Brent crude slides on peace talk optimism and demand concerns

Brent crude oil fell to 60.00 USD per barrel on Tuesday, marking its lowest price since early 2021. The sell-off was driven by two primary factors: renewed speculation about progress in Russia-Ukraine peace talks and mounting fears of a global supply glut.

The prospect of a peace agreement has raised the possibility that the US will lift sanctions on Russian oil exports, potentially releasing a significant volume of crude into an already well-supplied market.

Bearish sentiment was further amplified by weaker-than-expected economic data from China on Monday, intensifying concerns about slowing energy demand in the world's largest crude importer.

These downward pressures effectively overshadowed lingering geopolitical risks, including escalating tensions between the US and Venezuela, which could otherwise have supported prices through fears of supply disruption.

Technical analysis: Brent Crude

Four-hour chart

On the H4 chart, Brent crude broke downwards from a consolidation range around 61.61 USD, confirming the resumption of the bearish trend. This breakdown activated a downward wave with an initial target at 59.30 USD. We anticipate a near-term continuation of the decline to approximately 59.59 USD, likely to be followed by a minor technical rebound towards 60.45 USD.

Following this corrective bounce, we expect the downtrend to reassert itself, driving prices towards the primary target of 59.30 USD, where the current bearish impulse is likely to be exhausted. This outlook is supported by the MACD indicator, whose signal line remains firmly below zero, indicating sustained selling momentum.

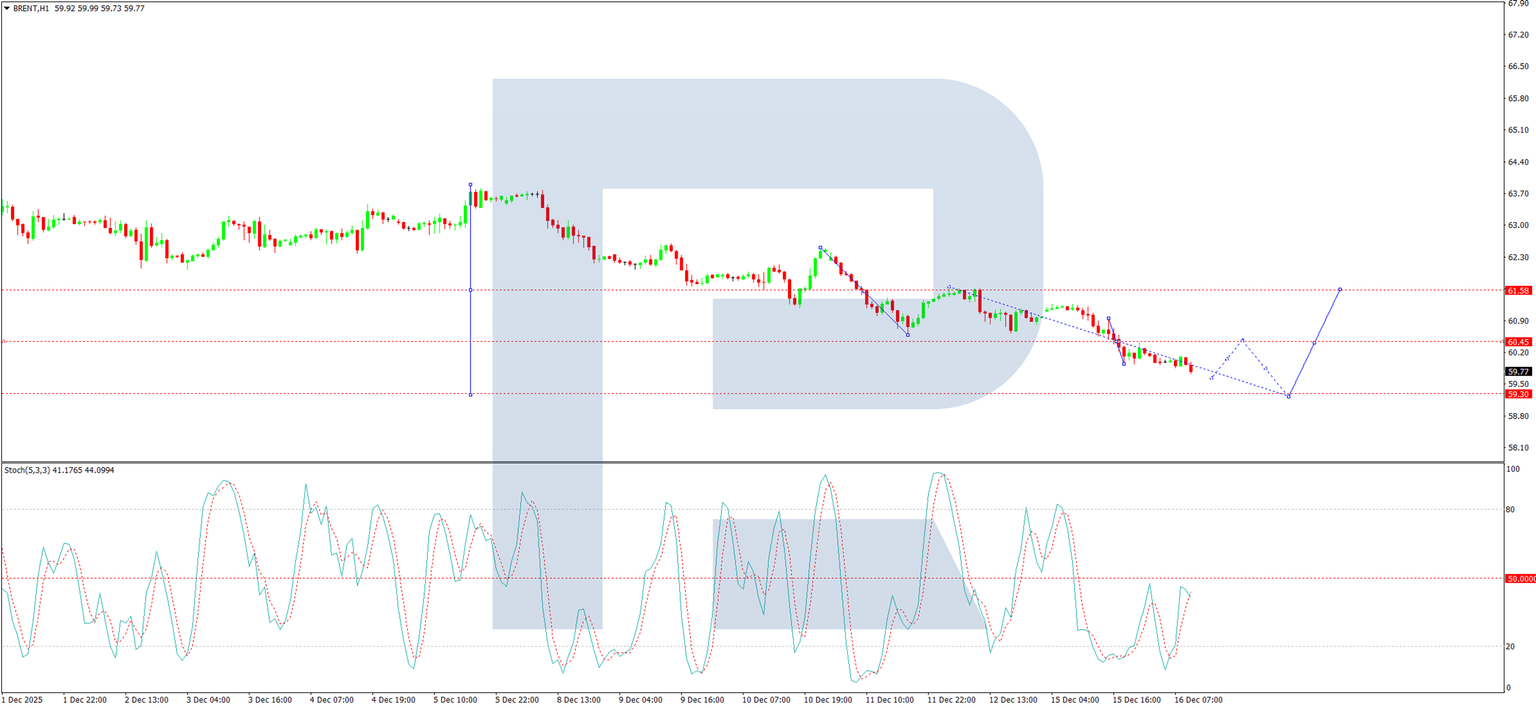

One-hour chart

On the H1 chart, the market continues to develop a clear downward wave structure following its rejection from the 61.60 USD resistance. The immediate path points towards a decline to at least 59.59 USD. A brief rebound from this level towards 60.45 USD is plausible, representing a short-term correction before the next leg down targets the 59.30 USD support.

The Stochastic oscillator corroborates this near-term bearish bias. Its signal line is at the 50 midpoint and is turning downward, suggesting that selling pressure is re-emerging.

Conclusion

Brent crude is under significant pressure, caught between the bearish implications of potential peace-driven supply increases and concerns over Chinese demand. Technically, the break below 61.61 USD has solidified a negative outlook, with a clear path towards the 59.30 USD target. Any near-term rebounds are likely to be corrective within this broader downtrend. Traders should monitor the 59.30 USD level closely; a decisive break below may trigger an acceleration of the sell-off, while a strong rebound from this support would suggest a period of consolidation.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.