EUR/USD bounces back after strong German Retail Sales data

US stock futures started the month on a positive note as investors price in robust economic recovery and strong corporate earnings. The Dow Jones rose by more than 150 points while the S&P 500 and Nasdaq 100 indices rose by more than 0.65%. According to FactSet, 59% of all companies in the S&P 500 have already published their Q2 earnings. Of these firms, 88% have reported a positive revenue surprise while the blended earnings growth rate was 85.1%. This was the fastest growth since 2009. Other firms that will publish their quarterly results this week are Square, Leggett & Platt, Vordano Realty Trust, Take-Two Interactive and NXP Semiconductor among others.

The USDCHF pair tilted lower after the relatively mixed data from Switzerland. According to the Switzerland statistics agency, the country’s headline consumer price index (CPI) declined from 0.1% in June to -0.1% in July. This was in line with the median estimates. The CPI rose from 0.6% to 0.7% on a year-on-year basis. Meanwhile, further data showed that the country’s manufacturing PMI rose from 60.4 in June to 71.1 in July. This was the highest reading ever recorded. It is a sign that the country’s economy is rebounding substantially as the vaccination process intensifies.

The EURUSD pair tilted upwards after the relatively strong economic data from Europe. According to the German statistics agency, the headline retail sales declined from 4.6% to 4.2%. This was a better performance than the median estimate of 2.0%. The sales rose by 6.2% on a year-on-year basis. It was better than the estimated decline of 2.2%. Further data revealed that the Eurozone manufacturing PMI declined to 62.8 in July. This was a better number than the expected 62.6. The German PMI rose to 65.9 from the previous 65.6. These numbers show that the bloc’s economy is doing relatively well.

EUR/USD

The EURUSD rose to a high of 1.1895, which was relatively higher than the intraday low of 1.1850. On the four-hour chart, the pair remains above the upper side of the descending wedge pattern. It is also slightly above the 25-day and 15-day moving averages while the Relative Strength Index (RSI) has been in an upward trend. Therefore, the pair will likely keep rising as bulls target the resistance at 1.200.

USD/CHF

The USDCHF pair declined to a low of 0.9050, which was the lowest level since June 15. On the four-hour chart, the pair moved below the 61.8% Fibonacci retracement level. It has also moved below the 25-day moving average. It is also slightly above the lower line of the Bollinger Bands while the Relative Strength Index (RSI) has moved to the oversold level of 30. Therefore, the pair may keep falling after the strong Swiss data.

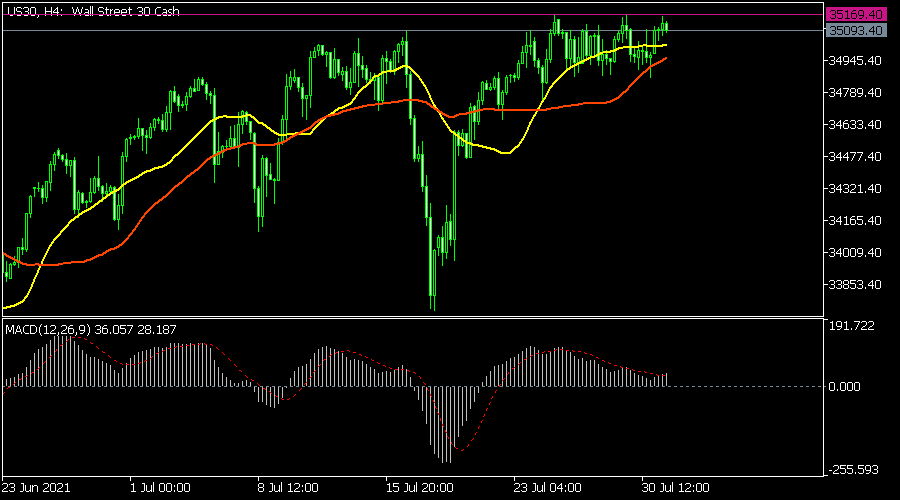

US30

The Dow Jones index rose by about 125 points in the futures market. On the four-hour chart, the index has found a strong resistance at the $35,170 level. It has also formed a bullish consolidation pattern. The index is also being supported by the 25-day and 15-day moving averages. The MACD is also slightly above the neutral level. Therefore, the index will likely keep rising as bulls target the next key resistance at $36,000.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.