Gold Price defines breakout levels ahead of ECB meeting, US CPI

- Gold Price retreated ahead of the weekend amid renewed dollar strength.

- 10-year US Treasury bond yield closes in on 3% after upbeat US jobs report.

- Next week's ECB meeting and US inflation report could ramp up XAUUSD volatility.

Gold Price erased a portion of its weekly gains on Friday as US Treasury bond yields gained traction on the better-than-expected labor market data. XAUUSD remains on track to close the third straight week higher but the recent price action suggests that the pair could find it difficult to make a decisive move in either direction unless it breaks out of the $1,840-$1875 range.

US yields push higher after US data

The monthly data published by the US Bureau of Labor Statistics revealed on Friday that Nonfarm Payrolls in the US rose by 390,000 in May. This reading surpassed the market forecast of 325,000. Additionally, April's print of 428,000 got revised higher to 436,000. Further details of the report showed that the Labor Force Participation Rate improved to 62.3% as expected and the annual wage inflation edged lower to 5.2%, matching analysts' estimates. The benchmark 10-year US Treasury bond yield pushed higher toward 3% with the initial reaction to the upbeat jobs report and caused XAUUSD to turn south following the two-day rally.

Also read: Gold Price Forecast: Is the uptrend expected to continue?

Gold Price eyes ECB meeting, US CPI as next catalysts

In an interview with CNBC on Thursday, Lael Brainard, Vice Chairwoman of the US Federal Reserve, noted that it was very hard for her to see the case for a pause in rate hikes in September. “We’re certainly going to do what is necessary to bring inflation back down,” Brainard further added and said that the US economy still has a lot of momentum. These hawkish remarks failed to trigger a leg higher in the US Treasury bond yields and allowed gold to continue to trade in the upper half of its weekly range on Thursday.

Next week, the European Central Bank (ECB) will announce its rate decision and release the monetary policy statement. The ECB is widely expected to hike its policy rate by 25 basis points (bps) in July. Several ECB policymakers said in the past couple of weeks that the bank might need to start considering 50 bps rate hikes to tame inflation. Signs of loss of growth momentum in the European economy, however, puts the central bank in a tough position. In case the ECB reveals a hawkish rate outlook, XAUEUR could come under heavy bearish pressure and cause XAUUSD to edge lower as well. Nevertheless, the dollar’s market valuation would also be impacted in a negative way in that scenario and help gold limit its losses.

ECB President Christine Lagarde

Next Friday, the BLS will release the May inflation data. On a yearly basis, the Consumer Price Index (CPI) is forecast to edge lower to 8.2% from 8.3% in April. The market reaction to the inflation data should be pretty straightforward with a lower than expected CPI print weighing on US T-bond yields and providing a boost to XAUUSD and vice versa.

Gold Price technical outlook

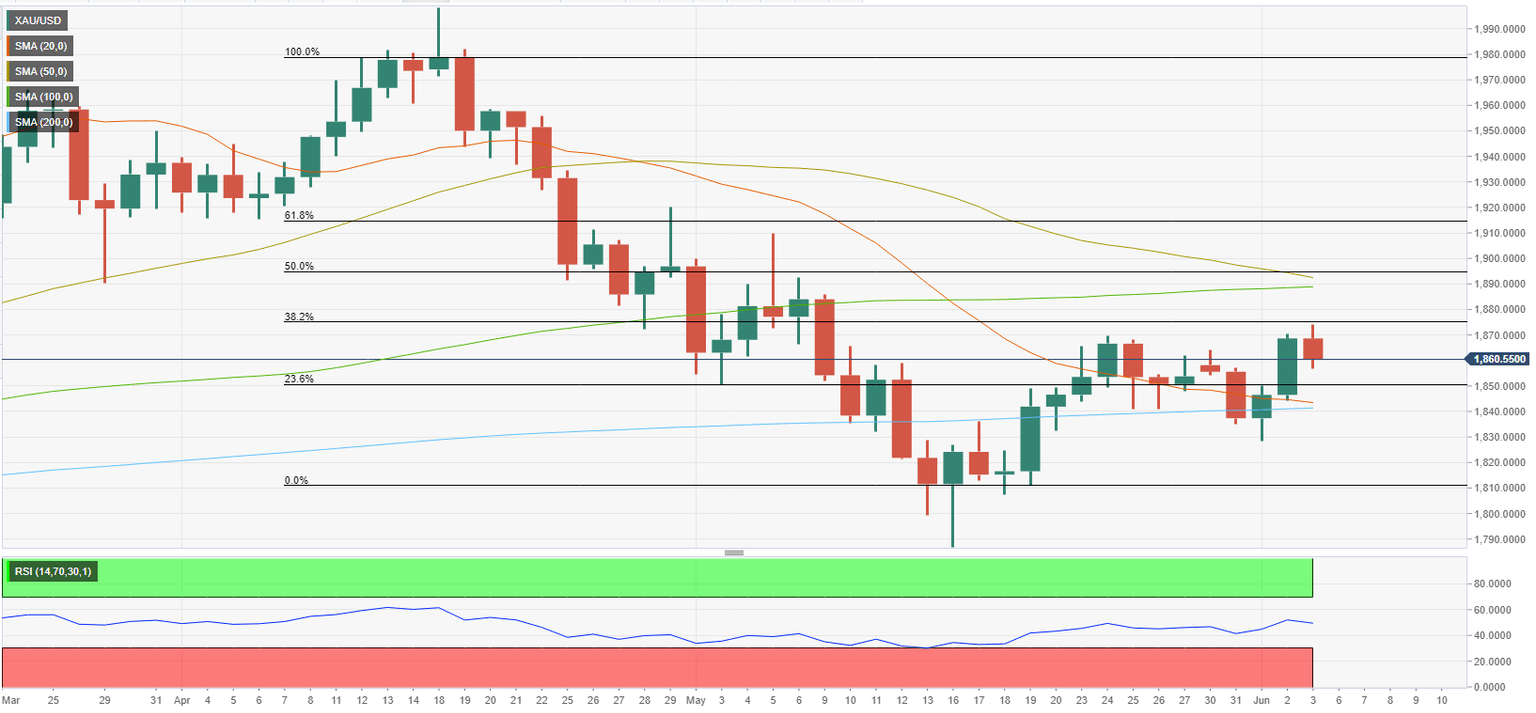

Gold Price seems to have gone into a consolidation phase with the Relative Strength Index (RSI) indicator on the daily chart moving sideways near 50. Although XAUUSD was able to close above the 200-day SMA for two straight days, the Fibonacci 38.2% retracement of the latest downtrend seems to have formed stiff resistance at $1,875. With a daily close above that level, gold could target the $1,890/$1,900 area (100-day SMA, 50-day SMA, Fibonacci 50% retracement) and $1,915 (Fibonacci 61.8% retracement) afterwards.

On the downside, $1,850 (Fibonacci 23.6% retracement) aligns as interim support before $1,840 (200-day SMA). In case the latter turns into resistance, this could be seen as a significant bearish development and attract sellers. In that scenario, additional losses toward $1,830 (June 1 low) could be witnessed.

In short, gold needs to break out of the $1,875-$1,840 range in order to determine its next short-term direction.

Gold Price Report: Commodity Supercycle

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.