GBP/USD Forecast: Can the UK's leadership advantage dethrone King Dollar? Coronavirus, Fed eyed

- GBP/USD has succumbed to US dollar strength as panic gripped markets.

- Further coronavirus headlines, and policy responses, including from the Fed, are on the cards.

- Mid-March's daily chart is pointing to further, yet limited falls.

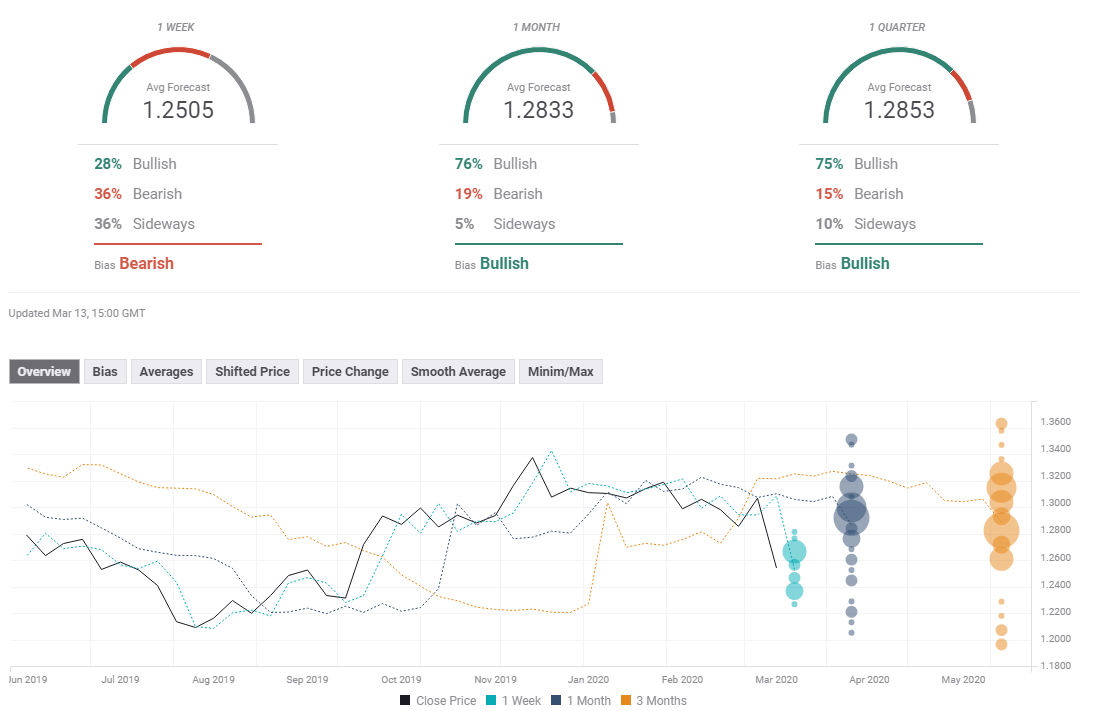

- The FX Poll is pointing to a surge in the medium and long terms.

Prime Minister Boris Johnson's coronavirus response is better than that of President Donald Trump – but that is insufficient as global investors rush to the safety of the dollar. The next moves depend on the virus news, policymakers' fiscal stimulus, and several data points.

This week in GBP/USD: Safe-haven dollar beats Boris' leadership

The UK has given an example to the world in its confrontation of coronavirus – a well-coordinated response from all involved. The Bank of England announced an unscheduled double-dose rate cut of 50 basis points – with both outgoing Governor Mark Carney and successor Andrew Bailey explaining the move.

A few hours later, Chancellor of the Exchequer Rishi Sunak presented a budget with funds towards battling the virus, relief for businesses and workers, and also a massive fiscal stimulus. The opposition Labour Party – whose policies the government partially copied – aligned behind the government.

Johnson later told the nation that many will lose loved ones, somber message preparing the public for the next steps.

On the other side of the pond, President Donald Trump failed to provide the needed measures to support the economy and to fight the disease, which he labeled a "foreign virus." While Democrats and Republicans worked on a plan, White House officials scrambled to clarify some of the details in the president's words.

Nevertheless, the massive sell-off in markets triggered a rush to the US dollar – with the greenback rising regardless of the sharp moves US yields. GBP/USD dropped with the market sell-off and extended its drop when it recovered, and returns on US debt advanced.

The Federal Reserve intervened twice in markets to provide liquidity, showing the severity of the situation. The Fed reignited Quantitative Easing by buying long-term bonds in addition to short-term ones.

Both governments refrained from imposing significant restrictions such as closing schools, unessential shops, and transport as Italy did and as other European countries are gradually following. Nevertheless, football matches are canceled in the UK, and the US NBA, MLB, and other leagues are suspended. Disney shut down its parks, and significant events are being called off. The economic damage – for two countries dependent on services sectors – is becoming severe.

The University of Michigan's preliminary Consumer Sentiment measure for March showed a drop of

UK events: Potential new UK restrictions, the jobs report

Will the UK close schools and impose other restrictions? Johnson is under pressure to jump forward, yet experts have been reluctant to recommend that. Nevertheless, the pace of events is rapid, and new instructions – that would significantly curb economic activity – may be slapped. It could have an adverse impact on the pound.

Andrew Bailey assumes office as Governor of the BOE, and he may hint at additional steps such as introducing more bond-buying – a step the bank refrained from so far – could also have an impact. If Bailey makes such an announcement without additional actions from the government, it could weigh on sterling. However, if it comes in tandem with more government spending, the pound has room to rise as more fiscal stimulus would be good news for the economy. Criticism about monetary funding would probably be reserved for another day.

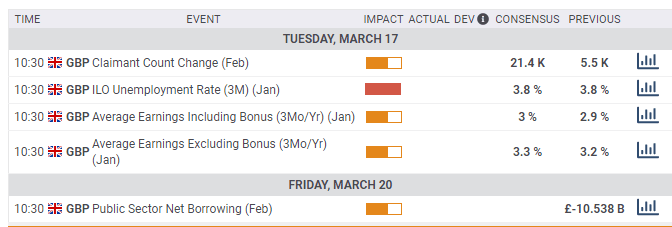

The only figure that stands out on the British economic calendar is the employment report for January. While it is stale – pre-coronavirus – the numbers provide insights for how the economy performed before the virus hit Britain's shores. The jobless rate is projected to remain at the historic low of 3.8% while wage growth is expected to edge up.

Here is the list of UK events from the FXStreet calendar:

US events: The Fed's second cut and coronavirus news

The US has been lagging in testing for coronavirus, and the number of cases is set to rise. If the mood severely sours, the greenback has room to climb on safe-haven flows. If things are relatively under control, the dollar may move with yields, as it did before the most recent market crash.

Investors will follow deliberations on Capitol Hill. If lawmakers manage to muster a majority for a considerable package, stocks have room to rise while failure could push them down. Outside Washington, things are moving at a faster clip. A succession of event cancelations, restrictions on travel – and a jump in infections – could move markets more than presidential decisions.

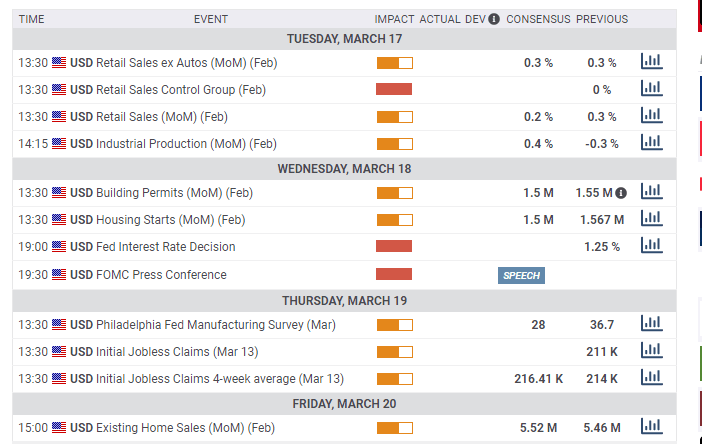

The Federal Reserve's rate decision stands out on the economic calendar. After the fed surprised with an unscheduled reduction of borrowing costs early in March, it may now double down and slash the remaining 100 basis points and bring the rates to zero. Given the recent injections of liquidity into markets, such a move would not be surprising. The focus is on what governments would do.

Nevertheless, Fed Chair Jerome Powell may shed more light on the new bond-buying schemes and on the bank's readiness to do more. A failure to cut rates could send markets tumbling, while massive money-printing can send stocks up and the dollar down.

Retail sales figures for February will likely show a moderate increase in spending. The release – which usually grabs investors' attention – is now seen as stale given the rapid pace of coronavirus developments.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar has been on the back foot, and the Relative Strength Index on the daily chart is just above 30 – currently outside oversold conditions, but only just. Another small downside move, and it would already indicate a correction.

Support awaits at 1.2405, 1.23, and 1.22 – all dating to October 2019.

Resistance is at 1.2495, 1.2625, 1.2720, and 1.2850, all stepping stones on the way down in March.

It is essential to note that volatility has significantly increased, making some of the technical lines obsolete. Nevertheless, these extraordinary times may pass.

GBP/USD Sentiment

The dollar has been king, but if Trump finally presents action to calm markets, the pound is one of the best-positioned currencies to rise.

The FX Poll is showing that experts see a moderately bearish sentiment in the short term and a rise afterward, with a potential rise above 1.28. While the average target tumbled for the upcoming week, it remained mostly unchanged for the medium and long terms.

Related Forecasts

-

Market crash, dollar surge, are only the beginning If leaders fail to act

-

Gold Price Forecast: Coronavirus, Oil War and King Dollar

-

EUR/USD Forecast: Bears taking over, but Fed in the way

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637197074045296197.png&w=1536&q=95)