Forex majors sluggish despite Trump signalling traction in phase one [Video]

![Forex majors sluggish despite Trump signalling traction in phase one [Video]](https://editorial.fxstreet.com/images/Macroeconomics/Countries/America/UnitedStatesofAmerica/Trump1_XtraLarge.jpg)

Market Overview

As we come towards the end of 2019, it seems that there is a positive bias to the macro picture that has been dominating market sentiment throughout the year. Donald Trump supposedly had a “very good talk” with President Xi of China and that a formal signing of a trade deal (phase one) would be signed “very shortly”. Perhaps in a sign of fatigue, markets have reacted with a shrug of the shoulders. We have been here before, and there is always the potential for a “buy on rumour, sell on fact” reaction. However, this should only be a short term response, as confirmed positive traction and a floor under the trade tensions will set markets on a far more constructive path for risk appetite in 2020. What is curious is that the opposite of what might have been expected is reflected in price moves this morning. Gold is breaking out to six week highs, Treasury yields are lower and equities are struggling. It is Christmas week, so liquidity will be lower, and this can create some erratic moves, however this is still somewhat counter-intuitive. The dollar is weaker slightly and this could help to explain some of the move in gold.

Wall Street closed at all-time highs once more on Friday, with the S&P 500 +0.5% at 3221. US futures are all but flat, with Asian markets mixed. The Nikkei was flat but the Shanghai Composite fell -1.4%. European indices are shading lower in early moves, with the FTSE futures -0.2% and DAX futures -0.1%. In forex, there is limited direction early today, although there is a mild USD negative bias across major currency pairs. In commodities, the precious metals are making the moves, with silver over 1% higher and gold up $6 (+0.4%). Oil is a shade lower after a strong run of recent gains.

There is one interesting US data point to keep an eye out for on the economic calendar today. US New Home Sales are at 1500GMT and are expected to improve marginally by +0.3% in November to 735,000 (from 733,000 in October).

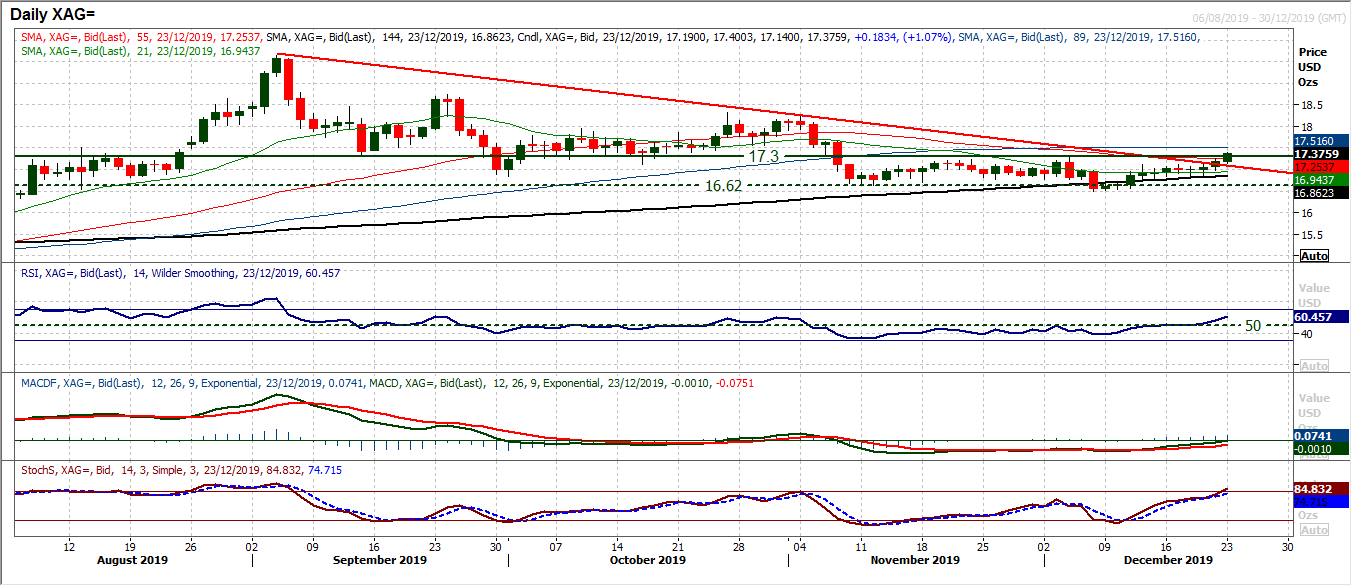

Chart of the Day – Silver

In the desperate search for direction (any direction) on precious metals, silver could be the one to give an early signal. Gold remains stuck under resistance, but there was an interesting move on silver in Friday’s session that has continued early today. A positive candle on Friday saw a close above $17.12 for a two week high. In isolation this may not sound like much, but it included a breach of a 15 week downtrend, and also finally signs of traction in the RSI. The main caveat is that silver gave a false signal two weeks (a false downside break). However, unlike now, momentum indicators were not confirming that time. This time, the RSI has broken out at a six week high along with Stochastics moving into bullish configuration. The key test for a silver recovery would be a closing breakout above $17.30. This is being eyed today. Momentum is suggesting the buyers are beginning to get more confident. Closing above $17.30 opens $18.23. The hourly chart shows a buy zone now $17.00/$17.12. Last week’s higher low at $16.84 (above $16.50) is now a higher low and supportive.

WTI Oil

After a decent run of successive positive candles, the bulls have finally run out of steam and the retracement is kicking in. This is still an uptrend channel and still a market to buy into weakness. So, given the low liquidity (could induce some erratic trading this week) there could be some opportunities. We see good support around breakouts between $57.85/$58.65 which have formed a good band of support. The bottom of the channel rises up between $56.70/$57.00 this week. The RSI unwinding back towards 45/50 has been a good opportunity too. Resistance is at $61.50 initially now and around the top of the channel (which is now at $61.50 today).

Dow Jones Industrial Average

Moving into late 2019 the Dow continues to break new high ground. However, the latest candlestick poses a few questions for the bulls. Having gapped sharply higher at the open, the market pulled back over -150 ticks to close around the day low. A solid negative candle suggests the bulls come into a very low volume/low liquidity week with questionable near term control. The gap is open at 28,381 and it will be interesting to see how it gets filled. Momentum has been strong recently, so we would be confident that a near term correction would still be a chance to buy. The support band 28,035/28,175 is still a good area for the bulls, whilst above 27,800 there is still bull control. Initial resistance now the all-time high at 28,608.

Other assets insights

EUR/USD Analysis: read now

GBPUSD Analysis: read now

USD/JPY Analysis: read now

GOLD Analysis: read now

Author

Richard Perry

Independent Analyst