US Dollar forecast: DXY turns south as rate-cut bets return?

- DXY remains heavy after the Fed’s 25 bp cut, with rallies selling into resistance as markets debate whether easing continues into 2026.

- What’s driving it: Softening labor signals, Fed pause-vs-cut uncertainty, and volatile yields are keeping the dollar trapped in a range with a bearish lean.

- Technical forecast: Unless upcoming red-folder data (NFP, CPI, jobless claims) surprises hawkish, DXY risks a fresh leg lower after failing to reclaim key resistance.

This US Dollar forecast is being shaped by one central theme: the Fed has already cut, and traders are now pricing the next move based on whether the economy is merely cooling or actually cracking. After the Federal Reserve delivered a 25 bp rate cut to 3.50%–3.75%, the dollar slipped as Powell leaned cautious and markets started debating a January pause versus a continuation of easing later on.

That uncertainty matters because the dollar doesn’t need bad news to fall - sometimes it only needs less conviction. When yield direction becomes unstable, the USD loses its clean advantage. And when the labor narrative turns noisy, it becomes harder for DXY to build sustained momentum.

The Core Narrative Moving US Dollar

The dollar’s current tone feels less like a trend and more like a tug-of-war.

1) Fed cut delivered, but guidance didn’t give bulls a clean runway

The cut itself was expected, but the market reaction revealed a simple truth: when the Fed is easing, USD strength needs a stronger risk-off shock to compensate. With Powell offering cautious guidance, traders leaned toward a near-term pause but kept future cuts priced in. This capped dollar rebounds quickly.

2) Labor signals are wobbling at the wrong time

Weekly jobless claims posted a sharp jump, reigniting debate over whether labor weakness is seasonal noise or a real signal. For the dollar, sustained strength usually requires confidence that US growth is outperforming globally. Right now, that confidence is fragile.

3) Bond market anxiety is creeping back in

Treasury markets are increasingly forward-looking, with investors focused on policy credibility and longer-term rate risk. When yields lose directional clarity, the USD tends to trade defensively instead of trending.

Highlights

- Fed easing removes part of the USD’s interest-rate advantage.

- Labor data volatility increases policy uncertainty.

- Yield instability turns USD rallies into short-lived corrective moves.

News that moved the US Dollar in the last seven days

Fed delivers 25 bp cut - USD sells the headline

The dollar weakened immediately after the decision, reflecting expectations that the easing cycle may not be finished. The reaction reinforced a sell-the-rally environment for DXY.

Jobless claims jump - markets debate noise vs signal

Claims rose sharply, unsettling traders already sensitive to labor market risks. Even if seasonal factors played a role, the timing matters as it feeds expectations for further policy support.

Dollar’s weekly tone remains soft

Despite brief stabilization attempts, DXY continues to struggle to regain upside traction, reinforcing the broader bearish bias.

Technical outlook (DXY)

The technical picture aligns with fundamentals: DXY remains vulnerable unless it can reclaim key resistance with conviction.

Technical narrative of price action

- Price structure shows lower highs, signaling weakening momentum.

- Recent rebounds appear corrective rather than impulsive.

- The dollar is trading as a macro reaction asset, with data releases driving directional moves.

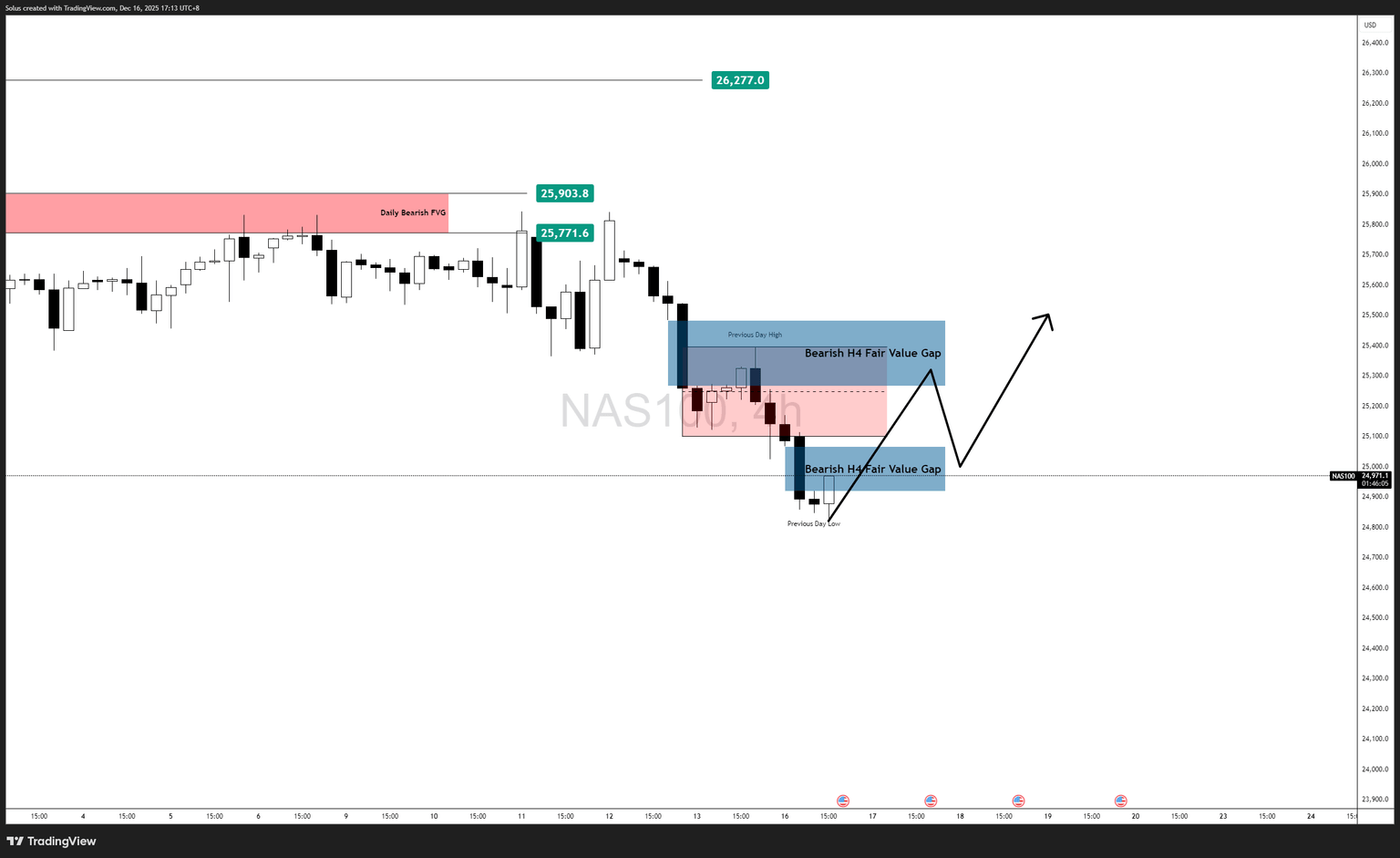

Bullish scenario (USD strength)

A bullish shift requires a meaningful repricing of rate expectations:

- NFP prints significantly stronger, particularly wages

- CPI shows renewed inflation pressure

- Treasury yields stabilize and push higher

- DXY reclaims and holds above recent resistance zones

Bullish path: A relief rally first, followed by confirmation only if follow-through persists after subsequent data releases.

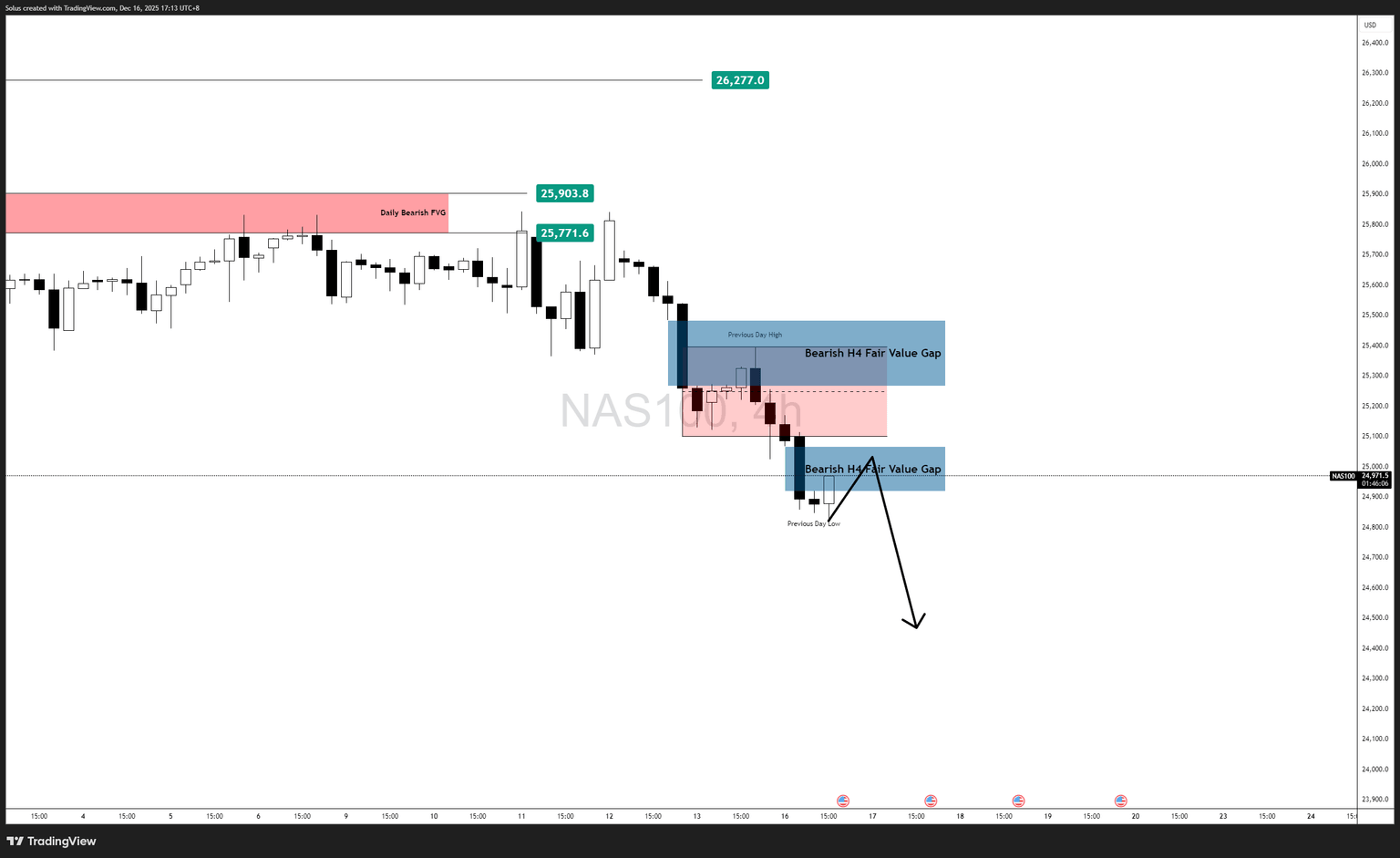

Bearish scenario (USD weakness)

The bearish case remains the base scenario:

- Weak NFP or rising unemployment

- Softer CPI reinforcing easing expectations

- Elevated jobless claims extending beyond seasonal explanations

- Failure to form higher highs on rebounds

Bearish path: Gradual grind lower toward support, with acceleration if inflation and labor data confirm slowing momentum.

Final thoughts

This US Dollar forecast remains straightforward: the dollar can bounce, but without a hawkish data surprise, rallies are likely to be sold. As long as the Fed stays cautious and labor risks linger, DXY remains range-bound with a bearish tilt. The next decisive move will be driven by NFP and CPI, not technicals alone.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.