Gold Price Forecast: XAU/USD recovers above $3,300 on another round of Trump letters

XAU/USD Current price: $3,311.32

- US President Donald Trump sent a second round of letters dictating levies.

- The Federal Open Market Committee will publish the June meeting Minutes.

- XAU/USD bounced from weekly lows, but the bullish potential is limited.

Financial markets turned recent caution into risk aversion, helping XAU/USD recover from a fresh weekly low of $3,282.74. The bright metal regained the $3,300 mark following United States (US) President Donald Trump's announcement of a fresh round of tariffs letters.

Trump posted on Truth Social screenshots of different letters dictating levies ranging from 20% to 30% to a second batch of countries to come into effect on August 1. Libya, Iraq, Algeria, Moldova, Brunei and the Philippines are Trump’s recent targets.

US indexes trimmed early gains as an immediate reaction to the news, while the US Dollar (USD) found near-term demand. Reactions, however, are limited ahead of the Federal Open Market Committee (FOMC) Minutes of the June meeting, when US policymakers decided to keep interest rates on hold.

The Federal Reserve (Fed) adopted a cautious approach to monetary policy amid mounting uncertainty related to Trump’s tariffs. Following the June meeting, Chairman Jerome Powell said that so far, things regarding levies have been better than feared. Nevertheless, Trump's recent letters are indeed reviving concerns, and hence, could overshadow the release.

Additionally, Trump took his time early on Wednesday to criticise once again Chair Powell. “Our Fed Rate is AT LEAST 3 Points too high. “Too Late” is costing the U.S. 360 Billion Dollars a Point, PER YEAR, in refinancing costs. No Inflation, COMPANIES POURING INTO AMERICA. “The hottest Country in the World!” LOWER THE RATE!!!,” he posted on social media.

XAU/USD short-term technical outlook

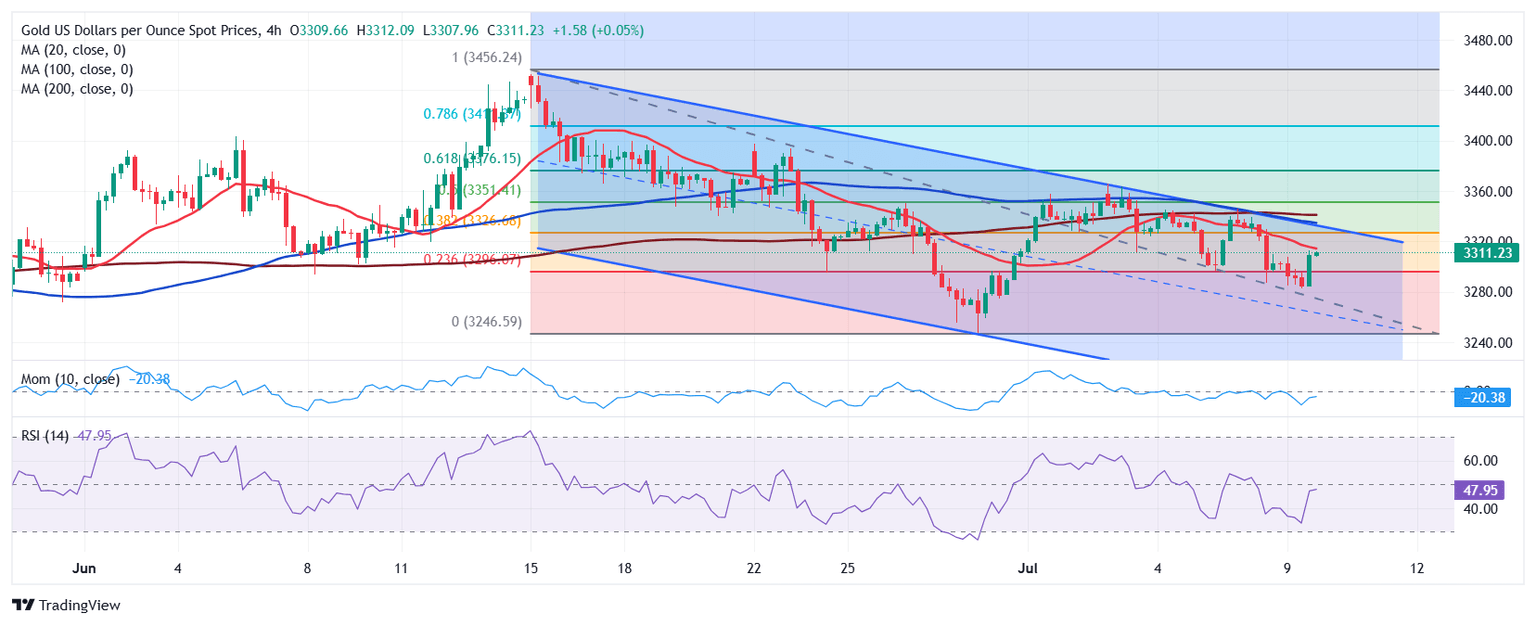

From a technical point of view, the bullish potential for XAU/USD remains limited. The daily chart shows that the pair is drawing a descending channel while developing between Fibonacci levels. The pair remains below the 38.2% retracement of the June decline, providing resistance at around $3,325. Meanwhile, a flat 20 Simple Moving Average (SMA) converges with the 50% Fibonacci retracement of the June slide at $3,350. The 100 and 200 SMAs aim north far below the current level, while technical indicators remain lifeless within negative levels.

The 4-hour chart shows technical indicators recovered from near-oversold readings, but remain below their midlines and with limited upward strength, overall suggesting buyers are still cautious. Even further, the pair develops below a bearish 20 SMA, which maintains its downward slope below the aforementioned Fibonacci resistance level. Finally, the longer moving averages stand above the shorter one, although lacking directional strength.

Support levels: 3,298.10 3,287.40 3,274.50

Resistance levels: 3,325.00 3,350.00 3,373.40

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.