Gold Price Forecast: Bulls return with a vengeance

XAUUSD Current price: $1,868.25

- Softer-than-anticipated US employment figures undermined demand for the greenback.

- US Federal Reserve Vice-Chair Brainard cooled down expectations for a pause in rate hikes.

- XAUUSD is technically bullish and could extend gains once above $1,871.50.

Gold Price soared to its highest in nearly a month, holding near a daily top at $1,869.75 a troy ounce. The American dollar gave up ground on Thursday after rallying in the previous session, with additional pressure coming from easing government bond yields and the better tone of Wall Street.

Adding pressure on the greenback, US employment-related data released on Thursday showed the slowest pace of job creation in the private sector since the pandemic hit the world. The ADP survey posted 128K new jobs in May, well below the 300K expected. On a positive note, Initial Jobless Claims contracted to 200K in the week ended May 27.

Meanwhile, US Federal Reserve officials returned to the wires. Fed Vice-Chair Lael Brainard cooled down expectations for a pause in rate hikes, noting that inflation is still at a multi-decade high. Stocks traders have chosen to ignore those comments, at least at the time being.

Gold Price short-term technical outlook

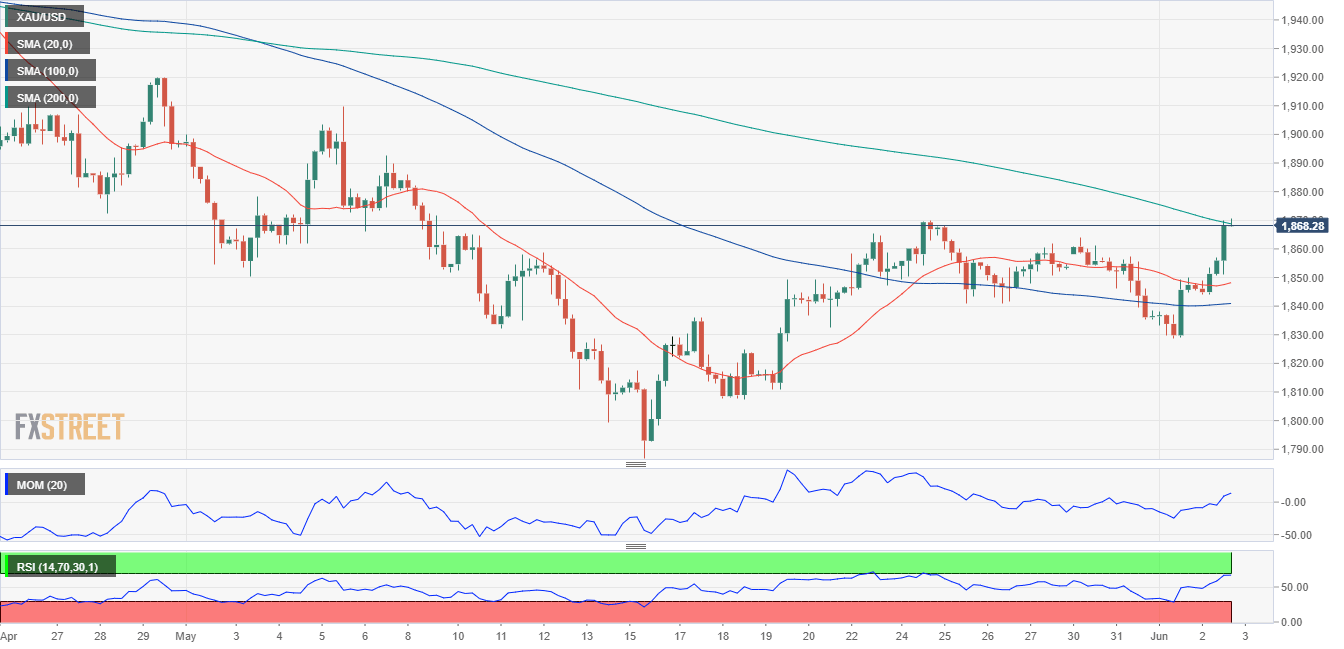

The XAUUSD pair is poised to extend its advance, according to the daily chart. Technical indicators have picked up momentum, maintaining their upward slopes within positive levels. Even further, the bright metal accelerated higher after meeting buyers around its 20 and 200 SMAs, both near the intraday low at $1,844.01.

Technical readings in the 4-hour chart also favor a bullish extension, particularly if the pair extends its gains beyond a bearish 200 SMA, now providing dynamic resistance at around $1,871.50. Meanwhile, the Momentum indicator heads firmly higher, well above its midline, while the RSI indicator approaches overbought conditions, all of which reflect persistent buying interest.

Support levels: 1,863.20 1,852.40 1,839.30

Resistance levels: 1,871.50 1,880.95 1,889.80

View Live Chart for the XAUUSD

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.