GBP/USD Weekly Forecast: Time to sell? Steaming hot US inflation set to reverse BOE-led rally

- GBP/USD has rocked and rolled on the BOE's mixed messages, Nonfarm Payrolls.

- US inflation and UK GDP stand out as key in the upcoming week.

Early February's daily chart is painting a mixed message. - The FX Poll is pointing to gradual declines.

Another rate hike and even more down the road – the BOE's words and actions have boosted sterling, and now it may be time to focus on the other side of the pond. A surge in US inflation could boost the greenback now.

This week in GBP/USD: BOE sends mixed messages

Don't ask for a pay rise to keep inflation low – that has been the message from Bank of England Governor Andrew Bailey, one of many eyebrow-raising ones. While the media focused on this blunder, investors eyed the BOE's announcement for future moves, and that has been mixed.

The BOE announced a 25 bp rate hike as expected, but four out of nine members dissented and opted for a double-dose 50 bp increase. This close call – echoing November's surprising no-hike decision – sent sterling higher.

On the other hand, Bailey stressed that most of the increase in inflation is related to an external supply shock, referring to supply-chain issues and energy costs. He said the UK economy is not roaring. That weighed on the pound.

On the other side of the pond, speculation about a double-dose rate hike also stirred the currency. Federal Reserve officials played down the chances of a 50 bp increase to borrowing costs when the bank convenes in March. That contrasted with comments from Fed Chair Jerome Powell, who opened the door to such a move. No fewer than six officials reiterated this message, weighing on the greenback.

US Nonfarm Payrolls smashed estimates with 467,000 – triple the early expectations and on top of massive upward revisions for the past two months. While annual changes make the overall employment picture somewhat less exciting, there is no doubt the American economy is doing well.

See NFP Analysis: America overcomes Omicron, more fuel for the Fed and the dollar

Tensions between Washington and Moscow escalated, with America warning of a Russian plan to fabricate a pretext for invasion. Both countries sent more troops to the region. However, as time passes without any exchange of fire, markets seem to be ignoring these tensions.

In UK politics, Prime Minister Boris Johnson came under fresh pressure after Sue Gray, a civil servant, published a report noting leadership failures around a series of parties in Downing Street. However, the PM has successfully convinced most of his colleagues to stay loyal, awaiting a parallel police investigation. The ongoing drama distracted markets but had little impact on the pound.

UK events: GDP and political popcorn

Has the British economy remained the fastest growing in the G-7? UK PM Johnson boasts about this achievement, but the last quarter of 2021 has probably seen slower expansion than beforehand. The Omicron covid wave has likely dented activity in December, following a jump of 0.9% in Gross Domestic Product in November.

Investors will likely focus on quarterly data. Despite the bounce in November, it will probably be hard for Britain to repeat the impressive 1.1% expansion in the third quarter. The full-year figures are also of interest – at least for politicians.

When will Boris Johnson face a vote of confidence? The rapid departure of senior aides in Downing Street and the accumulation of letters asking for a leadership contest are growing. Unflattering opinion polls may push the Conservative Party to oust its leader, but that may take more time. In the meantime, the entertaining Prime Minister's Questions event will keep traders distracted every Wednesday.

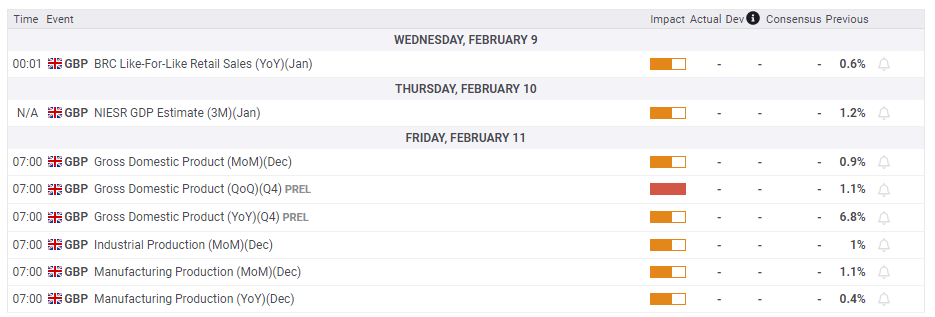

Here is the list of UK events from the FXStreet calendar:

US events: All eyes on inflation data

What if a temporary drop in oil prices cannot halt inflation? The Consumer Price Index (CPI) report is left, right and center in the upcoming week. The economic calendar points to an increase of headline CPI from 7 to 7.2% YoY in January, adding pressure on the Federal Reserve to act. Any increase toward 8% would be even more alarming.

Officials at the central bank focus on Core CPI, excluding energy and food prices. Here, expectations increase from 5.5% to 5.9%, and a 6% read or higher likely boosting the greenback.

The University of Michigan's preliminary Consumer Sentiment Index for February is also interesting. Still, it has lost some relevance after failing to project robust sales in the autumn. Moreover, it serves more as a political barometer than an economic one.

The crisis in Eastern Europe will likely remain in the headlines, but most analysts expect Russia to refrain from military action during the Beijing Winter Olympics. Chinese President Xi Jinping and his Russian counterpart Vladimir Putin vowed to strengthen ties, and China would prefer the world's attention to be on its achievements rather than a war.

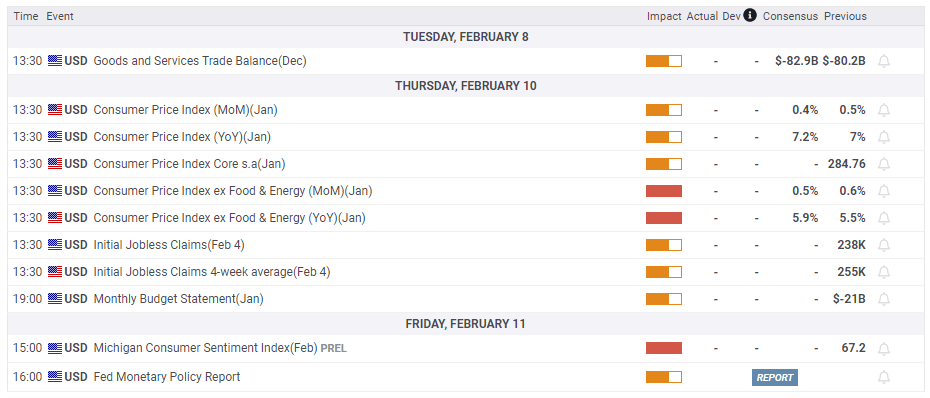

Here are the upcoming top US events this week:

GBP/USD technical analysis

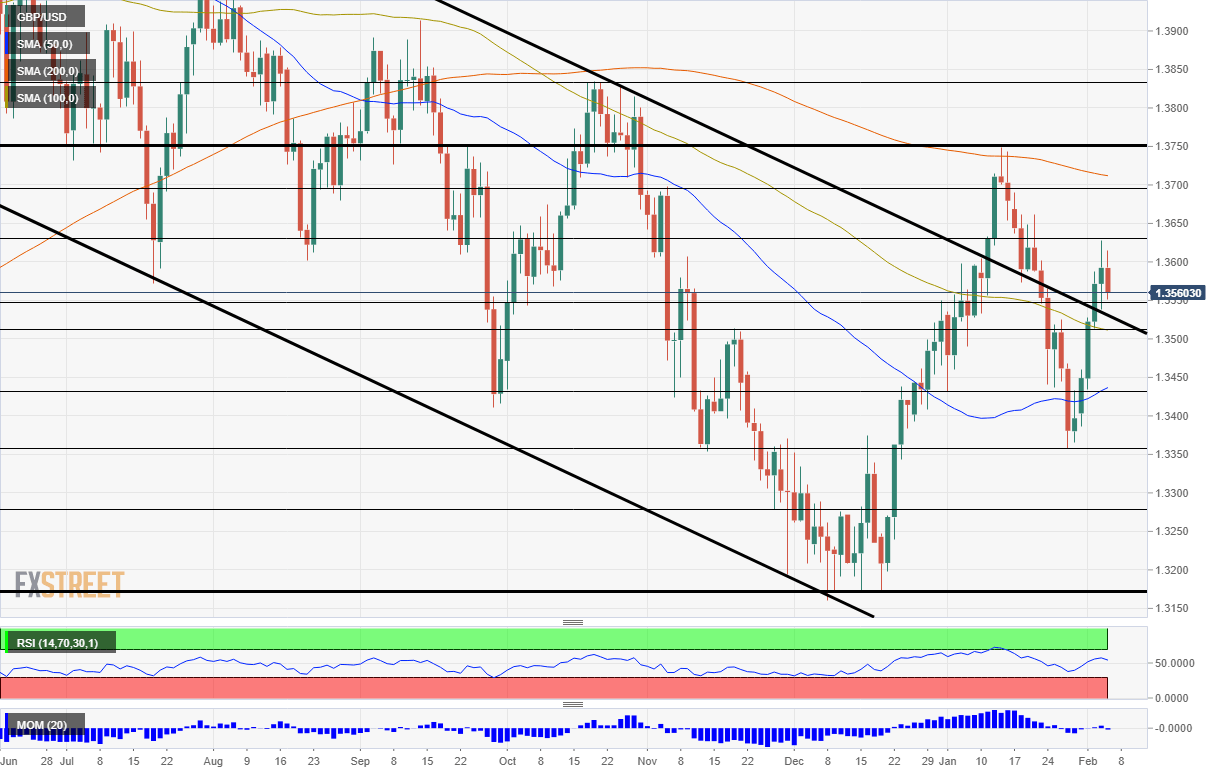

Pound/dollar has topped the 100-day Simple Moving Average, a sign of strength. It joins the pair's recapture of a downtrend resistance line that had capped it for several months. On the other hand, momentum remains to the downside, and the 200-day SMA still looms above. All in all, bulls are gaining ground but have far from total control.

Resistance is at 1.3635, the February high, followed by 1.37, which capped cable in early November 2021. The following upside targets are 1.3750 and 1.3840.

Support below 1.3550 is at 1.3515, which held cable down in November. It is followed by 1.3440, which was a swing low in early January, and then 1.3350, 1.3270 and 1.3175.

GBP/USD sentiment

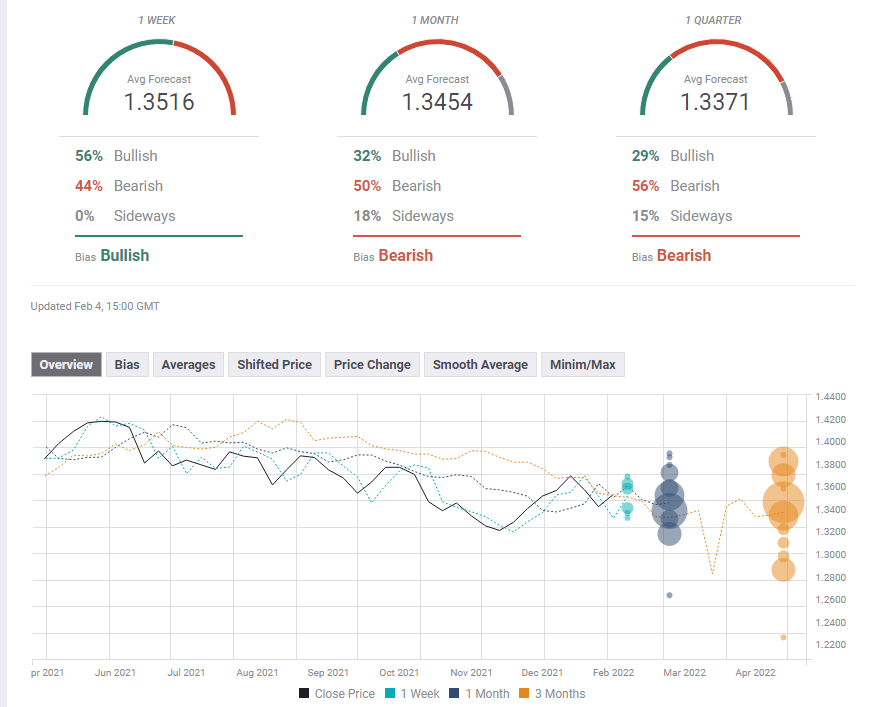

GBP/USD has gone too high for a hesitant BOE and will likely drop in response to robust US inflation data – serving as a reminder of the Fed's hawkish stance.

The FXStreet Forecast Poll is pointing to gradual declines. It seems that experts are unsure about the BOE's moves, and seem more confident with the Fed.

Related reads

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.