GBP/USD Forecast: Brexit, Boris' political bruises leave little room for gains

- GBP/USD has been on the back amid the Cummings' scandal and the Brexit impasse.

- US data, Sino-American relations, and negative rates speculation are eyed.

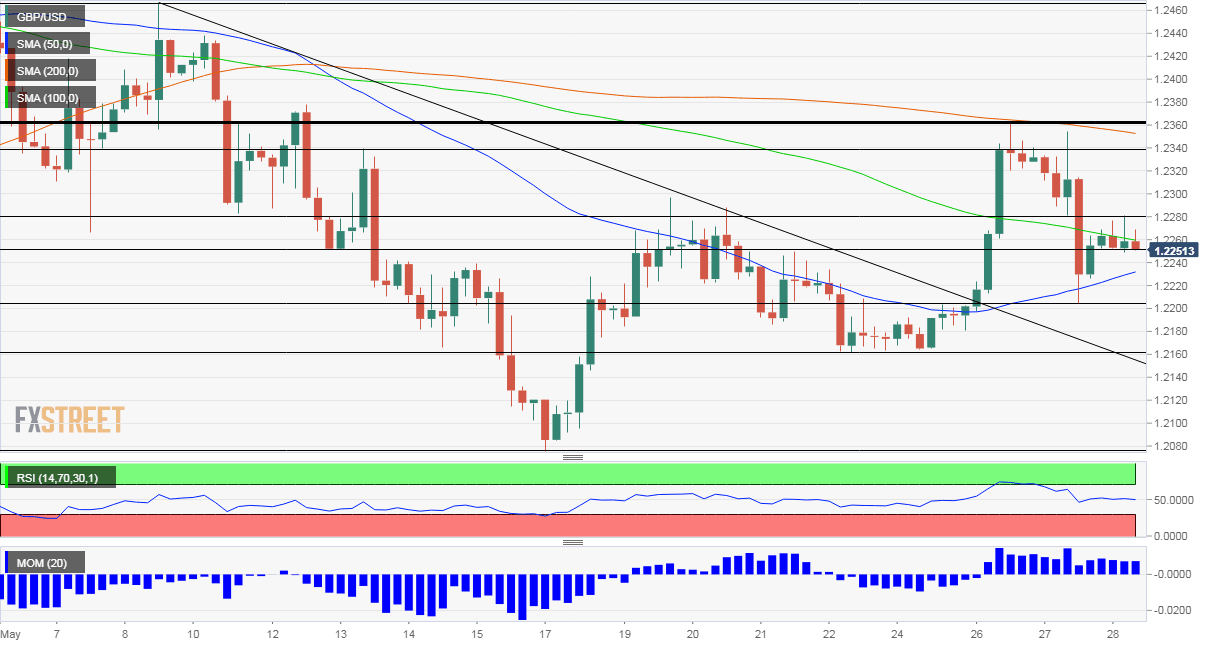

- Thursday's four-hour chart is painting a mixed picture.

Let us focus on coronavirus, not Cummings – the message from Prime Minister Boris Johnson to MPs quizzing him for his adviser's violation of the lockdown he contributing to planning. The Conservative Party and a majority in the British public want Dominic Cummings – the PM's powerful adviser – out.

The affair cannot be seen as yet another political scandal, as it affects the willingness of the people to cooperate with lockdown measures. Seeing one rule for the elite and another for all the rest may cause disobedience or lack of cooperation.

The UK is rolling out contact tracing schemes, critical for easing the lockdown. Elevated usage of coronavirus-related application is critical to a safe return to normal economic activity. Moreover, the PM's political weakness may weigh on managing the economy.

The second issue weighing on the pound is the neverending Brexit saga. Britain reiterated its refusal to prolong the transition period, raising the chances of trading at World Trade Organization terms in January. Talks with the EU have hit an impasse.

Andrew Bailey, Governor of the Bank of England, wrote an op-ed for the Guardian in which he kept the door open to setting negative interest rates. However, his tone showed that such a move is not imminent. That is somewhat supporting sterling.

The broader market moved is mixed. China's parliament approved the controversial law tightening its grip on Hong Kong. Protesters in the streets of the city sate and anger in Washington is limiting gains in equity markets and supporting the US dollar. America may strip the financial hub of its preferential tariffs.

However, investors are shrugging off Sino-American tensions – ranging from Xinjiang to Vancouver, where the CFO of Huawei faces extradition to the US. The reason for the lack of grave concern is that the world's largest economies want to keep the trade deal intact.

The focus will later shift to US data. Weekly jobless claims will be joined by the second read of Gross Domestic Product for the first quarter and likely confirm the fall of 4.8% in annualized output. Durable Goods Orders for April may have the greatest impact due to their recency and are forecast to show double-digit falls.

See:

- GDP Preview, First Revision: Economic archeology

- Durable Goods Orders Preview: If the automobile dealerships are closed, how do you buy a car?

- Initial Jobless Claims Preview: The action moves to continue claims

GBP/USD Technical Analysis

Pound/dollar has dropped below the 100 Simple Moving Average on the four-hour chart and also trades below the 200 SMA. However, it is holding above the 50 SMA and enjoys upside momentum.

Resistance awaits at 1.2275, the daily high, followed by 1.2335, a stepping stone on the way down in mid-May. The recent peak of 1.2360 is a strong cap.

Support awaits at 1.2205, Thursday's swing low, followed by 1.2160, the weekly trough. Further down, 1.2080 awaits sterling.

More: Separating economic fact and fiction – A market discussion with Ed Moya

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.