FOMC Minutes Preview: The complicated task of searching for clues

- The Federal Reserve will release the minutes of the FOMC meeting held on May 2-3.

- Fed members diverge on short-term rate outlook, but none anticipate rate cuts in 2023.

- The US Dollar Index is staging a recovery, which could continue if FOMC minutes reveal a firm tightening bias.

The US Federal Reserve (Fed) will release the minutes of the Federal Open Market Committee’s (FOMC) May 2 - 3 policy meeting at 18:00 GMT, on Wednesday, May 24. They will provide valuable insights into the Fed's monetary policy outlook and the potential for further rate hikes in the near term. Traders and investors will be closely monitoring the minutes for any hints on the Fed's stance on inflation, economic growth, and interest rates, which could impact the financial markets.

At the May meeting, the FOMC decided to raise the federal funds rate by 25 basis points to the range of 5.00% - 5.25%, in line with market expectations. This move has resulted in a total increase of 500 basis points since March 2022. In its statement, the central bank removed the reference "anticipates" additional policy tightening, opening the door to a potential pause at the next meeting on June 13-14.

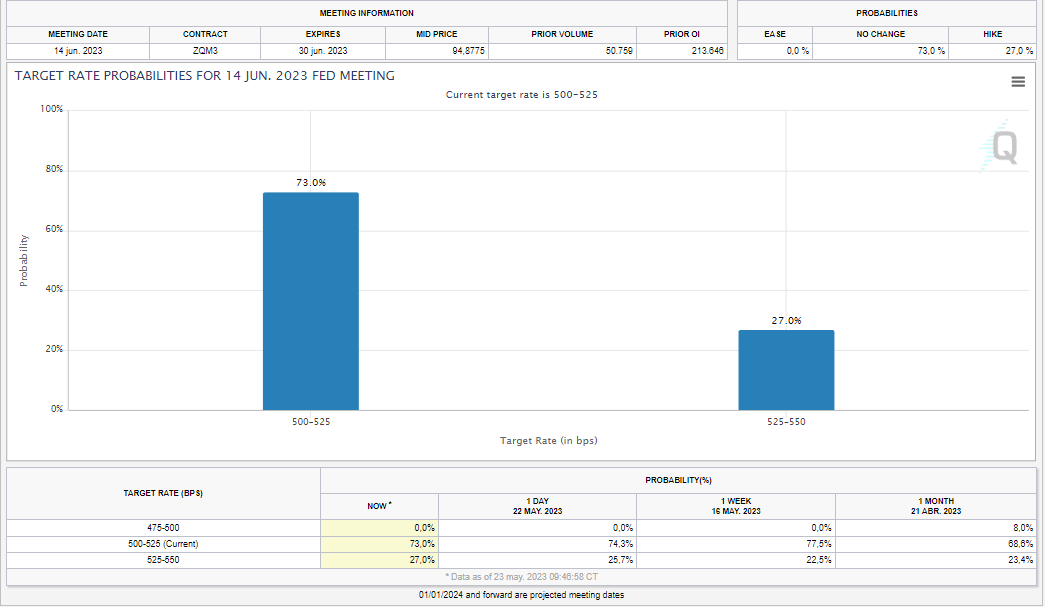

Market participants will scrutinize the minutes for clues about the central bank's next move at the upcoming June meeting. Although the odds of a rate hike have increased in response to the latest round of economic data, they remain small, and the expectation is for a pause.

Source: CME FedWatch Tool

The May meeting offered signals of a "hawkish pause" ahead. If the minutes confirm that tone, the market reaction should be limited. While comments about rate cuts by year-end are not expected, if present, they could trigger a sell-off in the US Dollar. The focus is on the Fed's view of the current rate in relation to the peak and whether, along with the tightening in credit standards resulting from the banking crisis, the rate is restrictive enough to bring inflation back to 2%.

Old news?

Since the May meeting, US economic data has shown a resilient economy, with mixed signals, but no sign of the recession that many had warned about. Despite this, the bond market continues to anticipate a deterioration in activity during the second half of the year and has priced in rate cuts from the Federal Reserve. However, the Fed members have repeatedly stated that they do not see rate cuts ahead, and they differ on the economic outlook.

The divergence between market expectations and the Fed has diminished somewhat during the last few days, which explains the rebound in US yields and the value of the US Dollar. This occurred even as Chair Jerome Powell suggested that he was open to holding rates unchanged, mentioning that the banking stress could mean that rates may not need to rise as high as otherwise. The divergence appears to be growing among the FOMC members, as some, like Kashkari, suggested they could support a pause, while others, like Bullard, explicitly said they have to move rates further higher.

Old or new, the FOMC minutes will be scrutinized as the June 13-14 meeting is looking increasingly likely to be a close call between a 25 basis point rate hike and no hike. Furthermore, the forward guidance and how it will be communicated will be critical. Any detail could have significant but short-lived implications.

Ahead of the next Fed meeting, several economic data releases will be important. On Friday, the US Core Personal Consumption Expenditure Price Index, which is the Fed's preferred inflation indicator, will be released. This will be followed by the May official employment report (June 2), and on the day the meeting commences, May's Consumer Price Index (CPI) will also be released (June 13).

US Dollar Index: Rising from essential support

The US Dollar Index is currently showing an upside bias after holding above the crucial support level of 101.00. The recent rally has faced resistance around the 103.50 area, and the DXY needs to break clearly above this level to pave the way for further gains. The bullish bias will remain in place as long as the index stays above 102.80. However, a drop under 102.20 would expose the critical support area of 101.00 once again.

The rise in US yields has been a significant factor behind the US Dollar Index's recent upward movement. The upcoming release could further boost Dollar's strength, especially if they provide an upbeat perspective. However, if the FOMC minutes fail to do so and the outlook is pessimistic, yields could drop, posing a challenge to the current bullish outlook.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.

-638204547663336318.png&w=1536&q=95)