Gold, Chart of Week: XAU/USD shorts about to get squeezed?

- Gold is setting up to offer something for both the bulls and bears.

- Will the US dollar continue lower and squeeze gold shorts?

The gold price has been stuck in a sideways range from both a daily and hourly perspective as investors covered short positions from near to $1,800, forcing the price back to $1,880 on three pushes before a retest of $1,800 again.

XAU/USD will open the new week after closing at $1,827 with no clear bias one way or the other:

Gold, daily chart

The price is in the middle of the range where it meets the potential resistance of the neckline of an M-formation which could lead to a downside continuation of the engulfing sell-off. What is apparent, all three prior sessions on Friday were consolidation days, coiling up to what could be a breakout start to the week.

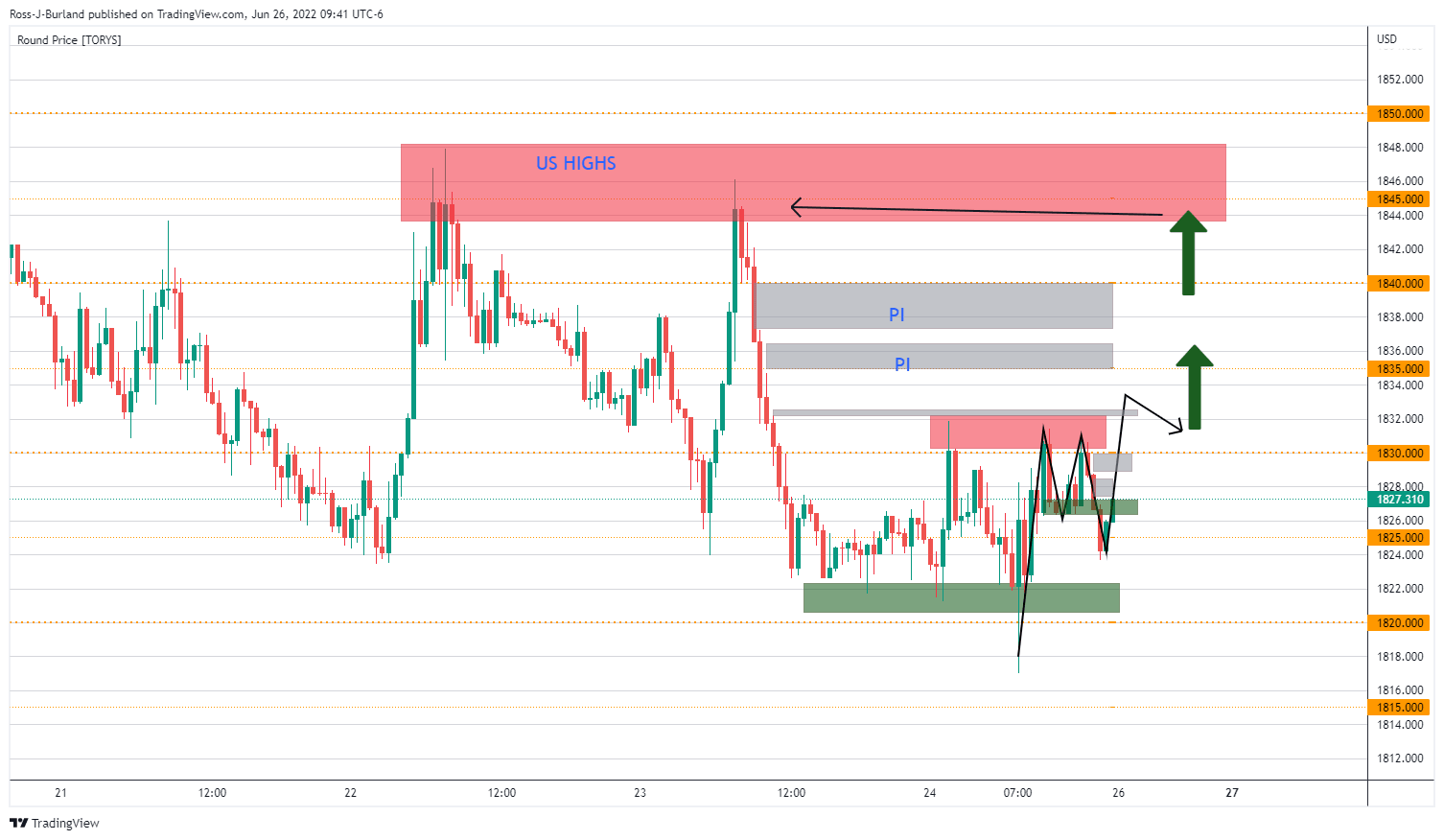

Gold, H1 chart

On the hourly chart, we can see that the price has consolidated the sell-off from $1,850 double top and the M-formation is compelling for a potential move on the $1,820 and break below to extend the downside and range.

Gold, M15 chart

On the other hand, we are seeing a void in bids on the 15-min chart toward the highs of this hourly range as follows:

The thesis is the market could move higher to collect liquidity for one last move up into the order block before the final blow-off to the downside as the week gets busier.

DXY outlook

With all that being said, taking the US dollar into consideration, then there needs to be a bullish thesis applied in the case of a weaker greenback.

Last week, the following analysis, US Dollar Price Analysis: Bears taking out short-term structure, 103 vulnerable of a test below, argues the case for lower DXY:

We have seen the price action play out as follows:

If there is more to come, as the price breaks structure and heads towards the price imbalances and order block below near 103.10, then what is that going to mean for gold?

The bullish case for gold

A bullish case for gold comes above the current consolidation rage above 1,832 towards the prior highs in the prior two US sessions and then $1,850 as follows:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.