Gold Price Forecast: Range play likely to extend below $1800, focus shifts to Fed

- Gold moves back and forth in a familiar range below $1800.

- Recapturing 21-SMA on the 4H chart to recall the XAU buyers.

- US dollar recovers amid downbeat mood, focus shifts to the Fed decision.

Gold (XAU/USD) rebounded on Monday after finding support just under $1770, tracking the late decline in the US dollar across the board after Wall Street indices closed at record highs. Earlier in the day, gold slipped as weaker US Durable Goods data lifted the safe-haven demand for the greenback while an uptick in the Treasury yields also drove the buck higher. Expectations of improving global economic outlook in the coming quarters were marred by concerns over surging covid cases in India, Japan and Brazil. Meanwhile, investors digested the latest updates on US President Joe Biden’s $2.25 trillion infrastructure spending plans.

Markets have turned risk-averse, as the Fed begins its two-day monetary policy meeting later on Tuesday. Further, the worsening covid situation in the emerging economies and a likely tax hike by Biden continue to put fresh bids under the greenback. Investors would refrain from placing any directional bet ahead of Wednesday’s Fed outcome, which could leave the price of gold in a familiar range. Traders will also take cues from the US CB Consumer Confidence data and sentiment on Wall Street amid upcoming corporate earnings results.

Gold Price Chart - Technical outlook

Gold: Four-hour chart

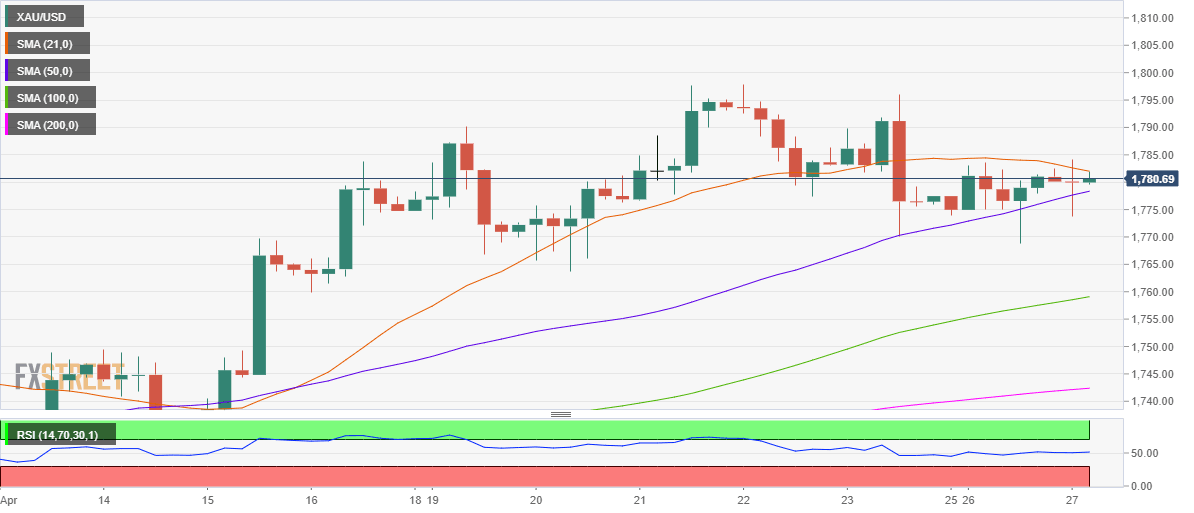

Gold’s four-hourly chart shows that a bull-bear tug-of-war persists, as the price remains trapped between two key averages.

The XAU bulls struggle to find acceptance above the 21-simple moving average (SMA) at $1782 while the downside remains cushioned by the upward-sloping 50-SMA at $1778.

The range is getting tighter, implying that a breakout in either direction could be on the cards.

The odds of a potential upside appear higher, given that the Relative Strength Index (RSI) trades in the bullish territory, currently at 51.39.

A sustained break above 21-SMA could fuel a rally towards Friday’s high of $1796, above which the $1800 mark could be probed.

Alternatively, a four-hour candlestick closing below 50-SMA is likely to expose Monday’s low of $1768.

The XAU bears could then target the ascending 100-SMA support at $1759. The next crucial cap awaits at the $1750 psychological level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.