Gold tested the resistance around $1480 every day last week [Video]

![Gold tested the resistance around $1480 every day last week [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-bars-50657756_XtraLarge.jpg)

Gold

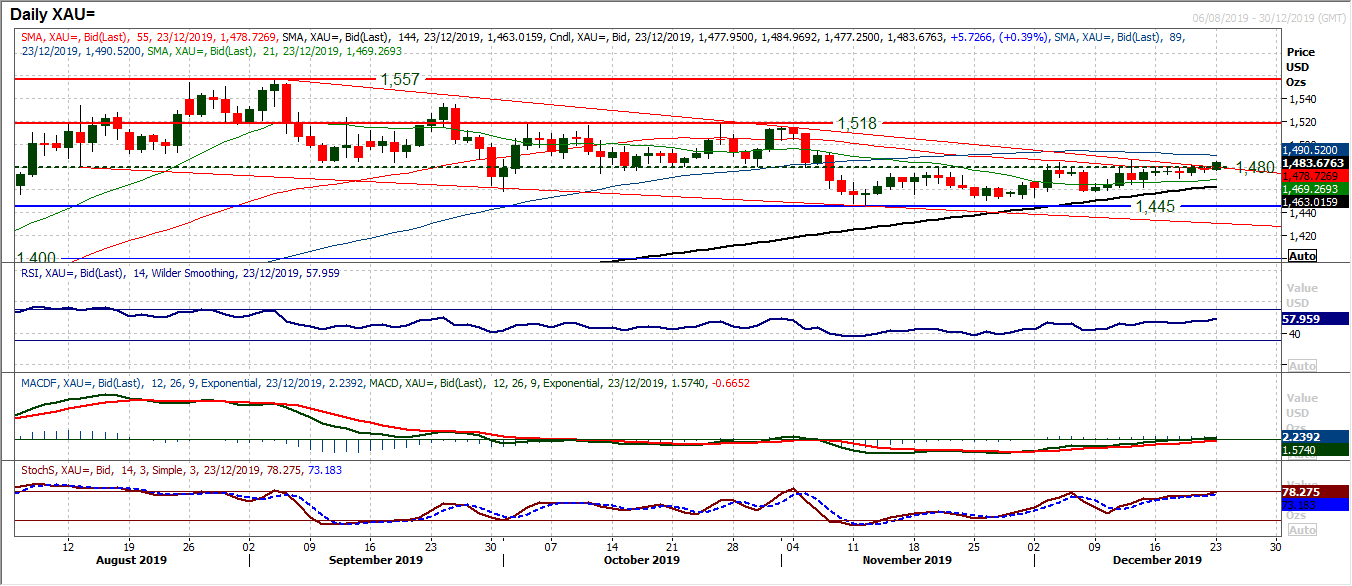

Gold tested the resistance around $1480 every day last week, only for the overhead supply (of trading throughout August to October) to restrict upside. However, as we have seen silver breaking out above its equivalent resistance, gold is now looking to follow suite. Is this the moment that gold pulls higher through the crossroads? Today’s early move above $1480 is encouraging, but it needs a closing break above $1487 to really break the shackles. Time and again, intraday moves above $1480 have faltered into the close. Having been stuck in the low 50s last week, momentum indicators are beginning to look more positive. The RSI needs to close in the 60s to really suggest traction, and MACD lines decisively above neutral. A close above $1487 would effectively be a breakout and confirm the end of a range (from around $1445/$1480). It would open the psychological $1500 level again, with the prospect of a move back towards the $1518 key resistance. Gold could be finally finding direction, but a closing breakout is all important.

Author

Richard Perry

Independent Analyst