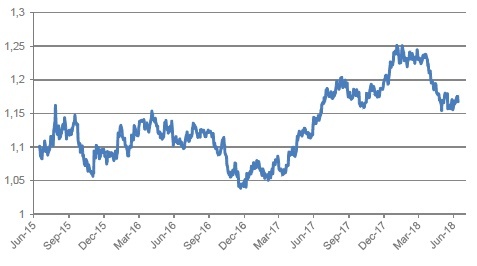

EURUSD's key support near 1.1550

Currencies

Nor a soft ECB nor outright dollar strength (caused by emerging markets nervousness) was able to break EUR/USD's key support near 1.1550. Continued dollar strength limits the upside room for now.

EUR/GBP

EUR/GBP's test of the upper band of the 0.87/0.885 consolidation pattern, failed. However, poor Brexit progress and the (internal and external) bickering May's Brexitstrategy undoubtedly will cause, remain a drag for sterling.

Revived dollar strength and a generally improved – but fragile – risk sentiment pushes USD/JPY further north from the 110‐area.

EUR/CZK

The CNB's rate hike offered little to no support for CZK. Continued weakness compared to the CNB's forecasts suggests more rate hikes will be coming sooner than anticipated earlier.

EUR/HUF

EUR/HUF trended further north, leaving the 305‐315 trading range. The forint lost ground following Orban's new election victory and during the emerging market turmoil. The NBH changed its forward guidance, the first step towards policy normalisation.

EUR/PLN

The zloty took a hit as the dollar firmed on the back of many emerging market currencies. Furthermore, the NBP has no intention at all to normalize policy any time soon as it made clear in its last June‐meeting.

Author

KBC Market Research Desk

KBC Bank