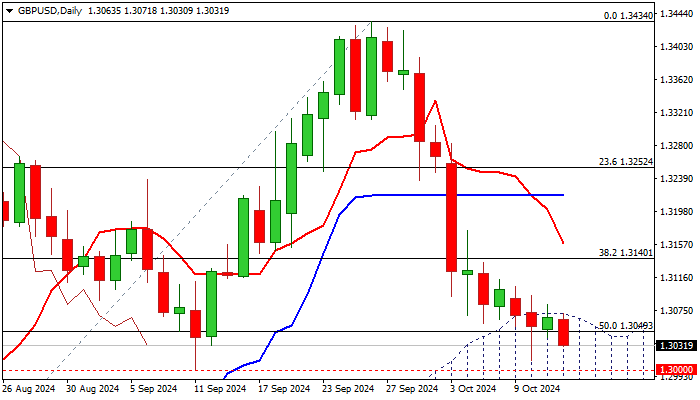

GBP/USD outlook: Bearish bias under daily cloud top

GBP/USD

Bears hold grip and keep the price within daily cloud for the third straight day, with cloud top acting as solid resistance and limits upticks.

Renewed probe through 1.3049 (50% retracement of 1.2664/1.3434) looks for eventual firm break here to signal bearish continuation for attack at psychological support at 1.30 (also Sep 11 higher low), which guards more significant levels at 1.2958 (Fibo 61.8%) and 1.2940 (daily cloud base).

Daily studies are weakening as negative momentum continues to strengthen and south heading daily Tenkan-sen diverges from Kijun-sen after formation of bear cross, however bears may face headwinds as stochastic emerged from oversold territory.

Near term bias is expected to remain with bears while the action stays capped by cloud top (1.3071).

Res: 1.3049; 1.3071; 1.3113; 1.3140.

Sup: 1.3000; 1.2958; 1.2945; 1.2870.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.