Finally, Something to get Excited about in the Eurozone!

Although much of the data has been worse than expected out of the Eurozone for the last month, German ZEW Economic Sentiment for October was released earlier today, and it came out better than expected at -22.8 vs -27.0 expected and -22.5 last. In addition, the Current Conditions number for October was -25.3 vs -26.0 expected and -19.9 last. The German ZEW is a six-month economic sentiment index gauged by institutional investors and analysts.

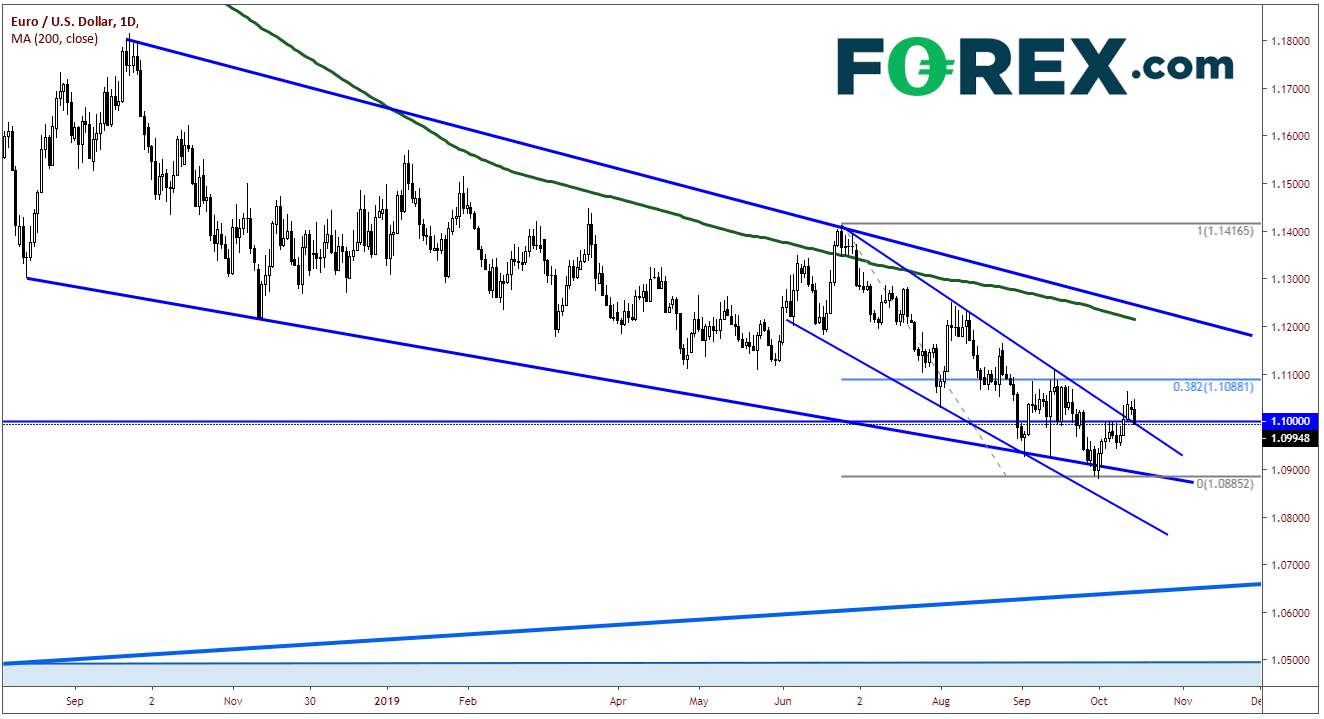

On a daily timeframe, the EUR/USD has been trading in a falling wedge since September 2018. Since June of this year, the pair has been trading in a descending channel (within the descending wedge) and broke out to the topside on October 9th. EUR/USD is currently pulling back and testing the top trendline of the falling channel as well as the important 1.1000 horizontal support and psychological level.

Source: Tradingview, FOREX.com

On a 240-minute timeframe, we can closely see that, not only are we testing the downward sloping trendline, but also the 38.2% retracement from the low on October 1st to the high on October 11th. In addition, price is testing the 50-period moving average right at that 1.1000 level.

Source: Tradingview, FOREX.com

First support on the downside is at the 50% retracement of the previously mentioned timeframe at 1.0970. Below there we can once again test the wedge lows near 1.0900 and the lows from October 1st at 1.0890. First resistance is at October 11th highs at 1.1061, and then the 38.2% retracement level from the June 24th highs to the October 1st lows at 1.0881.

Brexit headlines may affect the value of the Euro, while US-China trade deal headlines may affect the US Dollar. Both could act as catalysts for a move of EUR/USD in either direction.

Author

Forex.com Team

Forex.com