on the table alongside the US Dollar’s underperformance.

All eyes now turn to the US Producer Price Index (PPI) data as a flurry of tariff headlines has paused for now. A softer-than-expected US PPI could once trigger a similar reaction in the USD as seen after the consumer inflation release.

Fresh developments on the tariff-font globally could outweigh the US data and drive the sentiment around the broader markets, impacting the Gold price.

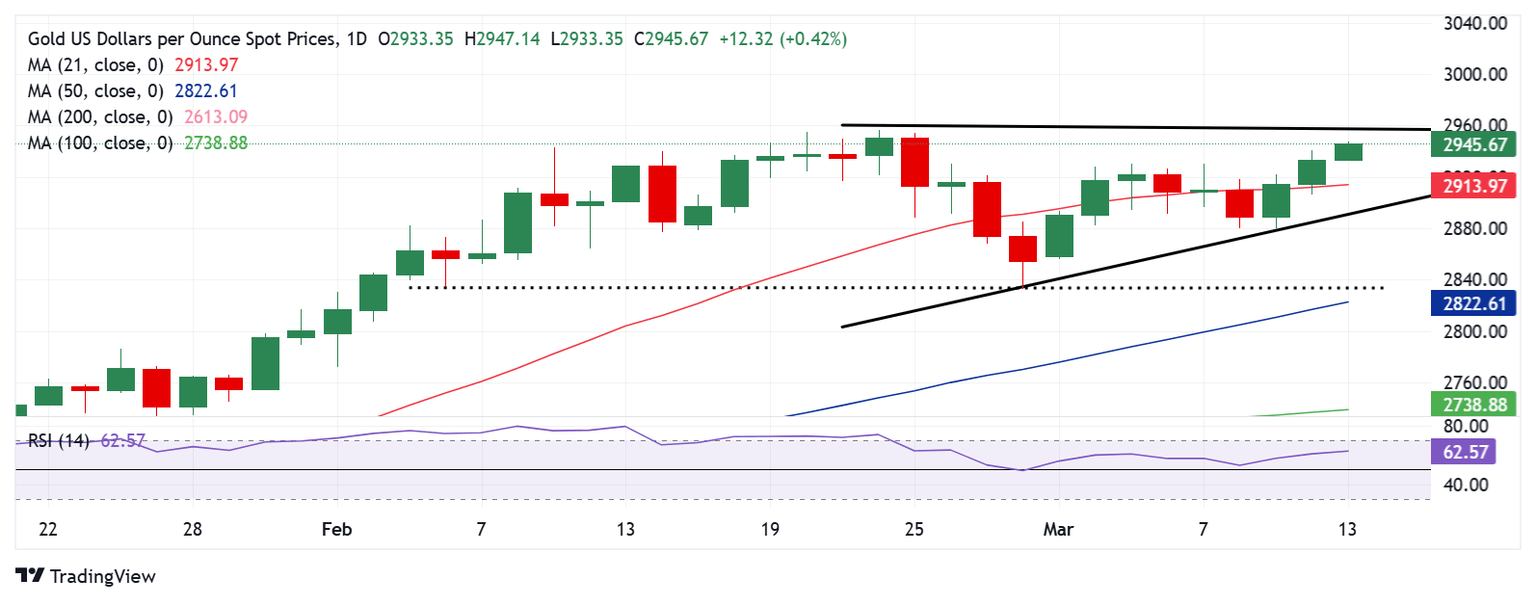

Gold price technical analysis: Daily chart

Gold price is forming higher highs while carving out an ascending triangle formation, which could be confirmed on a daily candlestick closing above the record high of $2,956.

Acceptance above that level could target the $2,970 round level. If buyers scale the latter, a test of the $3,000 psychological barrier will be inevitable.

The 14-day Relative Strength Index (RSI) looks north above 50, supporting the case for further upside.

Conversely, strong support is aligned at the 21-day Simple Moving Average (SMA) at $2,914.

If the selling pressure intensifies, the rising trendline support at $2,893 will be challenged.

Failure to defend that level will accelerate the downside toward the $2,850 psychological barrier.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.