EURUSD Weekly Forecast: Bulls in charge amid Federal Reserve's imminent pivot

- United States inflation finally started receding in October, spurring risk appetite.

- Market participants could now turn their eyes to Eurozone growth data.

- EURUSD bullish momentum is set to extend well into the next week.

The EURUSD pair soared to 1.0323 on Friday, its highest since early August, to end the week not far below. The US Dollar started the week on the back foot, as an encouraging Nonfarm Payrolls report (NFP) from the previous Friday lifted the market’s mood, and investors tepidly bet on a potential Federal Reserve (Fed) pivot. Throughout the first half of the week, the greenback remained under pressure, but speculative interest was extremely cautious ahead of the release of first-tier data.

US Consumer Price Index hints at a Fed pivot

The United States (US) unveiled the October Consumer Price Index (CPI) on Thursday, and the figures shocked financial markets. CPI grew at an annualized pace of 7.7%, well below the previous 8.2% and the expected 8%. Core inflation, excluding volatile food and energy prices, came down to 6.3% YoY. Signs that inflation receded, after reaching a multi-year peak of 9.1% in June this year, spurred risk-on flows, as odds for a 50 bps rate hike are now at 85.4% according to the CME Group FedWatch Tool.

The US Dollar collapsed as stock markets soared, with the Dow Jones Industrial Average adding a whopping 1,201 points on Thursday. The S&P500 and the Nasdaq were up over 5% each, extending their rallies into Friday and further weighing on the USD. EURUSD jumped above 1.0100 as an immediate reaction to the news, extending the positive momentum ahead of the weekly close amid persistent strength in equities.

Mixed news for the Euro

Whatever happened in Europe was ignored by market players. However, it is worth noting that the Eurozone Retail Sales were up by 0.4% MoM in September, declining 0.6% from a year earlier, better than anticipated. Additionally, Germany published the final estimate of the October CPI inflation, which was confirmed at 10.4% YoY.

The Euro benefited from the good mood triggered by relief news, extending its rally on Friday towards the aforementioned multi-month high. EUR bulls also welcomed market talks suggesting Russia could start peace negotiations with Ukraine after Moscow abandoned the city of Kherson, seen as a major retreat.

EURUSD’s Thursday rally made a bit more sense than Friday’s continuation. However, it could be explained by previously overcrowded Dollar longs and the unwind of long-term positions. The market is clearly not done pricing in a Fed pivot, and it would be interesting to see at which level that would occur.

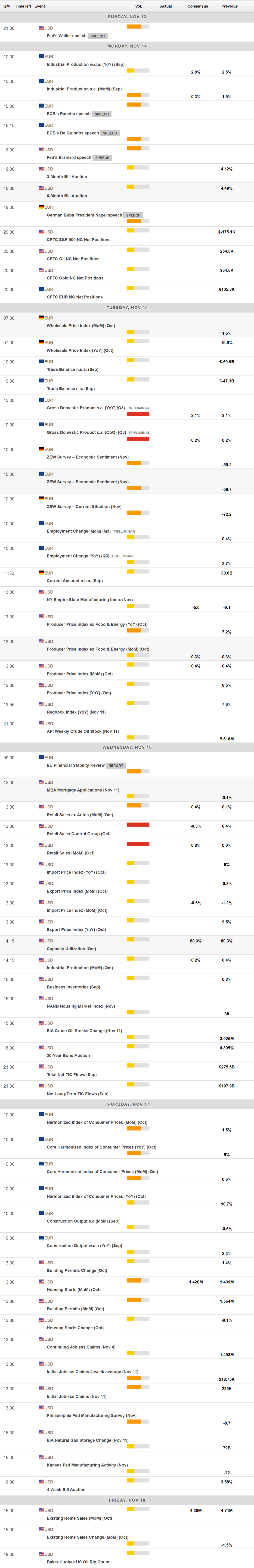

Next week will bring some interesting figures. The Eurozone will release the preliminary estimate of the Q3 Gross Domestic Product (GDP) expected to post a quarterly growth of 0.2%. Other than that, the US will publish October Retail Sales, while Germany will unveil the November ZEW survey.

EURUSD technical outlook

The EURUSD pair added over 400 pips in the week, turning bullish in the weekly chart for the first time this year. The V-shaped recovery hints at a potential interim bottom at 0.9535, while it anticipates a mid-term upward continuation. Technical indicators in the mentioned time frame head north vertically and have crossed their midlines into positive territory, supporting a continued advance. At the same time, the pair is trading above its 20 SMA for the first time since March.

The daily chart shows that technical indicators maintain firmly bullish slopes near overbought levels without signs of upward exhaustion. At the same time, the pair established well above its 20 and 100 SMAs, with the shorter one accelerating north below the longer one. The 200 SMA provides an ultimate dynamic resistance level, currently at around 1.0440.

Former monthly highs in the 1.0180/90 are now critical. The risk will remain skewed to the upside if the pair holds above such a price zone. Beyond 1.0365, the immediate resistance level, the rally can continue towards the 1.0440 price zone. Support could be found at 1.0250 and 1.0190, followed by the 1.0100 price zone.

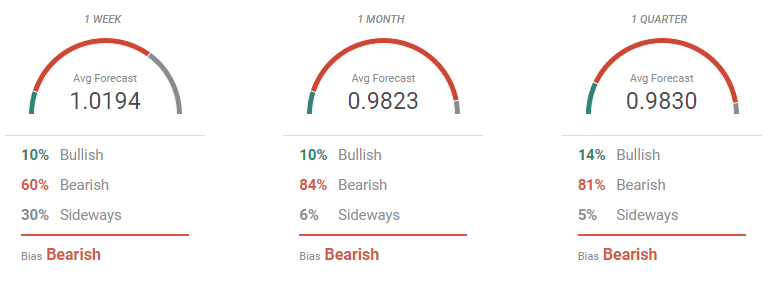

EURUSD sentiment poll

The FXStreet Forecast Poll shows that experts have been swamped by circumstances. The EURUSD pair is foreseen on average below the current level, as the latest US CPI left banks’ forecast kilter.

The tie change, however, is clear in the Overview chart, as moving averages have turned sharply higher. Updated analysts forecast seen the pair recovering towards the 1.0500 region in the monthly perspective and more betting for even higher levels in the longer view.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.