Gold and Silver nearing bottom as Gold-to-Silver ratio peaks

-

Recent U.S. economic data shows a faster slowdown than expected, leading to predictions of more significant interest rate cuts, benefiting non-yielding assets like gold.

-

Concerns about China's economic issues and Middle Eastern conflicts enhance gold's appeal as a safe haven, although rising U.S. Dollar demand might limit gold's short-term price increases.

-

The current drop in silver prices toward the critical area suggests that prices are very close to a bottom, similar to how the gold-to-silver ratio is nearing the top.

The dovish outlook from the Federal Reserve and geopolitical risks are attracting dip-buyers to precious metals. Recent U.S. economic data shows a faster slowdown than expected, leading to predictions of more significant interest rate cuts. This benefits non-yielding assets like gold. Concerns about China's economic issues and Middle Eastern conflicts add to gold's appeal as a safe haven. However, rising U.S. Dollar demand, driven by recovering Treasury bond yields and positive market sentiment, might limit gold's price increases in the short term.

These gold market trends also impact silver, seen both as a precious metal and an industrial commodity. Silver may gain from safe-haven demand due to geopolitical risks and the Fed's dovish stance, often moving with gold prices. Stabilizing equity markets could limit silver's gains, especially if the U.S. Dollar remains strong. Silver's industrial use could boost its demand if the global economy recovers, balancing any downward pressure from a strong dollar. Thus, silver prices will likely be influenced by safe-haven demand, industrial use, and economic and geopolitical factors.

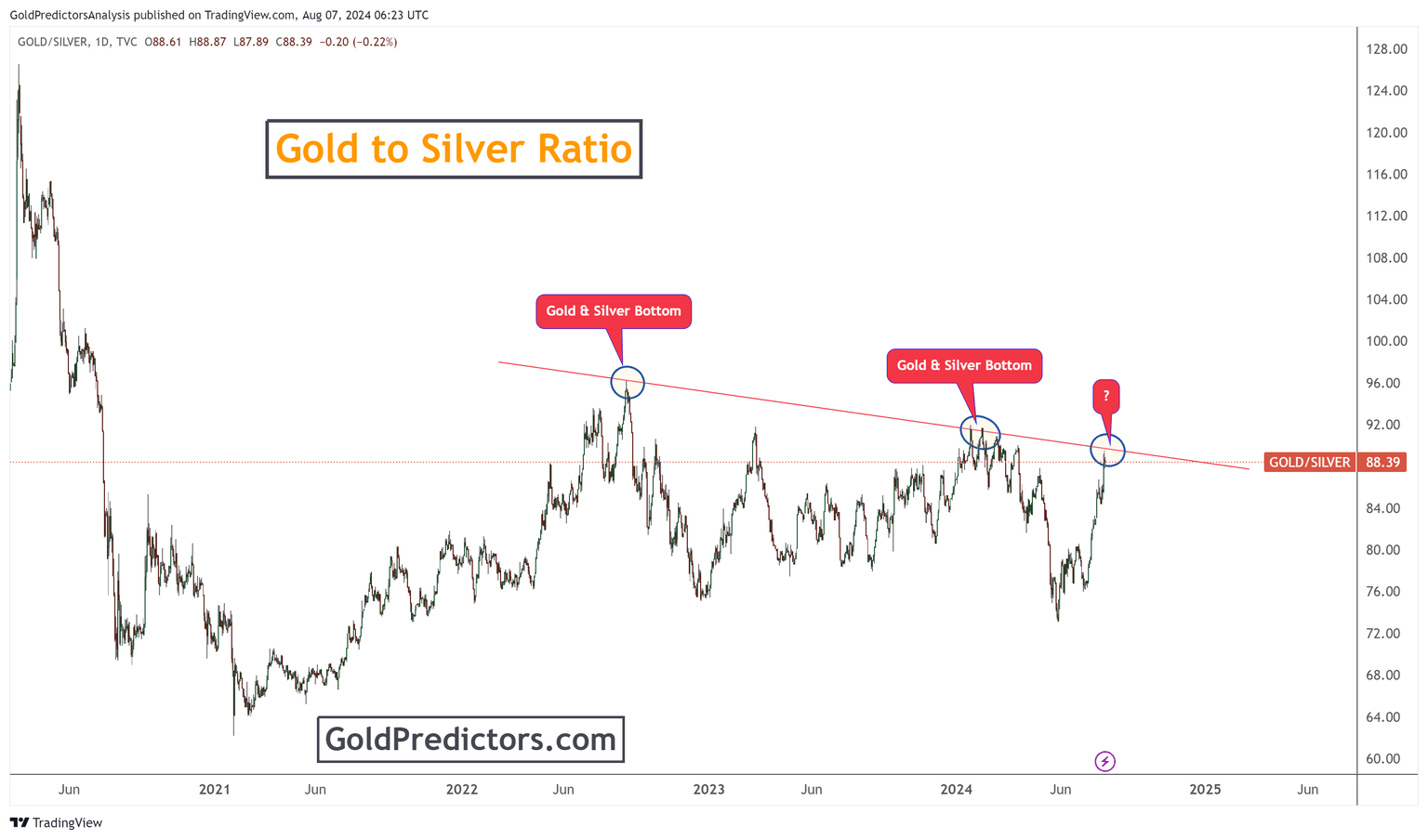

Identifying bottoms in precious metals with the Gold-to-Silver ratio

The gold-to-silver ratio is a valuable tool for identifying potential bottoms in gold and silver markets because it highlights the relative value between the two metals. Historically, when the ratio reaches extreme levels—either very high or very low—it often signals a turning point. A high ratio suggests that silver is undervalued compared to gold, indicating a potential buying opportunity for silver as it may outperform gold during a recovery. Conversely, a low ratio shows that gold is undervalued relative to silver. Monitoring this ratio allows investors to gauge market sentiment and relative value, helping them make more informed decisions about the optimal times to enter or exit positions in these precious metals.

The chart below shows that the gold-to-silver ratio is approaching a critical resistance area, indicating that a bottom in both metals may be imminent. The long-term trend line from 2022 demonstrates that when the ratio touches this resistance line, both metals tend to bottom, as observed in 2022 and 2024. Currently, the ratio is again nearing this strong resistance point, and silver is also approaching a critical support area. This suggests that the bottom is near, and prices are likely to rise soon.

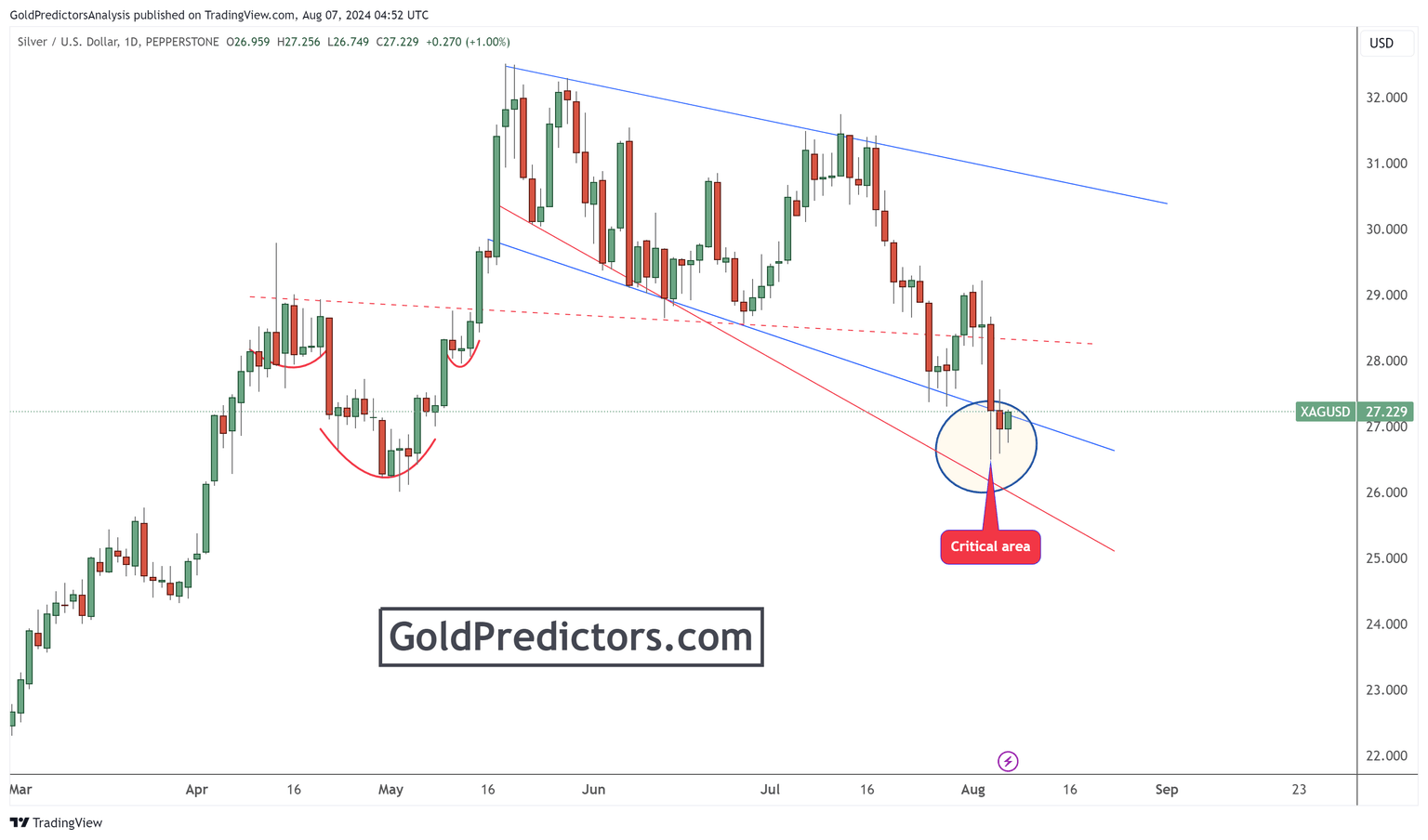

Volatility in Silver signals potential bottom

The daily chart of silver shows that the descending broadening wedge pattern indicates heavy volatility, which could lead to bullish price action if prices break above the blue trend line. The current drop in silver prices toward the critical area suggests that prices are very close to a bottom, similar to how the gold-to-silver ratio is nearing the top. Therefore, investors might consider buying silver around this critical area in anticipation of higher prices.

Bottom line

In conclusion, the current economic and geopolitical landscape suggests that both gold and silver are nearing pivotal points that could lead to significant price movements. The dovish outlook from the Federal Reserve, alongside ongoing geopolitical tensions, has made these precious metals attractive to dip-buyers, with gold particularly benefiting from its status as a safe-haven asset. Meanwhile, the gold-to-silver ratio is approaching a critical resistance level, and the silver price is nearing key support, indicating potential bottoms for both metals. Given these factors, silver, with its dual role as a precious and industrial metal, is poised for possible gains, especially if economic conditions stabilize and demand increases. Investors should consider these dynamics and the technical indicators suggesting an imminent bottom in order to make informed decisions about entering the market.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.