Gold flat as traders brace for pivotal U.S. inflation and jobs data

Gold spot prices have climbed to around $4,350 early Monday, before retreating lower. Day price range has been $4,350 to $4,285 trading inside Friday’s range. Bullion is up about 65% year-to-date, transforming from a traditional “safe haven” into one of 2025’s strongest performers. With momentum still intact. Metal investors are eyeing a potential year-end breakout that could redefine how this closing chapter is written.

Spot gold was quoted at $4,313 per ounce at 15:11 ET.

Traders now turn their attention to Tuesday’s delayed November nonfarm payrolls report and October retail sales for guidance on the Fed’s next steps.

November CPI lands on Thursday, and any upside surprise in inflation could swiftly reshape rate expectations—and gold’s path.

Fed officials are sending mixed signals, with Williams striking a more hawkish tone while Miran pushes for quicker rate cuts toward neutral.

Last week, the Fed delivered its third rate cut of 2025, lowering the target range to 3.50%–3.75% in a divided vote. At the same time, Chair Jerome Powell indicated they may halt further easing while the economy absorbs the 75 basis points already implemented.

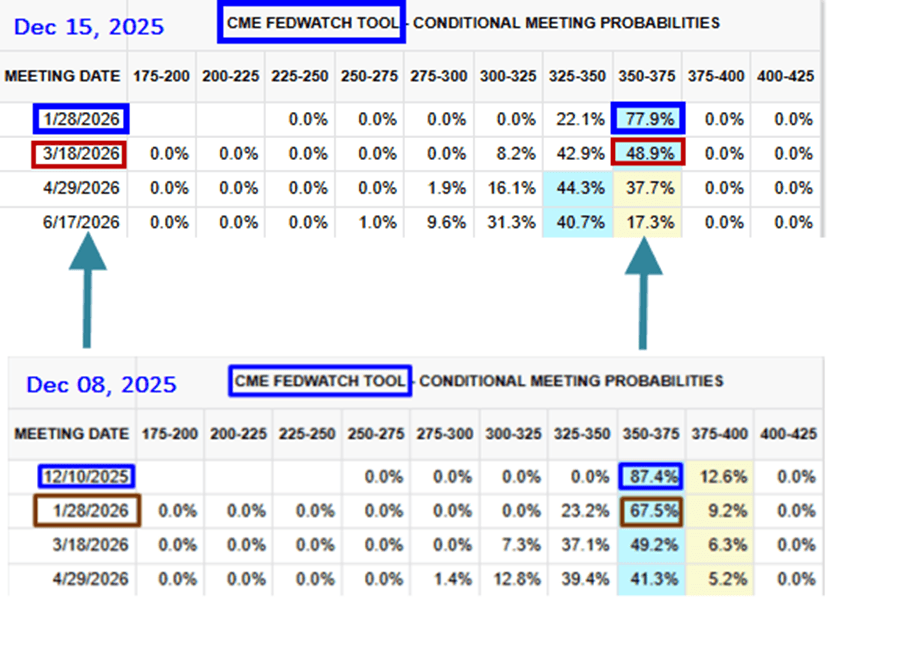

CME FedWatch:

· CME FedWatch January rate cut probabilities have moved lower to 77.90% today from 87.4% on December 08, 2025.

· February rate easing probabilities have declined to 48.90% today from 67.5% on December 08, 2025.

Technical analysis perspective:

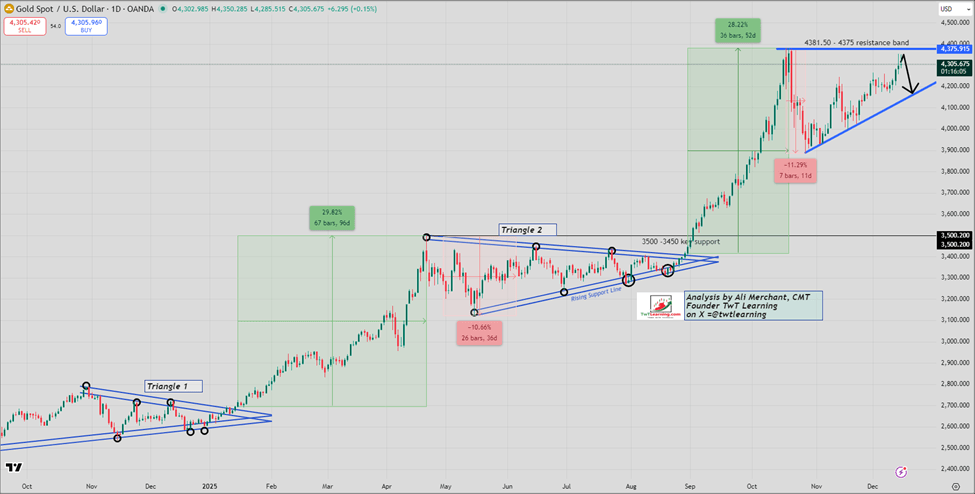

Gold / US Dollar:

· Spot gold has failed for a second straight session to retest the October 20, 2025, all-time high at $4,381.

· If bulls cannot clear the $4,381 barrier this week, a pullback toward $4,140 which is the late-October rising trendline base looks likely.

· The $4,140 support zone is expected to hold, keeping the door open for another run at $4,381.

· A clean break above $4,381 would invalidate the downside scenario.

Gold Daily chart:

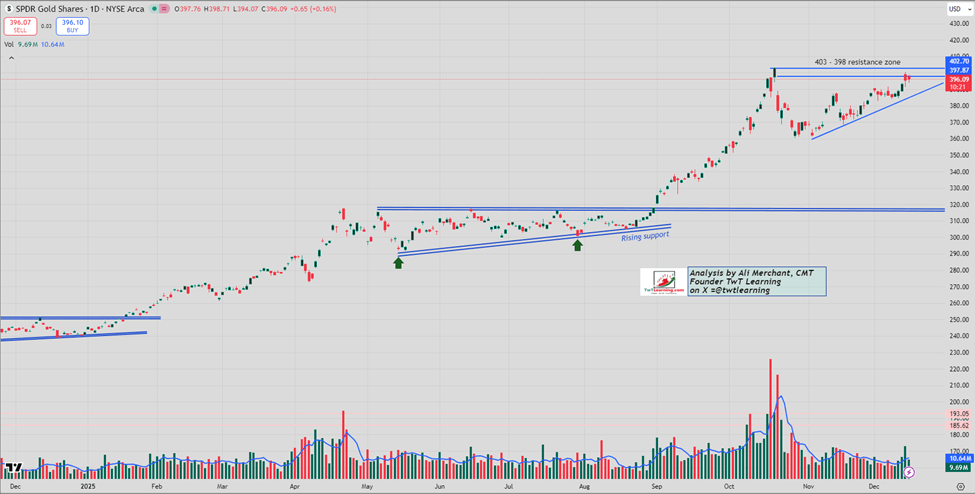

GLD (SPDR Gold Trust) ETF:

· GLD has rejected at the 398–403 resistance band for the second straight session.

· As long as this ceiling holds, a pullback toward the rising trendline near 385 remains likely.

· From that zone, a rebound toward 398–403 is the base case.

· A decisive break above 403, or a clear drop below 385, would set the next major directional move.

GLD daily chart:

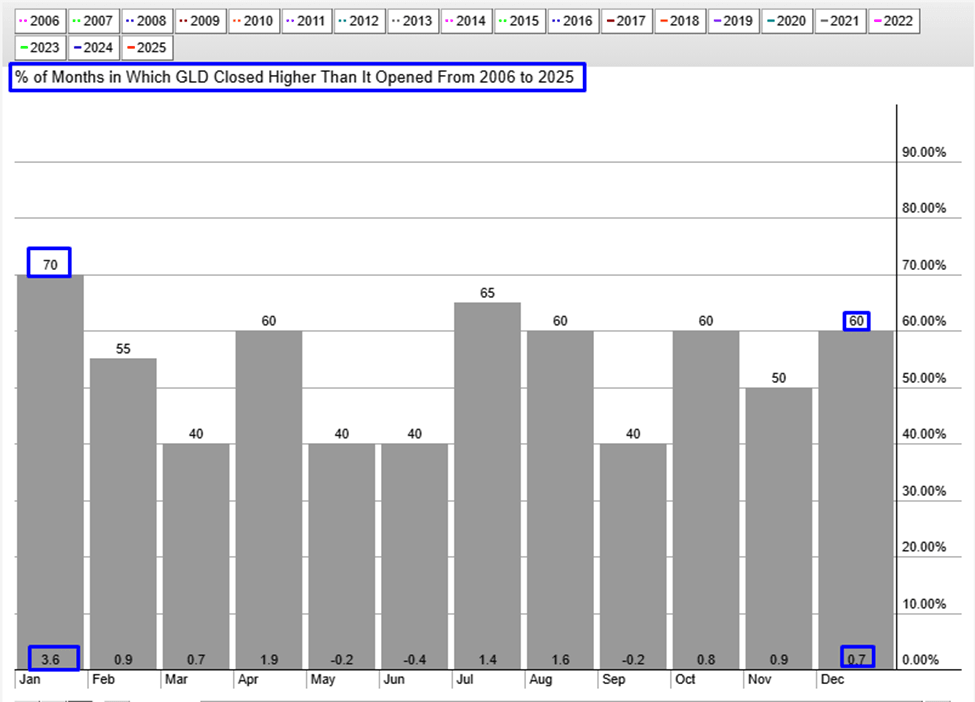

GLD Seasonality:

Since 2006, GLD has posted December rise of 0.7% in 60% of the years, while January has seen a rise of 3.6% in 70% of the years.

Author

Ali Merchant, CMT

TwT Learning

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, & Fund Management, He has been trading FX, FX options, US stock