Germany's €850 billion gamble: Can debt save Europe’s economic engine?

After three years of unprecedented economic stagnation, record business bankruptcies and flagging confidence, Germany seems to have reached a breaking point. Europe's industrial powerhouse, long a champion of budgetary orthodoxy, is now radically turning its back on past austerity. The coalition government led by Friedrich Merz has unveiled a debt-financed stimulus plan to revive the stalled economy of Germany.

This fiscal "Big Bang", hailed as a historic turning point in debt management by economists, could well transform the German economy... or, on the contrary, expose it to new imbalances.

Will growth take off again in the long term? Will inflation be contained? Will the Euro and the DAX, seemingly disconnected from the recent economic lull, emerge stronger or weaker? Behind the billions injected, a story of much deeper economic, political and strategic issues lies.

A historic turning point: €850 billion of debt to kick-start the machine

After years of debt management and budgetary orthodoxy, Berlin has definitively turned the page on the "debt brake". The new CDU/CSU-SPD coalition government, led by Friedrich Merz, has adopted an unprecedented investment plan: €850 billion in debt by 2029, including €500 billion via a special fund for infrastructure, energy and digital transition, and €300 billion to raise defense spending to 3.5% of GDP, in line with the new NATO target.

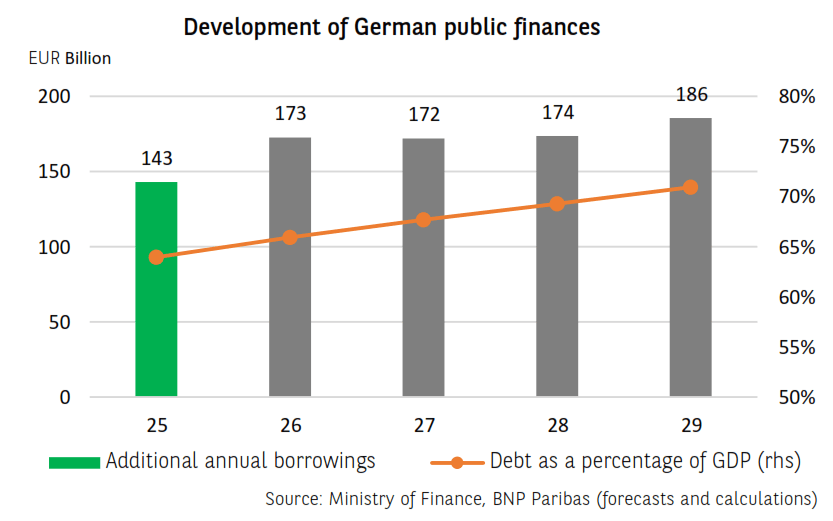

The logical consequence of this strategy is an increase in the debt burden. The debt-to-GDP ratio, currently close to 63%, is expected to reach 71% by 2030, according to BNP Paribas.

This is a significant increase, but still far from French or Italian levels. Above all, it remains sustainable as long as nominal economic growth remains dynamic.

But this trajectory remains conditional on rigorous budget execution and a rapid return to growth. Otherwise, pressure on bond markets could quickly mount.

Starting in 2025, federal investment will jump to €115.7 billion, and to €123.6 billion in 2026, compared with €74.5 billion in 2024. At the same time, the public deficit is expected to exceed 3% of GDP in 2025 and potentially 4% in 2026.

This expansionary policy is also supported by tax incentives for private investment and the revival of the construction sector.

"By 2029, we will increase the federal government's annual investments to almost €120 billion a year," said Finance Minister Lars Klingbeil, according to Reuters.

This paradigm shift in debt management is intended to put an end to the longest economic slump since 1949, according to the Economics Ministry, after two years of recession (the economy of Germany shrank by 0.3% in 2023 and by 0.2% in 2024) and stagnating growth expected this year, according to Bundesbank forecasts.

Expected impact on growth: Short-term rebound, but fragile in the long-term

In the short term, there are signs that growth forecasts are improving, even if they start from very low levels. But Germany's growth prospects are still among the weakest in Europe.

Deutsche Bank, for example, is now revising its short-term forecasts upwards. The German bank is counting on a rebound to 0.5% in 2025 and 2.0% in 2026, thanks to a powerful multiplier effect from investment in infrastructure and defense.

"The upward revision to our near-term growth forecast is largely due to the ambitious ramp-up in defence and infrastructure spending, but it is also important to note that the economy has weathered the uncertainty shocks this year better than expected. Indeed, while the economy grew at 0.4% q/q in Q1, the soft and hard data available so far suggest that the recovery continued in Q2, with our nowcast model pointing to 0.2% q/q", notes Deutsche Bank.

But this recovery would be largely "front-loaded". Growth potential for the German economy would remain weak beyond 2026, converging slowly towards a structural growth rate of around 1% by 2029.

The main brake on growth remains the labor shortage, in an aging country where 43% of companies are struggling to recruit, according to Euro News.

"The supply side is thus unlikely to support growth rates of more than 1% sustainably. As we have argued in recent reports, raising structural growth to levels around 2% will take ambitious supply-side reforms alongside the fiscal expansion. And while the new government has promised policy reforms to raise the labour supply, it would be premature to bake them into medium-term projections, in our view", adds Deutsche Bank.

In short, the German government's stimulus may boost growth, but only temporarily, if it is not accompanied by structural reforms.

The Euro between two fires: Growth versus deficit

This radical change has major implications for Forex. On paper, massive fiscal stimulus is good for the Euro (EUR): it boosts growth, reduces the output gap and improves domestic demand.

But in reality, German inflation is likely to remain above 2% until 2027, according to Deutsche Bank, under the effect of rising public wages and tensions in the construction industry. Moreover, German long-term interest rates are already rising (2.6% on the 10-year Bund), increasing the cost of debt and weighing on future room for maneuver.

Against this backdrop, the ECB could slow down its rate-cutting cycle, which would theoretically support the Euro... but beware of the psychological effect of the word "fiscal slippage" on international investors.

For traders, the Euro could become more sensitive than ever to the perception of German fiscal credibility.

But although Germany is preparing to increase its public debt to a level not seen for decades, its credit rating remains the strongest in Europe on the financial markets. The four major rating agencies (S&P, Moody's, Fitch and KBRA) maintain Germany's sovereign rating at AAA, the highest possible, with a stable outlook.

This confidence is explained by the country's institutional solidity, its past fiscal discipline and the depth of its bond market. Even though 10-year Bund rates have recently risen close to 2.6%, due to anticipated borrowing volumes, Germany continues to finance itself at a much lower cost than its neighbors, giving it leeway that few European states can afford.

DAX soars despite recession

In stark contrast, the DAX 40 has hit an all-time high, even as the economy of Germany is in crisis. The reason? According to Forbes, over 80% of the sales of DAX companies are generated abroad.

DAX index chart. Source: FXStreet.

Giants such as SAP, Deutsche Telekom and Allianz are benefiting from global growth and tech, while German auto stocks (VW, BMW, Mercedes) are suffering from the Chinese slowdown and US tariffs.

Defense companies such as Rheinmetall (+131% year-on-year) are another driving force, benefiting directly from massive German and European rearmament.

But beware, mid-caps (MDAX, SDAX) are in decline, and reflect more the local economic reality.

In short, the DAX doesn’t really reflect the economy of Germany, and equity traders need to look beyond the flagship indices.

MDAX index chart. Source: FXStreet.

A risky but necessary debt management

Germany's fiscal gamble is a bold one, aimed at emerging from a historic slump with massive public stimulus, at the risk of exploding debt and rekindling inflation.

If the economy of Germany takes off again in 2026, Berlin could claim a success comparable to Draghi's "whatever it takes" approach. But without far-reaching reforms in labor, innovation and energy, the upturn could be short-lived.

For the Euro, fiscal support may be positive in the short term, but German fiscal credibility remains under scrutiny by the markets. As for the DAX, watch out for the great divide between high-performance multinationals and struggling local SMEs.

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.