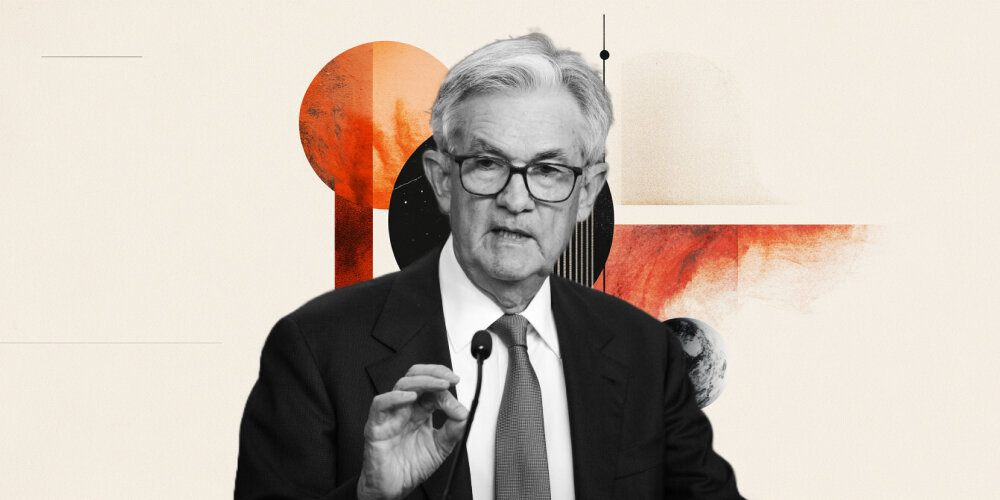

No more Powell cut

The widely anticipated Fed decision to hold rates unchanged means that December 2025 was the final rate cut under the Fed chairmanship of Jerome Powell. He has two FOMC meetings left to chair (March and May with no meeting shcheduled for April). Most notable about yesterday is that the FOMC statement was less dovish than Powell's press conference. The evidence lies in the 10-15 mins charts, showing EURUSD and gold dropping a bit after the FOMC statement, which noted improvements in growth and employment. Once Powell struck a dovish tone in his press conference, gold stabilized, and took off rapidly after Powell wrapped it up.

The other point helping metals was the lack of any substantial comments from US Treasury Secretary Bessent about supporting the US dollar. The fact that there was no explicit remarks favouring the USD strenbth, extended the status quo. Saying the US did not interevene in capping USDJPY was not enough.

Author

Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is an independent global markets strategist with over 15 years' experience. He is author of "Currency Trading & Intermarket Analysis", and founder of AshrafLaidi.com.