Gold maintains strength above $5,500 despite hawkish Fed signals

Gold’s historic run has extended beyond $5,600, with prices now holding firm above $5,500. Despite renewed Dollar strength and steady Fed policy, the metal continues to show strong momentum. Powell’s upbeat tone on the economy lifted the Dollar, briefly capping gold’s upside. However, persistent geopolitical risks and weakening confidence in fiat assets continue to support demand.

Gold holds firm above $5,500 despite Fed pause and stronger Dollar

Gold is holding firm above $5,500 after briefly testing the $5,600 level, maintaining strong momentum despite near-term Dollar strength. The metal’s upward drive remains intact even after the Federal Reserve held rates steady in its latest policy decision. The Fed’s steady tone kept markets calm, allowing gold to preserve its bullish momentum. However, Chair Jerome Powell’s confident remarks on labor market strength and solid economic performance gave the U.S. Dollar a lift, introducing a short-term headwind for the metal.

Meanwhile, U.S. Treasury Secretary Scott Bessent emphasized the administration’s commitment to a strong Dollar policy. His comments, particularly regarding Japan, made clear that the U.S. is not considering intervention in currency markets. This message helped the Dollar recover modestly and briefly capped further gains in gold. Even so, with global tensions rising and confidence in fiat assets weakening, demand for gold as a safe-haven remains firmly in place.

At the same time, strong corporate earnings provided a momentary lift to market sentiment. Positive earnings from major U.S. tech companies offered temporary support to broader confidence. Solid results from firms like Meta, Tesla, and Microsoft fueled equity markets and briefly reduced demand for defensive assets like gold. However, key concerns around U.S. fiscal direction, central bank independence, and geopolitical instability remain unresolved. These unresolved risks keep the backdrop supportive for gold, even during brief pullbacks.

Gold breaks above channel resistance, signals new phase of bullish momentum

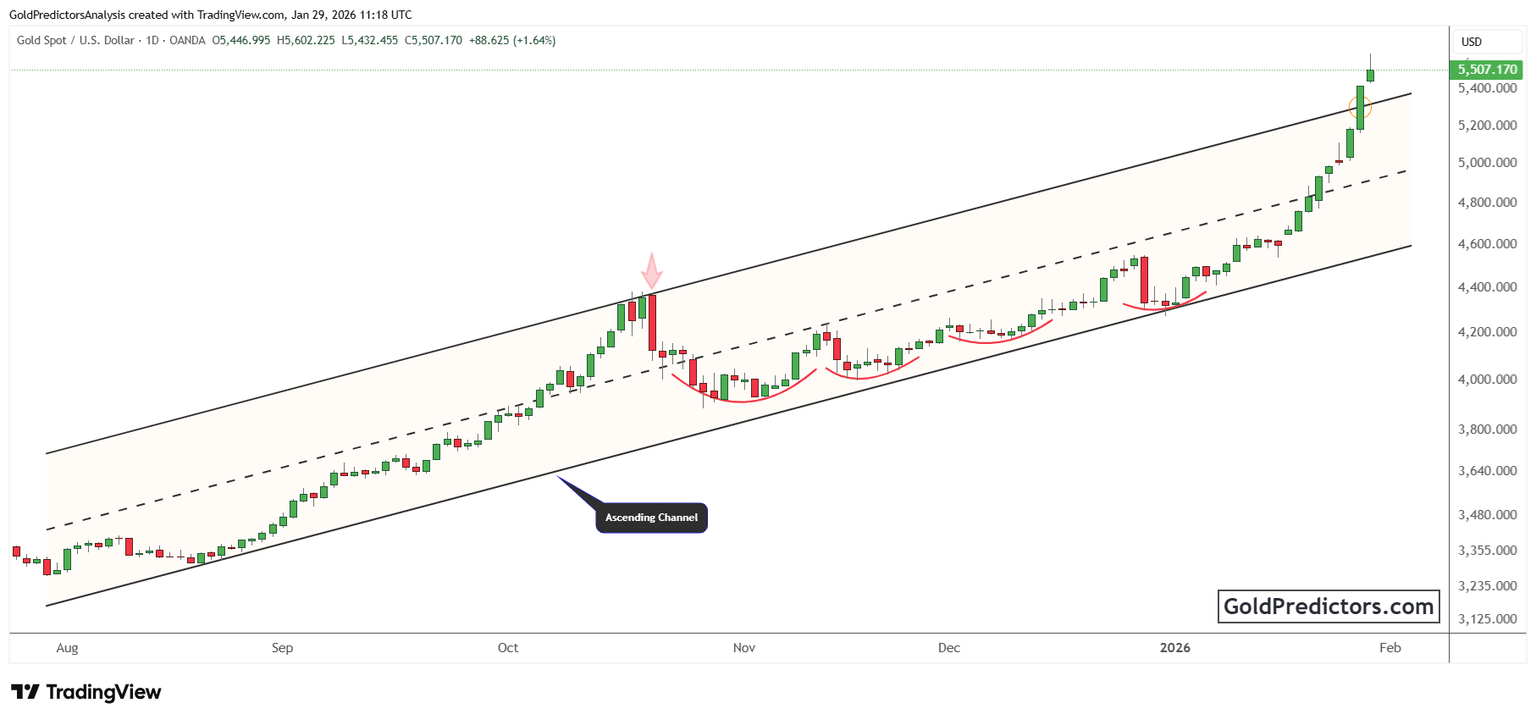

The gold chart below shows a decisive breakout from a long-standing ascending channel, signaling a major shift in bullish momentum. After months of steady progress within the channel, gold surged above the upper boundary with strong follow-through. The breakout occurred near the $5,200 level and triggered a powerful rally that pushed prices toward $5,600. The clean break above resistance marks a shift into faster upside momentum, backed by technical strength and supportive macro forces.

As the trend unfolded, gold formed a series of rounded consolidations that helped strengthen the broader structure. Earlier price action within the channel created several cup-like formations, especially during November and December. These acted as accumulation zones and provided a solid base for continued gains. Each pattern was followed by a steady advance, gradually lifting the midpoint of the channel. This consistent behavior supported bullish sentiment and confirmed the reliability of the channel formation.

With gold now trading above the upper trendline, the previous resistance zone may turn into support. This shift could establish a higher base, keeping price action anchored above the $5,200 level. The latest candle shows mild rejection near the highs, indicating a possible short-term pause. Still, the broader breakout remains intact, and the upward path is likely to continue as long as macro conditions align with technical support.

Gold outlook: Breakout remains intact despite Dollar rebound and Fed pause

Gold remains firmly supported above $5,500, even as the Dollar regains strength and Fed policy holds steady. The breakout above long-term resistance confirms strong underlying momentum. While Powell’s optimism and strong earnings briefly capped gains, unresolved geopolitical tensions and declining trust in fiat currencies continue to drive safe-haven demand. Technical structure also remains bullish, with the breakout zone now acting as solid support. As long as macro risks persist and gold holds this higher base, the metal is well-positioned for further upside.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.