Gold: on the brink of a crucial outlook changing move

Gold

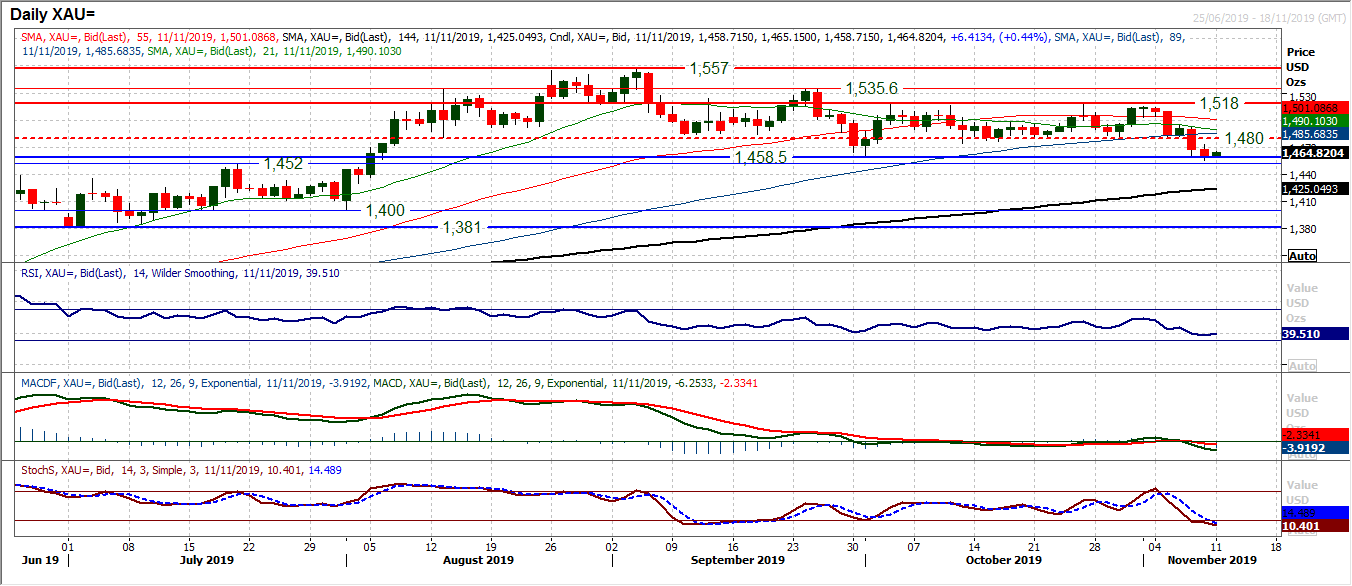

There has been an uncertain and ranging outlook to gold for the past few months. However, after a run of negative candles over the past week, the market is finally on the brink of a crucial outlook changing move. Thursday’s decisive bear candle below $1480 was a key move that really showed the selling pressure mounting. It came with the RSI falling decisively below 40 for the first time since April and suggested a real shift in sentiment. MACD lines turning lower and Stochastics under 20 also showed a growing sense of the market turning against gold. There has been an intraday breach of the October low at $1458 but interestingly, Friday’s close was bang on the support, whilst the market has ticked slightly higher today. This leaves the market still at a crucial tipping point. An intraday failure for the bulls today with a close under $1458 would see a confirmation of a new negative outlook on gold. The bulls have their work cut out now, with resistance $1474/$1480 also now a significant barrier of overhead supply. The early rebound today could just be prolonging the bear move. Initial resistance $1468.

Author

Richard Perry

Independent Analyst