Gold Price Forecast: Defending $3,350 support is critical for XAU/USD buyers

- Gold price flirts with weekly lows near $3,350 early Friday after a flattish close on Thursday.

- Risk appetite is back on easing Middle East tensions, weighing on safe-havens - Gold price and the US Dollar.

- Gold price tests critical 21-day SMA support at $3,350, with the daily RSI still bullish.

Gold price is back in the red early Friday, following a mixed close amid holiday-thinned trading on Thursday.

Traders continue to keep a close on the Middle East geopolitical developments and US Federal Reserve (Fed) commentaries for fresh trading incentives.

Gold price consolidates weekly losses

In the absence of top-tier economic data releases from the United States (US) on Friday, Gold price will likely remain at the mercy of the US Dollar (USD) dynamics, fuelled by the broader market sentiment, in the face of the ongoing geopolitical upheaval in the Middle East.

There has been no bad news on the Iran-Israel conflict front so far this Friday, rendering positive for markets and reviving risk flows.

US President Donald Trump reportedly said that he will give Iran a last chance to make a deal to end its nuclear program. Trump noted on Thursday that he would delay his final decision on launching strikes for up to two weeks.

Reports of the US easing its aggression on Iran are lifting higher-yielding assets at the expense of safe havens such as Gold price and the USD.

However, the end-of-the-week flows and the markets’ repositioning in the aftermath of the Fed’s policy announcements could influence the Gold price action as US traders return after the Juneteenth holiday break. Geopolitics will continue to lead the sentiment, primarily.

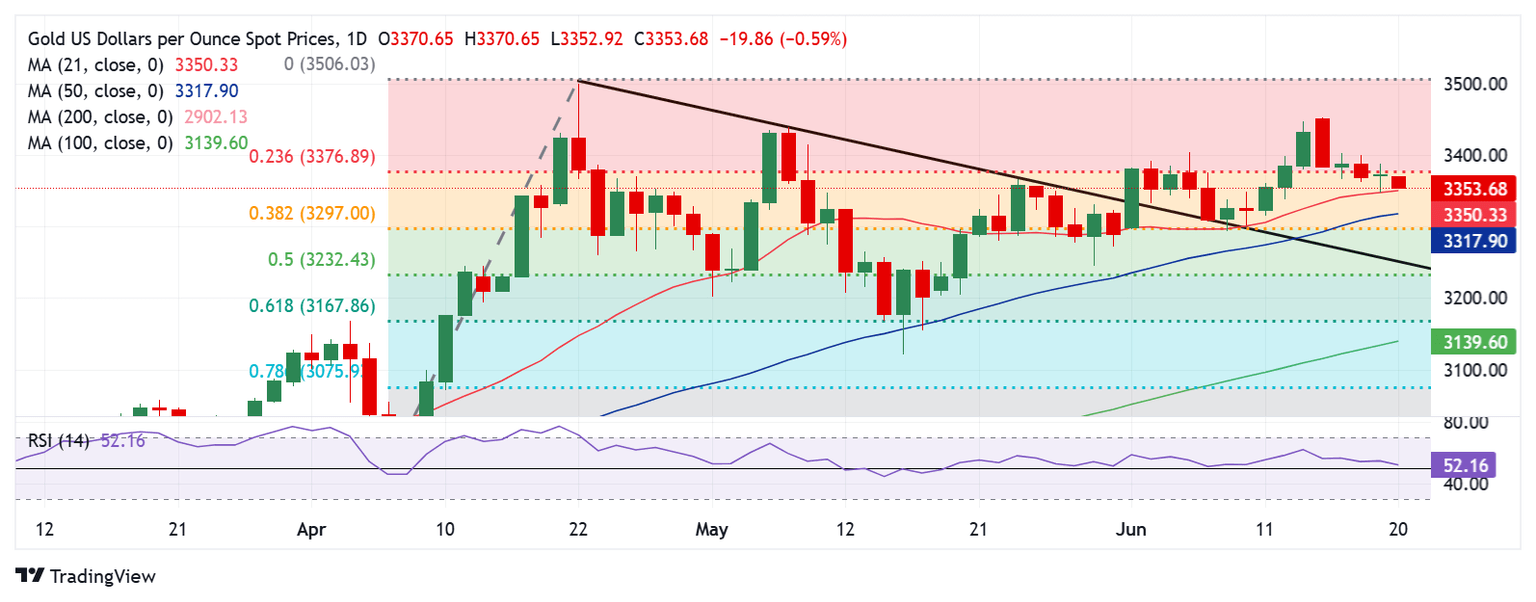

Gold price technical analysis: Daily chart

Technically, Gold buyers remain hopeful so long as the 14-day Relative Strength Index (RSI) holds above the midline. The leading indicator is currently pointing south, near 52.

Gold price must defend the critical short-term support of the 21-day Simple Moving Average (SMA) at $3,350 on a daily or weekly closing basis to reinforce buying interest.

If that fails, the 50-day SMA at $3,318 will be put to test. The next downside cap is aligned at $3,297, the 38.2% Fibonacci Retracement (Fibo) level of the April record rally,

Alternatively, Gold price recovery will need a clear break of $3,377, the 23.6% Fibo level of the same ascent to revisit the $3,400 supply zone.

Further upside will challenge the static resistance at $3,440 will be tested.

Buyers will then take on the two-month highs of $3,453.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.