GBP/USD at peak levels: Attention shifts to the Bank of England

GBP/USD remains near its August 2021 highs, holding around 1.3834 on Thursday, as heightened volatility in the US dollar continues to weigh on the pair.

Market participants are reacting to US Treasury Secretary Scott Bessent's comments, stating that Washington has no plans to intervene in currency markets by selling dollars against the yen. This statement has added to the prevailing sentiment of a "sell America" strategy, which is putting downward pressure on the dollar.

With the US Federal Reserve expected to keep interest rates unchanged, market focus has shifted towards the Bank of England. The consensus is that the BoE will maintain its key rate at 3.75% at next week's meeting. This expectation is supported by rising inflation, which hit 3.4% in December, alongside recent retail sales data showing increased price pressures.

Technical analysis

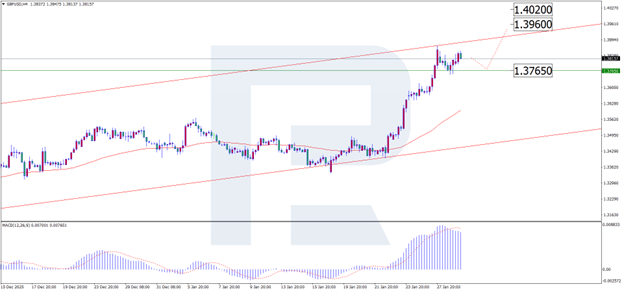

On the H4 chart, GBP/USD is currently undergoing a correction from the 1.3845 level. The market may continue this pullback to support at 1.3765, before potentially bouncing higher. The first target for any upward movement would be resistance at 1.3960, followed by 1.4020. This scenario is confirmed by the MACD indicator, which shows a downward trend but remains above the zero level.

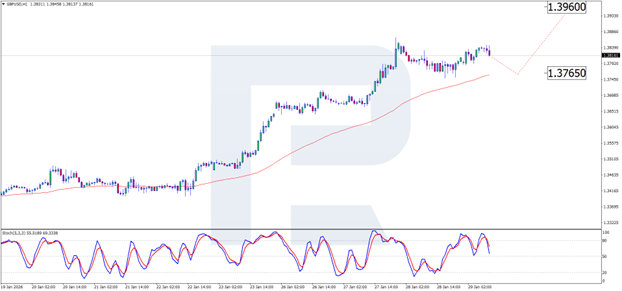

On the H1 chart, the correction from 1.3845 continues, with the next support target around 1.3765. A rebound from this level could drive prices higher, supporting further upward momentum. This is confirmed by the Stochastic oscillator, which shows a decline but remains below the 80.0 mark.

Conclusion

GBP/USD remains strong at its recent highs, and attention is now turning to the upcoming BoE decision. While the pair is currently in a correction phase, the outlook for further growth remains positive, depending on the Bank of England's response to inflation pressures.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.