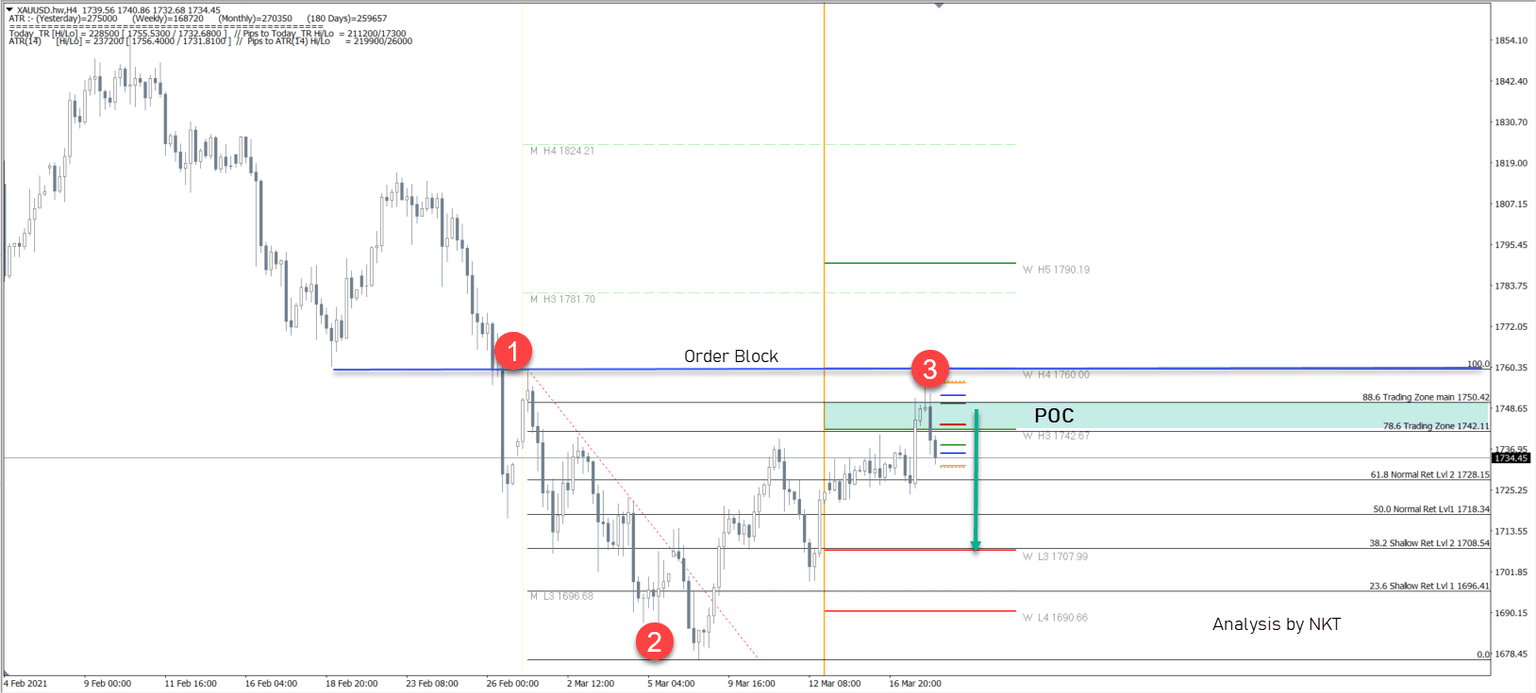

Gold POC zone shows strong sellers

After the FOMC, GOLD spiked up as the weakness in the USD was imminent. Stock went up, USD down and GOLD up as a part of inter market correlation.

GOLD is bearish. No matter the FOMC positive tone, I expect GOLD to drop as the markets are favouring other safe havens. Investors might start selling GOLD again and retail traders are joining the fray. 1740-50 is the POC zone and I expect rejections. Targets are 1728, 1718 and 1708. At this point I am selling on rallies. Only above 1760 we will see a deeper retracement up, as the trend is still down.

The analysis has been done with the CAMMACD.Core System.

For more daily technical and wave analysis and updates, sign-up up to our ecs.LIVE channel.

Author

Nenad Kerkez

Top-XE