Gold eases from peak amid signs of diplomatic progress

Gold is consolidating near the $4,800 level after retreating from record highs. The pullback followed Trump’s decision to ease tariff threats against Europe, reducing immediate safe-haven demand. A potential diplomatic resolution over Greenland also helped calm markets, though key details remain unclear. Cautious sentiment persists as markets await upcoming U.S. data, including GDP, jobless claims, and inflation. At the same time, strong central bank demand and broader policy uncertainty continue to support gold’s long-term bullish trend.

Gold consolidates after record highs on diplomatic progress

Gold remains stable near $4,800 level following a retreat from record highs. The recent correction in gold came after Trump backed away from threats to impose tariffs on eight European nations. Bloomberg reported that a diplomatic resolution over Greenland is now in the works, lowering immediate risks of a trade conflict. This move reduced safe-haven demand for gold, which had surged on escalating tensions between Washington and Brussels.

Still, the outlook remains uncertain. Trump offered no clear details about the proposed “framework,” leaving markets cautious. European leaders, including Germany's Finance Minister Lars Klingbeil, warned against assuming a full de-escalation. If negotiations falter or fresh tensions arise, risk sentiment could shift quickly, restoring safe-haven demand for gold.

At the same time, economic data remains a key driver. Markets now await the final Q3 GDP reading, jobless claims, and PCE inflation data. Weaker-than-expected figures could weigh on the Dollar and offer renewed support to gold. Meanwhile, ongoing central bank gold purchases, policy easing prospects, and geopolitical risks continue to support the long-term trend.

Gold holds bullish structure within ascending broadening wedge

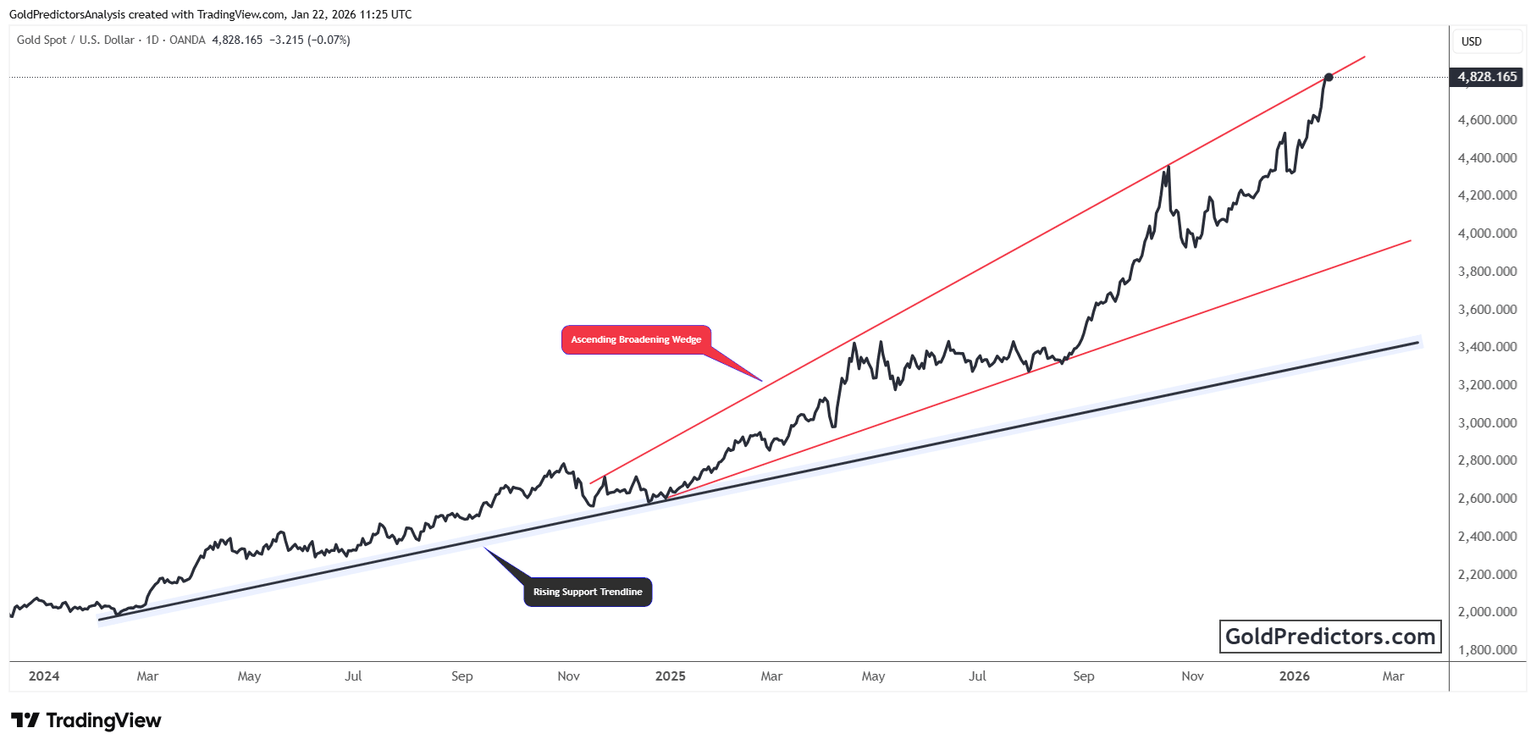

The gold chart below shows a clear long-term uptrend contained within an ascending broadening wedge. Price action has steadily climbed since early 2024, with rising volatility and widening price swings forming the wedge pattern. This structure, outlined by diverging red trendlines, reflects strong bullish momentum with expanding breakout potential.

A notable element on the chart is the rising support trendline that has consistently anchored the broader uptrend. Each pullback found support along this trendline, creating a series of higher lows. Its repeated validation during consolidation phases highlights firm underlying demand and sustained accumulation throughout the advance.

In early 2026, gold accelerated sharply higher and approached the upper resistance of the wedge. The breakout marked a critical technical milestone, confirming strong bullish momentum. Although prices have pulled back toward $4,800, the structure remains bullish. As long as price holds above the lower wedge boundary and the rising trendline, the broader trend remains upward.

Gold forecast: Bullish outlook intact amid short-term consolidation

Gold continues to consolidate near $4,800 level following a pullback from record highs. The retreat reflects short-term easing in geopolitical tensions, but the broader outlook remains bullish. Strong technical support, ongoing central bank demand, and uncertain economic conditions continue to favor gold’s long-term uptrend. A decisive move above recent highs could trigger the next leg of the rally.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.