GBP/USD Forecast: Pound Sterling remains fragile

- GBP/USD has stretched lower following Monday's unsuccessful recovery attempt.

- BoE Governor Bailey will testify on policy on Tuesday.

- Cautious market mood could continue to support the US Dollar.

GBP/USD has lost its traction in the early European morning on Tuesday and touched its lowest level in a month, slightly below 1.2400. The pair's near-term technical outlook suggests that sellers retain control. Bank of England (BoE) Governor Andrew Bailey will testify on monetary policy before the UK Treasury Select Committee and investors will continue to pay close attention to risk sentiment.

Following Monday's face-to-face meeting, US President Joe Biden and House Speaker Kevin McCarthy failed to reach a deal to lift the government's $31.4 trillion debt limit, causing markets to remain cautious. Early Tuesday, US stock index futures trade mixed and a negative shift in market mood in the second half of the day could allow the US Dollar (USD) to preserve its strength.

While speaking at the post-policy meeting press conference, BoE Governor Bailey said that they had good reasons to expect inflation to fall sharply over the coming months, beginning in April. In a speech to the British Chamber of Commerce last week, Bailey noted that there were signs that the UK labour market was loosening a little.

In case Bailey sticks to an optimistic tone regarding the inflation outlook, Pound Sterling is likely to have a difficult time finding demand.

In the meantime, data from the UK showed that the S&P Global/CIPS Composite PMI declined to 53.9 in early May from 54.9 in April. This reading fell short of the market expectations of 54.6 and showed a loss of momentum in private sector's business activity growth.

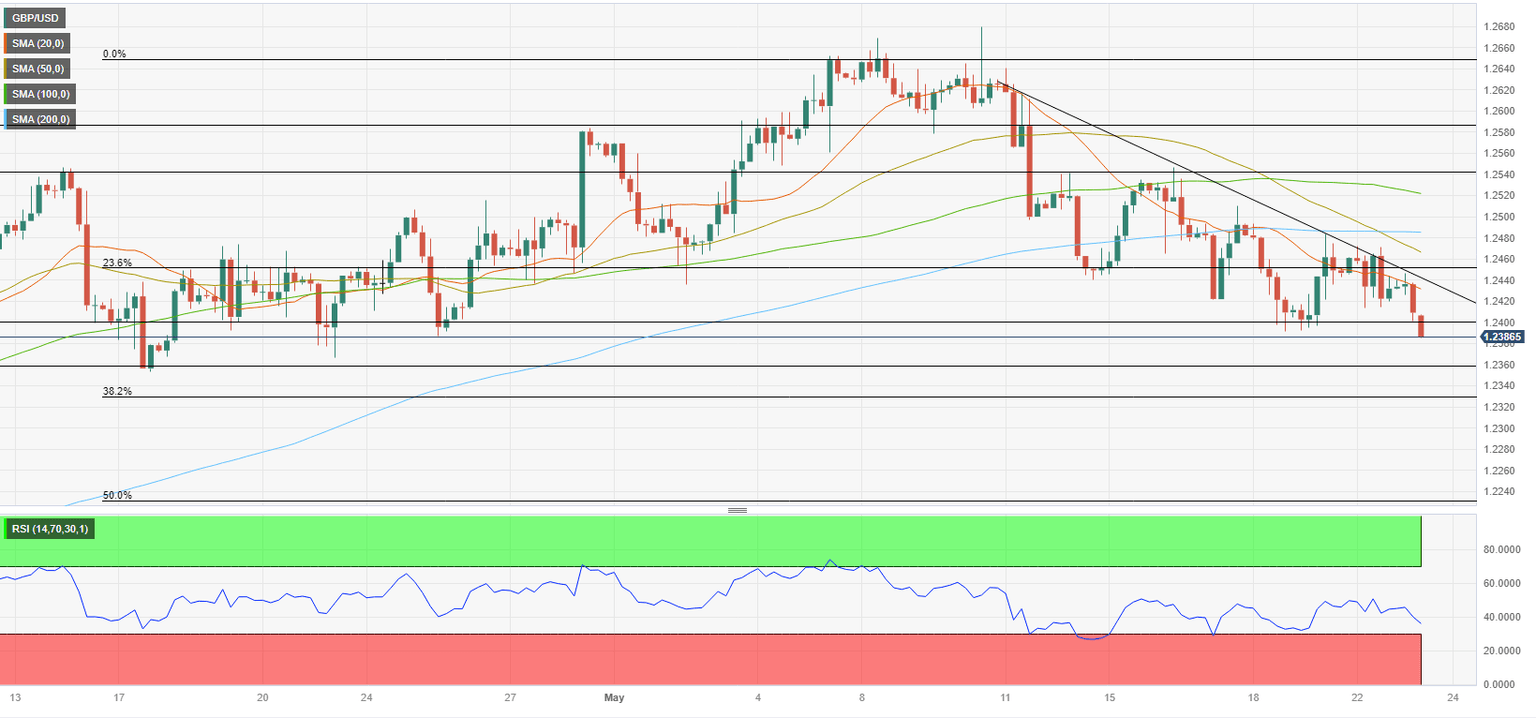

GBP/USD Technical Analysis

GBP/USD continues to trade below the descending trend line and the Relative Strength Index (RSI) indicator on the four-hour chart stays below 50, highlighting the lack of buyer interest.

On the downside, 1.2400 (static level, psychological level) aligns as initial support. With a four-hour close below that level, sellers could take action and drag GBP/USD lower toward 1.2360 (static level) and 1.2330 (Fibonacci 38.2% retracement of the latest uptrend).

If GBP/USD manages to stabilize above 1.2400, it is likely to face stiff resistance in the 1.2450/60 area (descending trend line, Fibonacci 23.6% retracement). Once the pair flips that area into support, buyers could show interest and open the door for an extended rebound toward 1.2490/1.2500 (200-period Simple Moving Average (SMA), psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.