Silver futures rotate within H4 range as key pivot continues to guide price

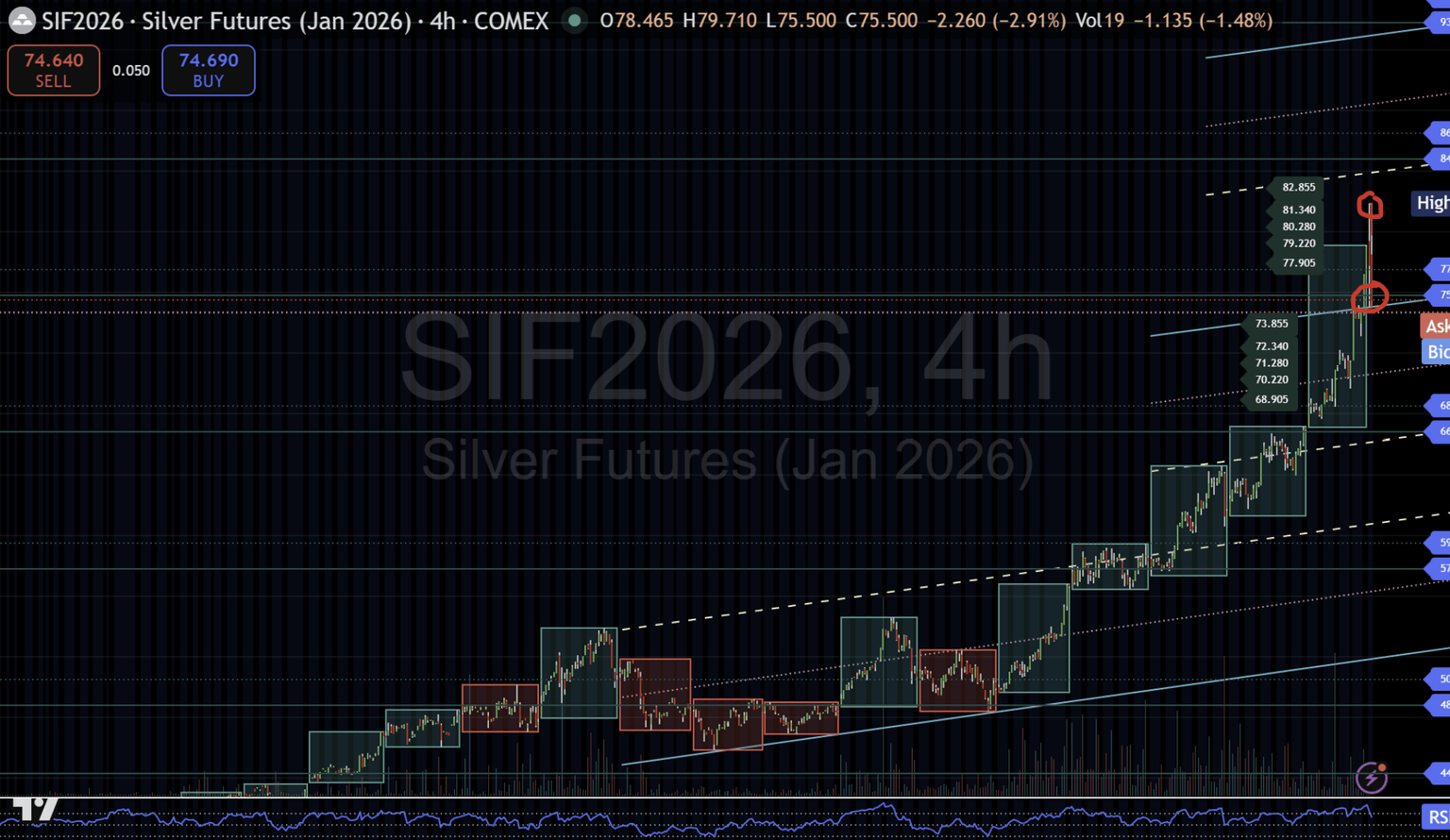

Following the December 29 report, silver has rotated between upper resistance and lower support, keeping the 75.78 pivot central to the current H4 structure.

Context

This desk update follows the December 29 H4 MacroStructure report, in which silver was transitioning from a multi-week expansion phase into a defined two-way structure. At the time, price was interacting with the 75.78 central pivot, with upper references layered through 77.90–82.00 and lower structure support defined between 73.85 and 68.90.

The focus of that report was on how price would respond around these predefined levels as momentum cooled following an extended advance.

What has changed since the December 29 report

Since publication, silver’s five-week winning streak has ended, with the final week of 2025 closing lower. Price initially slipped through the central pivot and rotated into the lower structure, testing the Micro 2 area around 70.22 on two occasions in a relatively short window.

Both attempts to rotate back toward the upper structure have stalled near the 75.78 pivot, reinforcing its role as the decision point in the current range. The most recent rejection from this level produced a sharp downside move, leaving a visible gap lower — a type of price behaviour not seen for some time in silver.

This suggests the pullback was driven by a sudden shift in positioning rather than a slow, orderly rotation.

Lower structure response

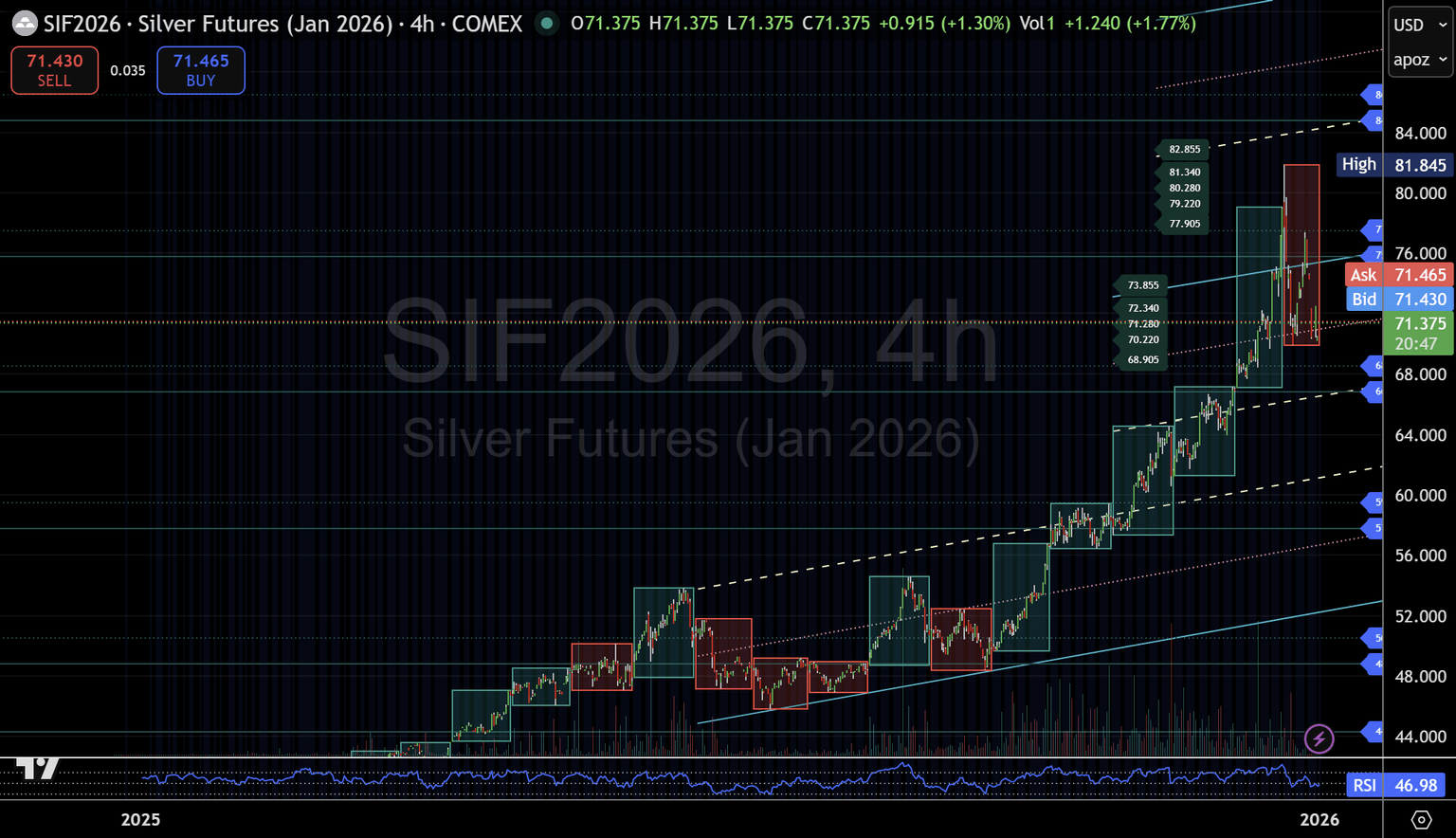

Despite the speed of the decline, price has now responded twice at the same support area, with reactions centred around Micro 2 (70.22). Repeated defence of this level points to active participation and confirms its relevance within the broader H4 structure.

At the time of writing, COMEX silver trades around 71.37, holding just above Micro 3 (71.28) and within the lower half of the established range.

Structure outlook (H4)

The broader H4 structure remains intact, provided price continues to hold above the 68.00–66.00 support band. A sustained break below 66.00 would represent a structural failure to the downside and shift the current framework.

On the upside, holding above Micro 2 (70.22) keeps the path open for further rotation back toward the 75.78 central pivot. Acceptance above this level would be required before the upper structure can come back into focus.

For now, silver remains in a clearly defined two-way phase, with price behaviour around the pivot continuing to dictate whether this consolidation resolves through rebuilding or renewed expansion.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.